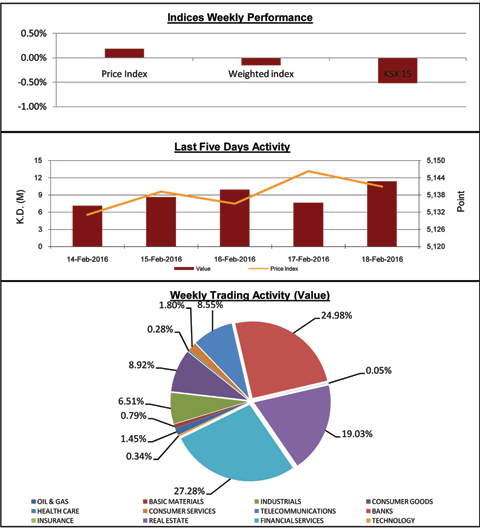

KUWAIT: Kuwait Stock Exchange (KSE) ended last week with mixed performances. The Price Index closed at 5,140.96 points, up by 0.18 percent from the week before closing, the Weighted Index decreased by 0.15 percent after closing at 349.83 points, whereas the KSX-15 Index closed at 822.89 points down by 0.52 percent. Furthermore, last week's average daily turnover decreased by 25.51 percent, compared to the preceding week, reaching KD 8.95 million, whereas trading volume average was 123.58 million shares, recording a decrease of 12.57 percent.

KUWAIT: Kuwait Stock Exchange (KSE) ended last week with mixed performances. The Price Index closed at 5,140.96 points, up by 0.18 percent from the week before closing, the Weighted Index decreased by 0.15 percent after closing at 349.83 points, whereas the KSX-15 Index closed at 822.89 points down by 0.52 percent. Furthermore, last week's average daily turnover decreased by 25.51 percent, compared to the preceding week, reaching KD 8.95 million, whereas trading volume average was 123.58 million shares, recording a decrease of 12.57 percent.

Kuwait Stock Exchange indicators closed mixed last week, among a continued decline in the trading activity compared to a week earlier, as the purchasing operations that included many small-cap stocks of positive annual results continued in providing support to the Price Index, which enabled it to realize some gains by the end of the week, whilst the Weighted and KSX-15 indices couldn't follow due to the continued profit collection operations in controlling the large-cap and operational stocks' activity during the week.

As per the daily trading activity, the stock market opened its first session of the week with grouped losses for the three indicators, due to the random selling pressures and the profit collection operations executed on some small-cap and leading stocks together. On the next session, the market was able to return to the green zone to compensate a part of its previous session's losses and record limited gains for the three indices, supported by the active purchasing operations that included many large-cap and small-cap stocks, especially the ones of low tempting purchasing prices, among an increased traded value.

On Tuesday's session, the market recorded a mixed closing for the three indicators, as the Price Index returned to decrease under the effect of the continued targeting to the small-cap and low-priced stocks, while the Weighted and KSX-15 indices maintained its upward direction as a result to the purchasing powers that were present during the session, and concentrated on some leading and operational stocks; the market witnessed such performance in parallel with an active movement of some investment groups which pushed the trading activity to increase and moved the cash liquidity to compensate its previous session's losses. However on Wednesday's session, the mixed performance of the market indicators continued, which changes in positions, as the Price Index was able to increase affected by the quick speculative operations that concentrated on the small-cap stocks that previously declined and reached low levels with good annual results, whilst the profit collection operations forced the Weighted and KSX-15 indices to close in the red zone.

On Thursday's session, the stock market indicators returned to the red zone once again, despite the random purchasing operations witnessed by some listed companies, and the increased trading activity during the session, especially the value, as the strong selling pressures executed on some small-cap and leading stocks pushed the market indicators to record different losses by the end of the session.

By the end of the last week, the number of companies that disclosed its 2015 financial results reached only 64 company, out of the 190 total listed companies in KSE , however more than half of the legal disclosing period have passed. The disclosed companies have realized around KD 1.16 billion, with an increase of 4.28 percent compared to the results of the same companies for year 2014. On the other hand, the market capitalization for Kuwait Stock Exchange reached by the end of last week KD 23.28 billion, down by 0.22 percent from its level in a week earlier, where it was KD 23.33 billion. On an annual level, the market cap for the listed companies in KSE dropped by 7.87 percent from its value at end of 2014, where it reached then KD 25.27 billion.

As far as KSE annual performance, the price index ended last week recording 8.44 percent annual loss compared to its closing in 2015, while the weighted index decreased by 8.35 percent, and the KSX-15 recorded 8.61 percent loss.

Sectors' Indices

Eight of KSE's sectors ended last week in the green zone, while the other four recorded declines. Last week's highest gainer was the Health Care sector, achieving 5.48 percent growth rate as its index closed at 987.80 points. Whereas, in the second place, the Technology sector's index closed at 822.10 points recording 3.07 percent increase. The Telecommunications sector came in third as its index achieved 2.43 percent growth, ending the week at 564.87 points.

On the other hand, the Oil & Gas sector headed the losers list as its index declined by 3.33 percent to end the week's activity at 740.36 points. The Consumer Goods sector was second on the losers' list, which index declined by 1.99 percent, closing at 1,048.07 points, followed by the Real Estate sector, as its index closed at 826.67 points at a loss of 1.04 percent.

Sectors' Activity

The Financial Services sector dominated a total trade volume of around 281.79 million shares changing hands during last week, representing 45.61 percent of the total market trading volume. The Real Estate sector was second in terms of trading volume as the sector's traded shares were 31.16 percent of last week's total trading volume, with a total of around 192.52 million shares.

On the other hand, the Financial Services sector's stocks were the highest traded in terms of value; with a turnover of around KD 12.20 million or 27.28 percent of last week's total market trading value. The Banks sector took the second place as the sector's last week turnover was approx. KD 11.17 million representing 24.98 percent of the total market trading value. -- Prepared by the Studies & Research Department, Bayan Investment Co.