Kuwait’s current account surplus widens in Q2 2017

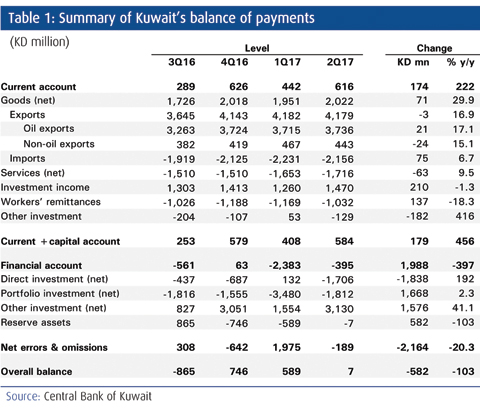

KUWAIT: Kuwait's current account surplus improved slightly in 2Q17 on lower remittances, a decline in imports, and some gain in investment income during the quarter. The surplus improved to KD 0.62 billion, up from KD 0.44 billion in 1Q17, rising to an annualized 6.9 percent of GDP. The balance continues to show broad improvement from a year ago, thanks in large part to the higher oil price during the first half of 2017 compared to the year before.

We expect the improvement in the current account over the last year to continue given the increase in oil prices witnessed in 3Q17 and thus far in 4Q17. The current account balance during the first half of 2017 improved to a KD 1.1 billion surplus, compared to a KD 0.7 billion deficit the year before. We expect this trend to continue for the remainder of 2017, with the current account balance rising to around 4-5 percent of GDP for the full year. This is due largely to higher oil prices. The price of Kuwait export crude averaged $50 per barrel during the first half of 2017, up from $34 the year before. Prices moved higher still after that, reaching $59.4 in November, a 35 percent increase from June's average.

Oil exports have seen healthy growth on the back of higher oil prices, even as production declined due to OPEC cuts. Oil export receipts rose by 17 percent year-on-year (y/y) in 2Q17, as Kuwait oil price rose by 18 percent. Non-oil exports, which are dominated by petrochemicals, also rose in tandem, rising by 15 percent y/y.

Imports have also continued to see solid growth, putting some pressure on the trade balance. Imports grew by 7 percent y/y, boosted in part by strong demand for capital goods imports. This strong growth follows some weakness in 2016, which is possibly linked to weaker consumer demand. This growth offset some of the gains from oil exports, though the trade balance still managed to increase by KD 0.5 billion y/y during the second quarter.

The services deficit widened slightly, reflecting a jump in Kuwaiti travel spending, though this is likely a one-off. The net services outflow rose by 9.5 percent y/y to KD 1.7 billion on a 21 percent y/y increase in travel expenses. Despite this increase, spending on travel services has eased notably over the last year. Spending was flat in 2016, after seeing double-digit growth in prior years. It has eased further in 2017, with spending shrinking by 3 percent y/y during the first half of the year.

Investment income was largely flat, though it did provide some support to the current account versus 1Q17. Investment income rose 3.1 percent quarter-on-quarter (q/q) to KD 1.5 billion in 2Q17. The trend in this item has generally been quite supportive over the last year, with investment income during the first half of 2017 up 2.9 percent y/y. This reflects the continued accumulation of assets in Kuwait's sovereign wealth fund despite the lower price environment and the fiscal deficits being recorded, as well as rising rates globally.

Another source of support to the current account has come from easing worker remittances. Worker remittances declined by 18 percent y/y in 2Q17. Remittance outflows had already eased notably from the double-digit growth seen before 2014; they shrank by 9 percent between 2013 and 2016. The decline is likely due to the lower oil price environment. Cuts in subsidies and increases in various fees have increased the cost of living. At the same time, an increased emphasis on Kuwaitization has reduced demand for expatriate workers.