Insight Report by Gulf Bank Economic Research Unit

The unexpected turn of events in 2020 that include the spread of COVID-19 and an oil price war has meant that the global economy is facing a sudden economic downturn. As this double blow has hit Kuwait, staging an economic recovery would require two key measures, a massive economic stimulus for the short term and economic diversification in the long term.

Economic stimulus to absorb short-term pain

Kuwait’s sizeable financial buffers, low debt to GDP ratio and well-capitalized banking underpin its financial resilience and highlights its capability to provide the necessary intervention. Kuwait Investment Authority’s (KIA) assets and central bank’s reserves total to about 435 percent of Kuwait’s GDP. Revival of economic growth needs a strong and well thought out stimulus package that includes supportive measures such as moratoriums on debt payments, wage support for the unemployed, subsidies to increase consumption and credit to SMEs would be required in the near term. So far, Kuwait’s cabinet has approved a bill to increase the budget of ministries and governmental departments by KD 500 million ($1.6 billion) for the 2020/21 fiscal year. Other measures include the setup of a temporary fund that will allow contributions from companies, individuals and institutions where the Kuwaiti banks initiated a KD 10 million fund to support the economy. Kuwaiti banks have suspended the charges and commissions levied on POS, ATM and online banking transactions and extended collection of due payments. Central Bank of Kuwait (CBK) will be providing liquidity to commercial banks during the period. The Central Bank also has kept the discount rates at a record low of 1.5 percent. The loan to value ratio for properties has also been increased.

The shortfall in oil revenues would translate to a large budget deficit. S&P has forecasted the general government deficit to exceed 10 percent of GDP in 2020. However, at a wartime-like scenario like now, drawing from the General Reserve Fund (GRF), which is estimated to be around 50 percent of GDP would be required. According to the IMF, after compulsory transfers to the Future Generations Fund (FGF) and excluding investment income, financing needs would cumulatively be KD 57 billion ($189 billion) over the next six years. At this rate, it GRF’s assets could be exhausted soon. Therefore, the passage of Kuwait’s revised debt law must be fast-tracked so that future budgetary requirements could be plugged through external borrowings.

Economic diversification the long-term solution

The current economic situation highlights a long-known problem for Kuwait, which has been its over-dependence on oil for its revenue. The problem started to exacerbate after the oil price crash in 2014-15, having a massive toll on revenues. Likewise, in the current scenario when oil is trading at historically low prices and high volatility, the impact on Kuwait’s balances is expected to be very high.

Likewise, the pace of reforms to develop the non-oil sector must also be accelerated. Capital expenditure on infrastructure projects, improvement of the business environment, better regulatory framework and favorable policies for the development of the private sector will aid the growth of non-oil sector. With oil prices remaining in uncertain territory, efforts must be fast tracked to diversify the sources of revenue away from oil for a sustainable future.

Capital expenditure on projects is key

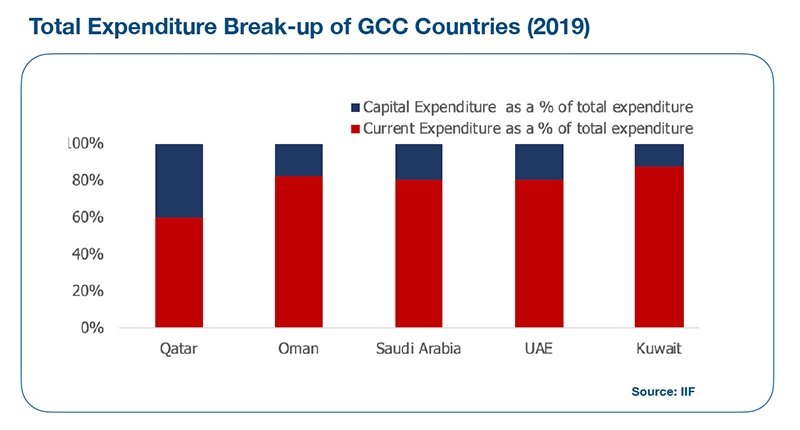

Kuwait has slowly adopted austerity measures such as reducing subsidies on fuel and electricity and rationalized their spending. However, their total expenditure is still highly skewed towards current expenditure in the form of wages, transfers and subsidies. Capital expenditure has not been ramped up at the necessary pace and new project awards have been slow. Even among GCC countries, Kuwait has one of the lowest capital expenditure to total expenditure ratio at 12.3 percent in 2019.

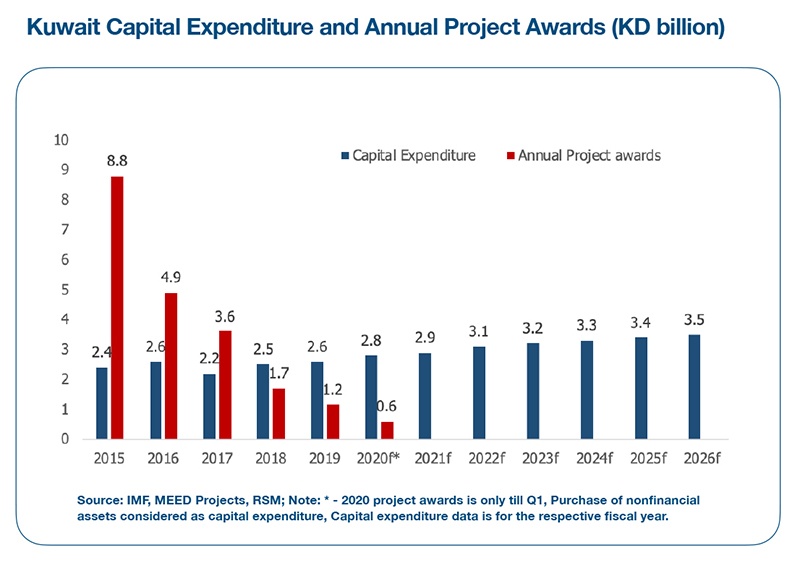

Falling project awards

Kuwait awarded a mere KD 1.15 billion of major project contracts in 2019, a 31 percent fall from 2018 levels. This will be the fourth year in a row that Kuwait’s project spending has fallen, and the value of awards will just be 13 percent of the level of awards seen in 2015. The lack of investment spending in Kuwait has made it very difficult for businesses to operate in the projects market. The problem has been partly due to the fall in government revenue.

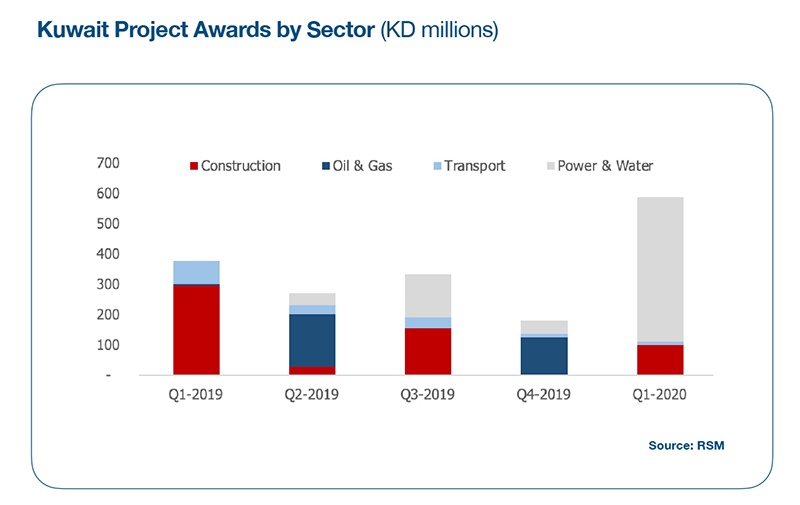

High current expenditure requirements and the fall in oil revenue have seen the project awards fall gradually. The first quarter of 2020 showed promise, however, the outbreak of COVID-19 is expected to defer project awards further.

Kuwait projects landscape – current status

Project awards in the fourth quarter of 2019 declined to KD 183 million, 45 percent lower than what was witnessed in the previous quarter. However, the value of project awards increased sharply in the first quarter of 2020 to KD 587 million, driven by the power and water sector, which accounted for about 81 percent of the total awards in the quarter.

Total projects that have been planned and unawarded stands at KD 62 billion. These projects include partly delayed ones in 2019. However, considering the current macroeconomic scenario, they are highly likely to be delayed further. Construction, transport and power projects account for the majority of unawarded projects at 38 percent, 32 percent and 14 percent respectively.

Disruptions Due to pandemic

The COVID-19 outbreak is likely to cause several disruptions to the project workflow and subsequent cost overrun. As contractors would not be able to keep their workforce fully mobilized, they would not be able to make significant progress in the work onsite. As contract workers are majorly migrants from different parts of the world, travel bans, screening and restrictions would affect labor supply. As the pandemic peaks at different periods in different countries, restriction on movement could be extended in certain countries even after activity recovers in Kuwait. These factors could affect workflow and extend the deadlines for completion. In a worst-case, there could be closure of project sites as well. Some of the materials required for infrastructure projects are sometimes prefabricated and imported from subcontractors. Raw materials are also imported from different locations.

Funding challenges and solutions

Delays in the realization of infrastructure projects pose large potential socio-economic costs, and Kuwait’s infrastructure investments are lagging. While there is a consensus on infrastructure bottlenecks, the underlying reasons for the lack of infrastructure finance is something worth looking into, given the abundant funds available in domestic and world markets and a low interest rates environment.

Delayed project payments

One of the biggest obstacles in financing of projects are the delayed payments of contractors by the government, which negatively affects the dates of delivery of different stages of projects and eventually the level of achievement in the long run. There is also a lack of coordination among the government officials to facilitate procedures and eliminate bureaucracy. In order to deal with these imbalances, several governmental agencies have reached an agreement with the Ministry of Finance to form a flexible mechanism for spending their budget for the current projects and reduce the operational roadblocks in due to delayed payment. Especially with the outbreak of COVID-19, the government must focus on accelerating payment to project contractors to reduce delays in completion.

The Kuwaiti government is very much aware of these issues and has undertaken several necessary steps to promote a healthy projects market. As highlighted in the World Bank’s Doing Business Report 2020, Kuwait made dealing with construction permits easier by streamlining its permitting process, integrating additional authorities to its electronic permitting platform, enhancing inter-agency communication and reducing the time to obtain a construction permit.

Imbalances in supply of finance

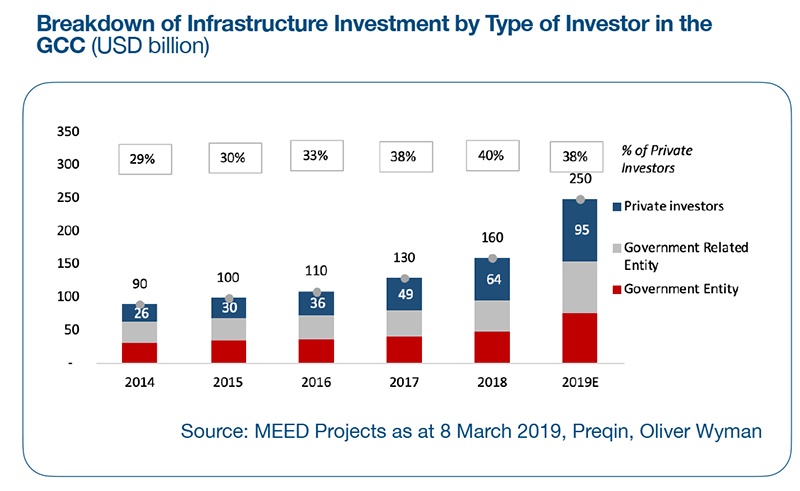

The cumulative investment requirements for infrastructure development in the GCC region from 2019-2023 is about $1.6 trillion, including large mega projects such as Neom, Al-Hareer City, Qiddiya, Amala, South Sabah Al-Ahmad residential city and others. This is 65 percent higher than the total invested in the last five years from 2014-2018. The issue therefore, is not whether to invest in more and better-quality infrastructure, but rather how to find the funding to do so. Governments in the region do not have sufficient funds to meet swelling infrastructure demand, and this puts the focus on their ability to draw private investment to bridge the funding gap. It is estimated that private investment to the tune of USD 400 billion will be needed over the next five years to plug the funding gap.

In Kuwait, as of the end of 2018, $60 billion worth of projects related to Kuwait Vision 2035 had been executed, with an additional $100 billion to be invested in future. Currently, there are 2,296 active projects, valued at a total of KD 138.5 billion in Kuwait.

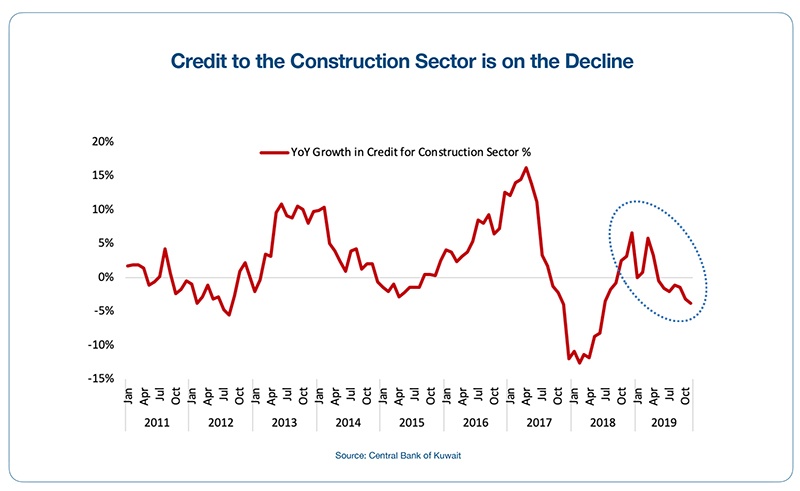

Falling credit allocation to construction sector

Commercial banks in Kuwait are the largest providers of funds for large-scale, capital-intensive projects, often accounting for as much as 50 percent of the overall project funds and up to 100 percent during pre-completion3. Growth in credit to the construction sector saw a major dip in 2016 but saw signs of recovery in 2018. However, the construction sector credit growth rate has been on the decline throughout 2019. Moreover, a shortage of long-term financing since the 2008 crisis has choked the investment-backed growth of companies around the world, hampering the ability of credit-worthy projects to borrow successfully.

Central Bank of Kuwait (CBK) has made available KD 5 billion for additional lending from local banks as part of its economic stimulus package in response to COVID-19. The package includes easing lending conditions previously set for lending. Credit risk weight for SMEs was reduced from 75 percent to 25 percent. The package also increases the maximum financing for residential real estate developments to the value of the property or the cost of development.

Active intervention from the government and regulatory relaxations would be required to save existing projects from closure and help in the recovery of project activity.

Basel III norms on project financing

Central Bank of Kuwait (CBK) approved the application of the Basel III capital adequacy standards to Kuwaiti banks in the year 2014. According to the Basel III guidelines, project finance exposures will be risk-weighted at 130 percent during the pre-operational phase and 100 percent during the operational phase. Project finance exposures in the operational phase, which are deemed high quality, will be risk weighted at 80 percent. Therefore, as the project moves from pre-initiation to operational phase, banks following Basel III norms will be able to lower the risk of the project. This is done to protect the interest of banks so that they capture the appropriate amount of risk for the project at each stage and keep the necessary capital buffers.

The rise of green financing

Green bonds have increasingly become popular instruments among investors in recent years, with issuances scaling new highs as investor focus has started shifting towards sustainable investing. The outbreak of COVID-19 has spurred ESG investing, with green financing likely to gain more emphasis in future. Rising climate awareness, the need for strong environmental regulations, and demand for infrastructure projects in Kuwait will likely support the development of the green finance market. Global investor appetite for green bonds has been growing with the market absorbing the current instruments and showing signs of wanting more. Issuers have also been happy to tap the markets, coming out with repeat issuances. In line with the pick-up in Green bonds, there is a high likelihood that Green Sukuk could emerge to become a successful instrument in the future. Despite the market size being miniscule when compared to Green bonds and the fact that issuances have predominantly been coming from select markets like Malaysia and Indonesia, there is still a lot of potential for the instrument.

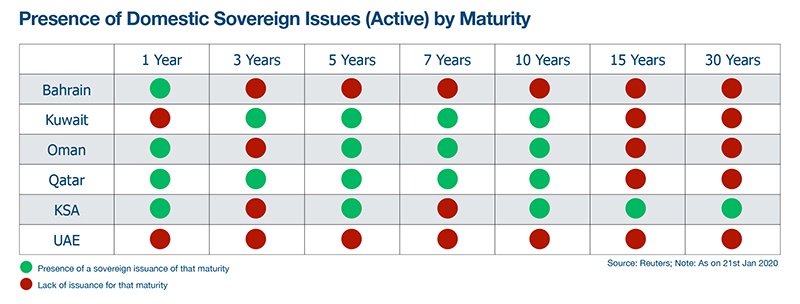

The need for sovereign

long-term yield curve

A number of GCC corporates have been active in the debt markets, especially in the recent past. Considering the surge in corporate and sovereign issuances and the need for development of domestic debt market, many have been advocating for the need to establish a domestic sovereign yield curve, which can be used as a benchmark to support the development of a vibrant debt market. In the absence of any sovereign benchmark yield curve in the GCC region, businesses are forced to borrow debt at a high premium than what their risk may warrant.

Promoting public private partnerships

Public Private Partnership (PPP) are emerging as the preferred path to bring private investors in to fund major projects, reducing the fiscal burden on governments, and perhaps as importantly, bringing private sector expertise and efficiency to the table. Making greater use of the PPP model in infrastructure delivery will help reduce public financing pressures, while also promoting development. The Government of Kuwait has embarked on an ambitious PPP program, which promotes collaboration between the public and private sectors to develop quality infrastructure and services for Kuwaiti citizens.

PPP will be a key tool for the government to achieve the objectives of Kuwait Vision 2035. With COVID-19 outspread taking its toll on the economy in the near term, it becomes imperative for the government to take necessary steps to protect existing PPP projects and build confidence among prospective participants by showing an intent that the government is willing to be supportive during tough economic conditions.

PPPs are expected to face revenue generation challenges in addition to difficulties in running day-to-day operations due to the weakening of the economy. The government’s willingness to provide liquidity to the financial sector will bode well for PPP participants, as they would be able to receive support in the short and medium term.

Keeping the supply chain intact by making periodic payments would ensure that once demand picks up, the project could return to its sustainable self. Projects that are of national importance must receive a government bailout, keeping national interests in mind. A clear timeline or the duration up to which there would be government support should be established based on how the crisis progresses and should be clearly communicated to all participants. If proper mitigation of damages in the near term is carried out, it would boost PPP activity in the medium to long term.

In PPPs, private parties are largely responsible for the design, construction, operation, and maintenance of an infrastructure asset, implying that they are assuming bulk of the development, finance, construction and market risks associated with the project. Governments should make this entire exercise as seamless as possible for investors, and iron out any regulatory and legal issues that can affect the performance of the asset. The Government has established a clear regulatory framework for implementing PPP projects, constituting a reference point for all stakeholders, the laws and regulations establishes high levels of transparency and certainty throughout the PPP process – both key to the success of a PPP program. The New PPP Law creates a greater degree of certainty, reliability and flexibility for foreign contractors, investors and lenders that participate in PPP projects in Kuwait.

The Kuwait Authority for Partnership Projects (KAPP) serves as the main body responsible for PPP projects implementation. KAPP aims to utilize private sector skills and expertise to maximize value for money and service quality. KAPP is currently in the process of initiating several high-impact projects in the power, water/wastewater, education, health, transportation, communications, real estate, and solid waste management sectors.

Recommendations

The current phase where the economy is facing a slowdown is a critical stage where government intervention is greatly required. Supportive measures are required from both short and long-term perspectives.

• Providing stimulus to the non-oil sectors will help in mitigating the risks caused by COVID-19 and also aid in achieving economic diversification. Funding infrastructure projects through greater capital expenditure will have a positive impact on Kuwait’s diversification objectives.

• Providing monetary support in the form of additional liquidity facilities and accelerating project payments would protect ongoing projects and help them in weathering the near-term disruptions caused by COVID-19. Eliminating bureaucratic challenges will help in achieving faster payment cycles, which would in turn boost project activity.

• Most projects are financed by using a combination of equity (in the form of cash and/or Equity Bridge/Shareholder Loans) and debt (bank loans, bonds etc.) on a limited recourse or project finance basis. Banks will remain important financiers, particularly in the early stages of new projects. However, boosting infrastructure financing will require broadening of the potential group of investors and a broader mix of financial instruments.

• Pension funds, insurance companies and other long-term institutional investors have very large and growing long-term liabilities and need long-term assets in their portfolio, very little of which is allocated to infrastructure. Alternative financing, in the form of infrastructure investment funds and bonds, can also help to tap into some of the vast resources of international capital markets.

• Rising climate awareness, strong environmental policies and regulations, and demand for green and infrastructure projects in the region will likely support the development of the green finance market. This is likely to comprise of a diverse combination of conventional green bonds and green sukuk, which could lower the cost of capital and help provide the massive amounts of funding for projects in the pipeline.

• Improvements in dealing with delays in payments, an ambitious PPP program, and improvements in construction permits and property registration are steps in the right direction by the government to revive the projects market.