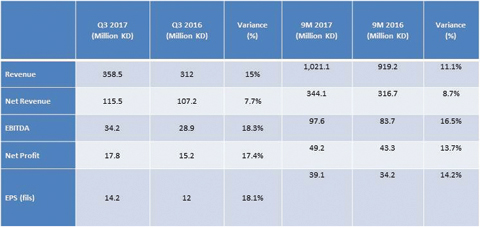

KUWAIT: Agility, a leading global logistics provider, yesterday reported third quarter earnings of 14.2fils per share on net profit of KD 17.8million,an increase of 18.1 percent and 17.4 percent respectively over the same period in 2016.AgilityEBITDA grew 18.3 percent to KD 34.2 million. Revenue increased 15 percent to KD 358.5 million.

KUWAIT: Agility, a leading global logistics provider, yesterday reported third quarter earnings of 14.2fils per share on net profit of KD 17.8million,an increase of 18.1 percent and 17.4 percent respectively over the same period in 2016.AgilityEBITDA grew 18.3 percent to KD 34.2 million. Revenue increased 15 percent to KD 358.5 million.

Through the first nine months, earnings were39.1fils per share, up 14.2 percent, and net profit was KD 49.2 million, up 13.7 percent. EBITDA for the first nine months was KD 97.6 million, an increase of 16.5 percent; revenue was KD 1,021.1 million, up 11.1 percent. The results are in line with the company's long-term guidance.

Tarek Sultan, Agility Vice Chairman and CEO, said: "We remain on track to meet our 2020 EBITDA target of $800 million. Agility's Infrastructure portfolio of companies continue to drive performance, and we are heavily investing in further growing their footprint in emerging markets across the Middle East, Asia and Africa."

Agility's global logistics business has shown double-digit growth in air and ocean tonnage, and contract logistics revenue growth. "Even so, it's a tough market because capacity constraints and higher freight forwarding rates continue to affect profitability," Sultan said. "Looking ahead, we are investing in technology so that we can better serve our customers online, and drive productivity, efficiency, and operational excellence."

Third quarter revenue for Agility Global Integrated Logistics (GIL), the company's core logistics business, grew by 19.4 percent to KD 273 million. GIL's commercial strategy is to drive growth by committing to defined solutions and customer segments, improved sales productivity, and development of efficient trade lanes. That strategy has increased revenue across all products and generated growth in all customer segments. Air and ocean posted revenue increases of more than 20 percent, as a result of a 16.1 percent growth in air tonnage and 12 percent increase in ocean TEUs. Project Logistics also improved revenue by 27.3 percent.

Net revenue in Q3 increased 2.4 percent primarily as a result of growth in contract logistics, which has been performing well in the Middle East and Asia Pacific. This growth is occurring at both new and existing warehousing facilities. Net revenue margins shrunk to 22.6 percent compared with 26.3 percent in Q3 2016, because capacity constraints and higher freight market rates adversely affected yields for freight forwarding.

As a result, Q3 EBITDA was almost flat (it grew only by 1.4 percent) vs the prior year. EBITDA was further affected by foreign exchange rates. Excluding foreign exchange impact, GIL's EBITDA grew 3.4 percent in Q3.

GIL continues to refine its approach to its customer segments and product lineup, improve operational performance and cost discipline, and invest in technology and systems that will enhance its efficiency and productivity. It is developing tools to better serve customers online.

Agility's Infrastructure Companies

Agility's Infrastructure group EBITDA rose 24 percent, to KD 29.4million in Q3. Revenue grew 4 percent to KD 91 million. Agility Real Estate posted healthy revenue growth as it focused on improving efficiency of the existing assets and its development of new warehouses across the Arabian Gulf countries and Africa.

Tristar continues to drive growth in its shipping business. In Q3, Tristar issued new shares and received a $100 million capital injection from Gulf Investment Corporation (GIC) for a consideration of 19.4 percent of the company's capital, implying a post-money valuation of $515 million, which crystalizes the value created over the years since its acquisition in 2003. This deal will help position Tristar for further growth and value creation for its shareholders.

NAS operations in Kuwait, Ivory Coast, and Afghanistan showed major growth in revenue and EBITDA. Performance in those three markets is expected to remain strong, and operations in Abu Dhabi and India also should grow in the near term. NAS faces challenges in Morocco and Tanzania but is positioned to grow revenues in both countries by early 2018 without incremental investment or cost.

UPAC continues to improve operational efficiency at existing operations in Kuwait International Airport, the Sheikh Saad Terminal and at Discovery Mall, locations where it is currently operating at full capacity. In Abu Dhabi, the Reem Mall project is moving forward and is a cornerstone of UPAC's strategy to be a major commercial real estate player in the region. GCS, a customs consultancy, also contributed to Q3 growth. GCS manages all customs activities at ports of Kuwait.