Revenue reached KD 1,407 million, EBITDA KD 135.2 million

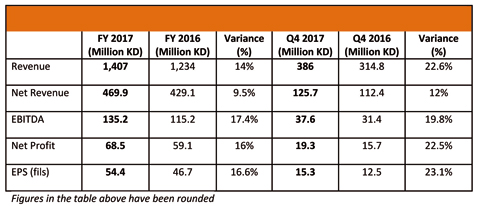

KUWAIT: Agility, a leading global logistics provider, yesterday announced its 2017 financial results, reporting a net profit of KD 68.5 million, or 54.4 fils per share, an increase of 16 percent over 2016. Revenue for the year reached KD 1,407 million and EBITDA was KD 135.2 million.

For the fourth quarter 2017, Agility reported a net profit of KD 19.3 million, or 15.3 fils per share, an increase of 22.5 percent over Q4 2016. EBITDA for Q4 2017was KD 37.6 million, an increase of 19.8 percent.

Board of directors recommendation

The Board of Directors has recommended a cash dividend distribution of 15 percent (15 fils per share), along with 15 percent bonus shares (15 shares for every 100 shares), subject to approval of the General Assembly.

Agility consolidated results

"In 2017,Agility posted another year of healthy growth and continued to plant the seeds for a future of sustainable growth. To reach our target of $800 million EBITDA by 2020, we remained focused on improving GIL's performance and investing in our Infrastructure companies. For every business in the group, 2017 was a critical year," said Tarek Sultan, Agility CEO and Vice Chairman.

2017 Milestones:

* 17.4 percent growth in EBITDA largely as a result of strong Infrastructure group performance

* Net profit and EPS growth of 16 percent and 16.6 percent respectively.

* Healthy operating cash flow growth, but limited Free Cash flow due to the required investment to grow the business

* Balanced dividends distribution which rewards shareholders without inhibiting business growth

* Increasing borrowing to fund company's future developments which resulted in a net debt position of KD 93.2 million

* The settlement of the US Department of Justice litigation;

Agility Global Integrated Logistics

Agility Global Integrated Logistics (GIL) revenue grew 14.3 percent to KD 1,061.6 million in 2017. The increase is attributable to growth in the freight forwarding business and contract logistics. Full year net revenue grew 2.6 percent. Net revenue margins shrunk to 23.7 percent from 26.4 percent amid yield pressure across the industry.

In Q4, GIL revenue was KD 293 million, a 21.5 percent increase over Q4 2016. Air and ocean revenue were up 25 percent on air tonnage growth of 9.7 percent and a 12 percent increase in ocean TEUs. Contract logistics and specialties (Project Logistics and Fairs & Events) improved revenue 17.6 percent over the same period in 2016.

Fourth-quarter net revenue increased 6 percent, but net revenue margins declined to 22.6 percent vs. 26 percent in Q4 2016, amid yield pressure throughout the freight forwarding industry. Contract logistics continued its strong growth in Q4, primarily in the Middle East and Asia Pacific, aided by a combination of new customers and investments in new facilities. EBITDA improved 30.7 percent with margins expanding from 4 percent in Q4 2016 to 4.3 percent in Q4 2017.

"GIL is growing through a strategy that focuses on defined solutions and customer segments, enhanced sales productivity and efficient trade lane development," Sultan said. "In addition, GIL is building systems and solutions that enable business insight, efficiencies, and increased productivity for our operations and for our customers. As always we are working hard to maintain cost discipline."

Agility's infrastructure companies

For the full year, revenue for the Infrastructure group grew by 12.7 percent, EBITDA has also increased by 28.2 percent to KD 120.9 million with margins expanding from 29.7 percent in FY 2016 to 33.7 percent in 2017. Agility is investing in those companies to drive its future growth.

Infrastructure group revenue grew 25 percent in Q4 2017. EBITDA increased largely on strong performance by Global Clearinghouse Systems (GCS), Agility Real Estate (RED), National Aviation Services (NAS) and Tristar.

Agility Industrial Real Estate, a leading owner and developer of logistics parks, remains one of the strongest contributors to Agility's performance. Agility Industrial Real Estate is working to improve the efficiency of its Kuwaiti assets, develop a Saudi logistics park and expand in multiple locations in Africa. In 2017, Agility broke ground on two warehouses of 38,000 SQM each in Saudi Arabia. Delivery is expected this year. In Africa, Agility identified new locations for logistics parks, and established operations in Ghana,Cote D'Ivoire and Mozambique to cater for increasing demands for warehousing services in the continent.

Tristar, a fully integrated liquid logistics company, on-boarded the strategic investor Gulf Investment Corporation (GIC) in 2017. Tristar received a capital injection of $100 million for a consideration of 19.4 percent of the company's capital. Tristar revenue grew from existing and new customers in 2017. Tristar continues to diversify its business via shipping growth and geographic expansion in an effort to create more value for shareholders.

National Aviation Services (NAS), Agility's airport services subsidiary posted healthy growth in Kuwait, Cote D'Ivoire and Afghanistan; with revenue in Cote D'Ivoire and Afghanistan growing more than 20 percent. In Q4, NAS also launched operations in Liberia and Uganda. The company is working to turnaround performance in Tanzania and Morocco.

UPAC, a leading real estate and facilities management company in the Middle East, experienced a strong year in 2017. It improved operational efficiencies and reduced costs across its key operations within the Kuwait International Airport, Sheikh Saad Terminal and Discovery Mall. UPAC is also developing the 450-store Reem Mall in Abu Dhabi in partnership with National Real Estate Company (NREC).Financing for the $1.2 billion project concluded in 2017.

GCS, a company specialized in customs modernization, manages all customs activities at ports of Kuwait and aims to enhance customs modernization through its services. GCS showed improved performance in 2017 by deploying new services within different ports.

Financial performance for 2017

* Agility's net profit reached KD 68.5 million, a 16 percent increase from KD 59.1 million in 2016. EPS was 54.4 fils, compared with 46.7filsa year earlier.

* EBITDA was KD 135.2 million, a17.4 percent increase from 2016.

* Agility's revenue for 2017was KD 1,407 million, an increase of 14 percent from KD 1,234 million in 2016. Net revenue increased by 9.5 percent.

* GIL's revenue was KD 1,061.6million, a14.3 percent increase from 2016.

* Infrastructure group revenue was KD 358.2 million compared with KD 317.9 million in 2016, a 12.7 percent increase.

* Agility enjoys a healthy balance sheet with KD 1,729 million in assets. Its net debt position was KD 93.2 million as of Dec. 31, 2017. Operating cash flow was KD 63.5 million for full year 2017 a figure that accounts for the settlement of litigation claims.

Closing

"Agility thanks its shareholders, customers, employees and partners for a strong year. The company continues to grow in emerging markets logistics parks, fuel logistics, airport services, and commercial real estate development. The core commercial logistics business is also growing its volumes, despite margin pressure in a tight market. Agility is accelerating its strategy to transform the business through technology and establish its position as the leading digital player in our industry," Sultan said