KUWAIT: PROCAPITA Management Consulting launched its special annual report on the latest HR practices for 2020, which was distinctively developed. The report includes the main features and trends of business and human resources practices in the State of Kuwait, the effects of the COVID-19 epidemic, how various companies operating in the private sector are dealing with emerging challenges, and the future outlook on the human resources strategies for 2021.

Mohammad Abu Al-Rob, CEO of PROCAPITA, said that the survey's participation rate was very stimulating, reaching more than 80 percent of companies invited to participate and addressing the opinions of more than 210 business leaders (CEOs, board members, and executive business leaders), in addition to HR leaders from various sectors in Kuwait. The participants represented more than 144 major companies, 45 of which are listed on the Kuwait Stock Exchange, and 99 are not listed.

This report covered 12 sectors in the Kuwaiti market, the most important of which are: telecommunications, oil and gas, financial services (banks, insurance, asset management, and capital markets), general trading and contracting, manufacturing, business and professional services sector, etc.

This survey's significant interaction indicates the urgent need for business leaders to know recent trends in human resource practices to deal with the Covid-19 pandemic and the high confidence that PROCAPITA has gained as the largest HR consulting services provider in the State of Kuwait and the GCC. Abu Al-Rob expressed his sincere thanks and gratitude for PROCAPITA's clients' continuous support and steadfast confidence. This fundamental pillar has enabled PROCAPITA to continue achieving more excellent value for its services.

Abu Al-Rob added that the main highlights of the survey conducted by PROCAPITA Management Consulting are:

- The economic impact of the COVID-19 pandemic

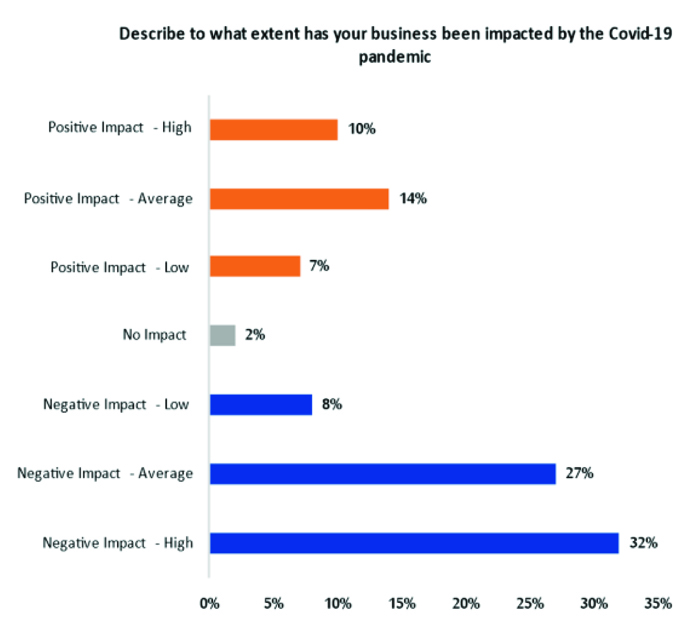

- The results have shown that 31 percent of companies from various sectors in Kuwait have been positively affected by the COVID-19 pandemic, including telecommunications companies, internet service providers, IT companies, e-commerce, and some professional services such as legal advisory services, insurance companies, consumer-trade companies, and food and medical manufacturers.

- 67 percent of companies from various sectors in Kuwait have expressed negative impact on the COVID-19 pandemic, including the sports sector, entertainment, travel & tourism sector, the banking sector, some investment and money markets companies, automotive sector, transportation and logistics companies, food and beverage companies (restaurants), in addition to general trading and contracting companies.

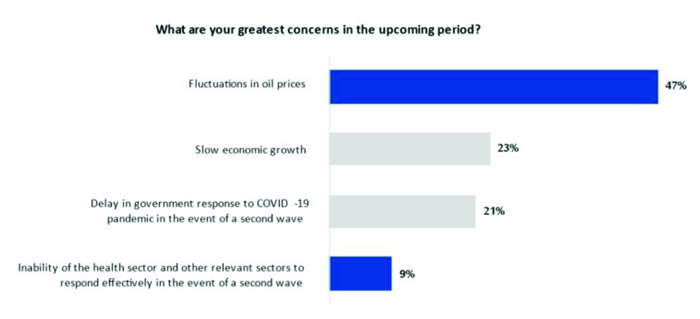

- 47 percent of business leaders indicated that the decline in oil prices is the primary concern facing businesses in the coming period.

- The incentive plans and economic support packages provided by the government

- Concerning the government's incentive plans and economic support packages, 37 percent of business leaders expressed their satisfaction with the incentive plans and government measures presented to face the repercussions of the COVID-19 crisis and revive the affected sectors. In comparison, 44 percent of business leaders expressed their dissatisfaction to some extent.

- Business and technology practices

- Regarding the penalties and challenges that represent an obstacle to business growth, 44 percent of business leaders stated that the legislative and legal environment and the availability of talent and competencies required in the local labor market are among the most critical challenges facing companies and impeding their business growth process. In comparison, 19 percent of business leaders indicated that the adequacy of governance and the application of transparency standards in different business transactions constitute the most prominent challenges that negatively affect the growth of their business, followed by operational risks, risks of delays in technology and digital transformation, crisis management, environmental risks, cultural and social factors, and logistical factors. Only 3 percent of companies reported no challenges and penalties that negatively impacted their business growth.

- 79 percent of business leaders emphasized the importance of investing in digital transformation as part of the plans set to confront the pandemic and its repercussions.

- 32 percent of business leaders stated that direct government support for private sector companies to attract and develop national workers is one of the most critical aspects that must be improved to contribute to raising the percentage of localization of jobs (Kuwaitization) in the coming period, followed by improving education outcomes in line with future labor market requirements by 27 percent.

- The scarcity of talents and specialized competencies in the local market ranked first concerning the use of skills and competencies attracted from abroad by 43 percent. Simultaneously, the vast majority of the participants indicated that the talents and competencies currently available do not serve their companies' future strategic goals.

- 76 percent of business leaders indicated the importance of attracting and retaining talent, such as implementing long-term incentive plans, granting shares to employees, awarding competitive wages, and other related strategies. Half of them expressed their continuous implementation and updating of these plans and strategies. On the other hand, the other half expressed their tendency to study and develop these strategies and monitor their budgets to realize their importance.

- More than 50 percent of the participants expressed their satisfaction with remote work effectiveness and praised their employees' efficiency and productivity during the previous period. PROCAPITA expects that many companies will continue to adopt and implement this strategy in the next year, 2021.

- Manpower and Recruitment Department

- Only 8 percent of the participating companies have reduced employees' wages in line with the companies' powers by the relevant government agencies. In comparison, 19 percent of them granted employees paid leave and adopted a remote work mechanism to maintain business sustainability, reduce the pandemic's effects, and exit from it with less possible losses.

- Concerning recruitment, 62 percent of the responding companies indicated that they did not dispense any of their employees' services as one of the alternatives available to confront the pandemic. Also, 52 percent of the participating companies expected an increase in hiring employees in 2021 compared to 2020.

- Compensation practices

- Concerning compensation practices and adjusting the salary scale and benefits, 8 percent of the responding companies expect a total change in the salary scale, including all job titles. In comparison, 65 percent of them expect a partial change in the salary scale, including some job titles, and at varying levels according to sectors and their extent affected by the pandemic.

- 27 percent of companies were limited to granting short-term incentives (annual bonus) depending on their financial performance in 2019. While some companies indicated a lack of clarity of vision about the possibility of disbursing annual increases or incentives in 2021 due to poor economic conditions and declining returns as a result of the pandemic, and that it may have to stop or postpone it in response to the changes taking place.

- Future expectations of human resource practices (structural imbalance):

- On the other hand, Abu Al-Rob stated that a structural defect in the local employment market is expected as a result of the repercussions of the pandemic on the structure of supply and demand in terms of high supply of many skills and competencies working in the affected sectors such as tourism, aviation, and others, which led to an imbalance in the rates of salaries and wages as a result of the accumulation of some competencies in the Kuwaiti market and the dispensation of some companies of human cadres and thus the high unemployment rate.

- However, it is necessary to note that the local market suffers from a shortage of supply and a scarcity of some specialized skills and competencies such as IT-related jobs (such as software developers, professional IT trainers, smartphone application developers, and data analysts) and technical and professional jobs (such as professions Medical, engineering, technicians, and chefs), in addition to the decision to stop recruiting from abroad, which will increase the gap between supply and demand, and this constitutes an additional challenge for companies to develop their business and an imbalance in the salary and benefits scale.

- Based on the foregoing, Abu Al-Rob commended that the companies must review the current salary and benefits scale and amend it depending on the extent of the pandemic sector and business. He also pointed out that the amendment and modernization of the salary scale do not necessarily mean reducing the salaries and benefits granted, but rather it means restructuring them in proportion to the skills available in the local market and being able to attract them easily and give them a competitive advantage to companies.

- It is worth mentioning that it is not expected that there will be an amendment to leaders' salaries and benefits during the current period and not expected to be affected in the coming period, as factors such as scarcity and specialized expertise play a "decisive role" in continuing the demand for leadership positions and thus salaries and benefits may be negatively affected. However, the annual incentives granted to leaders may be affected in part, depending on the decrease in the profits made versus the planned profits or the desired returns.

- In addition to what was mentioned above, Abu Al-Rob expressed the importance of adopting several different strategies in the coming period to improve the economic conditions of companies and enable them to face any exceptional circumstances that may arise in the external environment, including:

- Remote work strategy, as many companies could continue their work and run it smoothly despite the exceptional circumstances witnessed by the whole world.

- Developing talent management programs, including performance appraisal systems, and linking their outputs with annual incentives, development and training plans, succession planning, and others, because of their significant impact on the process of attracting and maintaining competencies and skills, and thus companies advance and gain a competitive advantage in the local market.

- Defining business trips and using video and audio communications as a viable alternative to holding and attending meetings.

- Investing in digital transformation, artificial intelligence, and partly relying on electronic transactions and e-commerce.

- Using "Outsourcing" contracts to meet the companies' needs to support jobs because of their benefit in reducing costs and pressure on the recruitment team and many other benefits.

PROCAPITA Management Consulting and Human Resources Services is a regional company headquartered in the State of Kuwait in addition to its regional offices in both Jordan and Dubai. Since its establishment in 2013 to this day, it has succeeded in providing the best consulting and administrative services to more than 400 clients through the efforts of its distinguished consultant staff. Throughout the Middle East and the Arab Gulf states.

PROCAPITA has distinguished itself for its unique approach by providing human resource consulting, recruitment counseling, and human resource outsourcing services in addition to human capital development services, which has been a significant factor in making PROCAPITA one of the leading consulting firms in the region, and in line with leading practices in consulting services, PROCAPITA has given technology a lot of attention through its investment in ZENITHR Intelligence Solutions business.