2018 another successful year for AUB; net profit grows 15.3% y/y

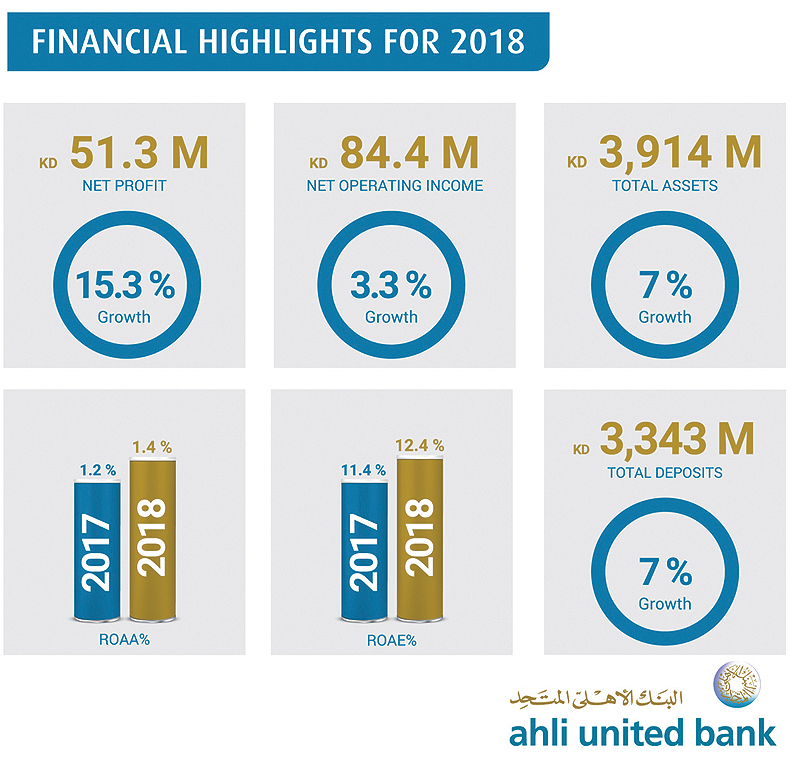

KUWAIT: Ahli United Bank K.S.C.P. ("AUB") has marked 2018 as another successful year by delivering a net profit of KD 51.3 million (2017: KD 44.5 million) for the year, a net growth of 15.3 percent.

The bank achieved a growth in total operating income of 1.2 percent to reach KD 121.6 million at the end of 2018 (KD 120.1 million in 2017), while the equity attributable to shareholders has increased by 5.9 percent reaching KD 430.8 million, up from shareholder's equity of KD 406.9 million posted at the end of 2017. Net operating income has increased by 3.3 percent reaching KD84.4 million as compared to KD 81.7 million for 2017.

Beside these accomplishments, the bank has maintained a sound capital adequacy ratio, before dividend distributions, of 16.6 percent (18.0 percent in 2017), comfortably higher than the required regulatory level. This provides room for future expansion in both customers' credit facilities and core businesses. Moreover, the bank achieved a return on equity and a return on assets of 12.4 percent and 1.4 percent respectively at the end of 2018 being amongst the highest key performance indicators in the local market. Earnings per share increased from 23.3 fils in 2017 to 27.1fils per share at the end of 2018.

Total assets, total customer deposits and net financing receivables stood at KD 3,914 million, KD 2,425 million and KD 2,800 million respectively at the end of the year. Finance receivables and deposits are prudently managed by maximizing returns. The Bank maintained a conservative risk approach which helps in robust asset quality and lower NPF ratio at 1.27 percent (1.39 percent in 2017) and with a coverage ratio of 334 percent. During the year, the bank implemented IFRS 9 guidelines issued by CBK.

Commenting on the results, Dr Anwar Ali Al-Mudhaf, Chairman said: "With God Almighty willing, Ahli United Bank has succeeded in 2018 to continue its success at a steady pace and to establish its unique position as one of the leading Islamic banks not only in Kuwait but also at the regional level."

Dr. Al-Mudhaf said that despite the challenging global operating environment, Ahli United Bank continues to pursue its role as a leading financial institution that is keen to play an active role in contributing to economic growth within "Kuwait's New Vision 2035", based on the strengths of Kuwait's operating environment which includes political stability and the size of the large sovereign assets, which is reflected ultimately on the strength of Kuwaiti banks in general.

Dr. Al-Mudhaf pointed to the advanced capabilities enjoyed by AUB and its commitment to the highest professional standards that are most appreciated by global ratings agencies and place the bank at the forefront of banking and financial service providers in the State of Kuwait, which enables the bank to continue to receive these superior ratings from agencies such as Fitch, Moody's and Capital Intelligence.

Credit ratings

The bank maintained a credit rating of "A+" on the long term and "F1" on the short term with stable outlook by Fitch Ratings Agency, and "A2" on the local currency with stable outlook by Moody's. Capital Intelligence affirmed the Bank's long term credit rating of foreign currency to "A+" and enhanced the short term foreign currency rating to "A2". All these ratings confirm the credit standing, capital quality, and stability of the Bank for future growth.

The Chairman attributed the bank's success year after year to the efforts made by the Executive Management to provide integrated banking services and solutions to customers, which contributed to maintaining customer confidence and enhancing the bank's presence in the corporate banking, retail banking, private banking and wealth management sectors, and the treasury sector, stressing that this success has contributed to putting the bank among the list of the best Islamic banks in Kuwait.

On the back of this success, the board has recommended a cash dividend of 15 percent (15 fils per share) of the share capital and 5 percent bonus shares (5 shares for each 100 common equity shares) subject to the final approval of the Bank's General Assembly.

Tareq Muhmood, Acting Chief Executive Officer, expressed his pride in achieving these financial results for the year 2018, stressing that this results in a new year of success as part of the implementation of the five-year strategic plan of the bank, launched in 2015 based on a comprehensive development and growth.

Based on our success, we are proud to have received a number of awards for excellence in 2018, including The Best Islamic Bank in Kuwait 2018, Islamic Banker of the Year 2018 - Kuwait, and the Best Premium Banking in Kuwait 2018 by Islamic Business & Finance International Magazine.

Muhmood added in line with the banks keenness to fulfill its client's expectations, we have made significant strides in 2018 using technology to make the lives of our customers easier.

We continue to upgrade the capabilities and user experience of our mobile delivery, whilst also continuing to invest in our internet banking. also used technology to introduce our most advanced branch in Avenues Phase 4 which show cases many of our technology developments.

The bank has been able to cater for those needs most efficiently by designing banking solutions and services on the basis of those analysis. Our most outstanding success in this regard has been the launching of POS devices for the first time in Kuwait on Kuwait Airways flights, exclusively. This service is a new development in POS usage as it allows travelers to use these devices in flight to buy various products available in onboard KAC flights by using credit cards or debit cards most conveniently and safely. Customers can now upgrade their seats from "Economy" to "Business" or "First" class when available in flight at special rates, thereby enabling customer to enjoy luxury on KAC flights. This has been a new initiative launched by AUB to employ its technical and technological potentials and capabilities to provide an unsurpassed banking experience to customers wherever they may be.

The bank has taken wide steps toward developing its electronic services provided to individuals with special needs, thereby catering for all the needs of this segment of our customers, while fulfilling all control requirements in this regard.

Finally, in concluding his statement, Dr Al-Mudhaf extended his thanks and appreciation to the Central Bank of Kuwait, the Bank's Board of Directors, customers, shareholders, management and staff for the confidence and support they have conferred upon the Bank. This has enabled the bank to realize these continued achievements and maintain its preeminent position in the Kuwaiti banking sector.