Premier Market index, Main Market index edge down

KUWAIT: Boursa Kuwait ended August in the red zone. The Premier Market Index closed at 5,261.82 points, down by 0.66 percent, the Main Market Index decreased by 0.72 percent after closing at 4,897.46 points, whereas the All-Share Index closed at 5,132.31 points down by 0.68 percent. Furthermore, last month's average daily turnover decreased by 23.85 percent, compared to the preceding month, reaching KD 20.97 million, whereas trading volume average was 105.26 million shares, recording a decrease of 16.98 percent.

KUWAIT: Boursa Kuwait ended August in the red zone. The Premier Market Index closed at 5,261.82 points, down by 0.66 percent, the Main Market Index decreased by 0.72 percent after closing at 4,897.46 points, whereas the All-Share Index closed at 5,132.31 points down by 0.68 percent. Furthermore, last month's average daily turnover decreased by 23.85 percent, compared to the preceding month, reaching KD 20.97 million, whereas trading volume average was 105.26 million shares, recording a decrease of 16.98 percent.

Post to the outstanding and large gains recorded by the Boursa Kuwait during the month of July, supported by the purchasing powers that were strongly present then, the profit collection operations interfered to stop the Boursa boost and forced its indices to decline and end the month of August's trading in the red zone. The Boursa decrease came as a result to the selling pressures that many of the listed stocks were subject to, especially the ones that witnessed strong increases previously, headed by the leading and heavy stocks listed in the Premier Market, for profit collection purposes and building new price positions to restart once again.

Also, the Boursa witnessed during the month of August a contraction in the purchasing operations and weak cash liquidity, which declined by the end of the month by around 44 percent compared to its level in the previous month, as a result to the long Eid Al-Adha holiday during the month, in addition to the watch state of many traders as the Boursa promotion to the developing markets getting into effect, which contributed relatively into the decline of the liquidity levels and pushed the market indicators to end the month's trading in the losses area.

Moreover, the market capitalization of the Boursa recorded monthly losses of over KD 211 million, as it reached by the end of last month KD 28.71 billion, down by 0.73 percent of its level in the previous month, where it was KD 28.92 billion. The Boursa gains contracted since the application of the new market segmentation phase reaching KD 855.29 billion and 3.07 percent. (Note: The market capitalization of the listed companies in the Market is calculated based on the weighted average number of outstanding shares as per the latest available financial statements).

On the other hand, the month of August witnessed an end to the legal period for the listed companies to disclose its first half of 2018 financial results, whereas the number of disclosing companies reached 167 out of 175 listed company in the Market, with around KD 1.09 billion in net profits, and up by 11.64 percent for the same companies' results for the same period of 2017, where it was KD 972.92 million. In addition, after five months of the application of the Market Segmentation, the Premier Market Index's gains reached 5.24 percent, while the Main Market Index losses contracted to reach 2.05 percent, and the All-Share Index growth reached 2.65 percent.

Sectors' indices

Seven of Boursa Kuwait's sectors ended last month in the red zone, four recorded increases. while the Heal Care sector's index closed with no change from the month before. The Technology sector headed the losers list as its index declined by 10.53 percent to end the month's activity at 865.73 points. The Telecommunications sector was second on the losers' list, which index declined by 1.39 percent, closing at 931.63 points, followed by the Banks sector, as its index closed at 1,062.19 points at a loss of 1.19 percent. The Consumer Services sector was the least declining as its index closed at 1,056.99 points with a 0.05 percent decrease.

On the other hand, last month's highest gainer was the Basic Materials sector, achieving 4.48 percent growth rate as its index closed at 1,118.21 points. Whereas, in the second place, the Oil & Gas sector's index closed at 1,097.18 points recording 3.89 percent increase. The Real Estate sector was the least growing as its index closed at 986.77 points with a 0.17 percent increase.

Sectors' activity

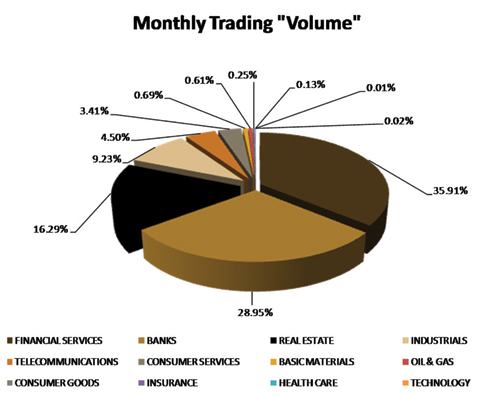

The Financial Services sector dominated a total trade volume during the last month of 642.56 million shares changing hands, representing 35.91 percent of the total market trading volume. The Banks sector was second in terms of trading volume as the sector's traded shares were 28.95 percent of last month's total trading volume, with a total of 517.98 million shares.

On the other hand, the banks sector's stocks were the highest traded in terms of value; with a turnover of KD 175.28 million or 49.17 percent of last month's total market trading value. The Industrial sector took the second place as the sector's last month turnover of KD 70.79 million representing 19.86 percent of the total market trading value.

BAYAN MONTHLY MARKET REPORT