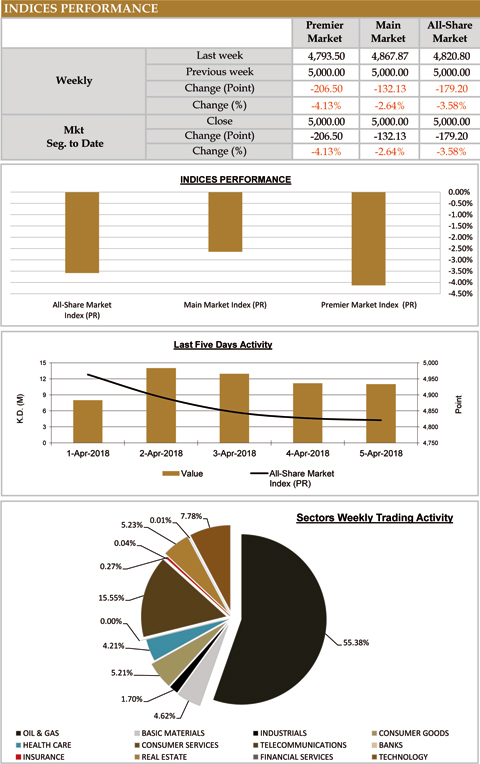

Premier Market Index closes down 4.13%

KUWAIT: Boursa Kuwait ended last week in the red zone. The Premier Market Index closed at 4,793.50 points, down by 4.13 percent, the Main Market Index decreased by 2.64 percent after closing at 4,867.87 points, whereas the All-Share Market Index closed at 4,820.80 points down by 3.58 percent. Furthermore, last week's average daily turnover decreased by 5.97 percent, compared to the preceding week, reaching KD 11.41 million, whereas trading volume average was 45.02 million shares, recording a decrease of 7.60 percent.

The Boursa recorded declines this week affected by the selling pressures that included many listed stocks in the Market, headed by the leading stocks listed in the Premier Market, which received most of the traded cash liquidity during the week, and was apparent on the Premier Market Index, the most declining among the three markets indices, where it recorded a loss of over 4 percent in the last week. The Boursa witnessed such performance in parallel with the drop in the trading indicators, where the total volume during the week decreased by 7.60 percent reaching 225.12 million stock, and the value declined by 5.97 percent reaching KD 57.07 million.

The Market lost more than KD 1 billion in five sessions only, as the market capitalization for the total listed stocks dropped by the end of the week to around KD 26.50 billion against KD 27.86 billion in the previous week, down by 4.85 percent. (Note: The market capitalization for the listed companies in the Market is calculated based on the weighted average number of outstanding shares as per the latest available official financial statements).

As far as the daily trading activity during the last week; the Boursa initiated the first session, which came in parallel with launching the Market Development 2, with a decline in its three indices, affected by the selling operations that the Market witnessed on many stocks. The Premier Market Index was the most declining by the end of the session, due to the concentration of the selling operations on the heavy stocks. The next session witnessed a decrease in the three Market indices, headed by the Main Market, which lost more than 100 point by the end of the session, recording a loss of 2.08 percent, and came as a result to the continued selling trend in controlling the trading operations in the Market, amid concentration of the cash liquidity on the Premier Market stocks, as its Index declined by 1.03 percent by the end of the session, while the All Share Index decreased by 1.42 percent.

The Boursa continued its downward sloping in the mid-week session amid a drop in the cash liquidity and the increased selling pressures over the leading stocks, which was reflected on the Premier Market Index in particular, to receive around 75 percent of the cash liquidity during the session. However, the selling operations sharpness declined on Wednesday's session, which witnessed a fluctuated closings of the Market indices for the first time since its new launch, as the All Share Index and the Premier Market Index continued to decrease, while the Main Market Index was able to realize a limited increase by the end of the session, supported by the purchasing operations that included some small-cap stocks. The end of week session witnessed a return to the three Boursa indices to meet in the red zone once again, whereas it recorded limited declines affected by the continued selling operations in controlling the trading activity, amid a continued decline to the cash liquidity which decreased by 1.60 percent, while the number of traded stocks grew by 4.66 percent at the end of the session.

Sectors' Indices

Nine of Boursa Kuwait's sectors ended last week in the red zone, two recorded increases, whereas the Health Care sector's index closed with no change. The Consumer Goods sector headed the losers list as its index declined by 7.62 percent to end the week's activity at 923.80 points. The Telecommunications sector was second on the losers' list, which index declined by 6.46 percent, closing at 935.41 points, followed by the Banks sector, as its index closed at 957.42 points at a loss of 4.26 percent. The Real Estate sector was the least declining as its index closed at 990.49 points with a 0.95 percent decrease.

On the other hand, last week's highest gainer was the Technology sector, achieving 3.59 percent growth rate as its index closed at 1,035.86 points. Whereas, in the second place, the Consumer Services sector's index closed at 1,000.40 points recording 0.04 percent increase.

Sectors' Activity

The Banks sector dominated a total trade volume of around 70.56 million shares changing hands during last week, representing 31.35 percent of the total market trading volume. The Real Estate sector was second in terms of trading volume as the sector's traded shares were 21.36 percent of last week's total trading volume, with a total of around 48.08 million shares.

On the other hand, the Banks sector's stocks were the highest traded in terms of value; with a turnover of around KD 31.61 million or 55.38 percent of last week's total market trading value. The Industrial sector took the second place as the sector's last week turnover was approx. KD 8.88 million representing 15.55 percent of the total market trading value. -Prepared by: Studies & Research Department - Bayan Investment Co.

BAYAN WEEKLY MARKET REPORT