Key indices fluctuate amid selling pressures

Click to view larger

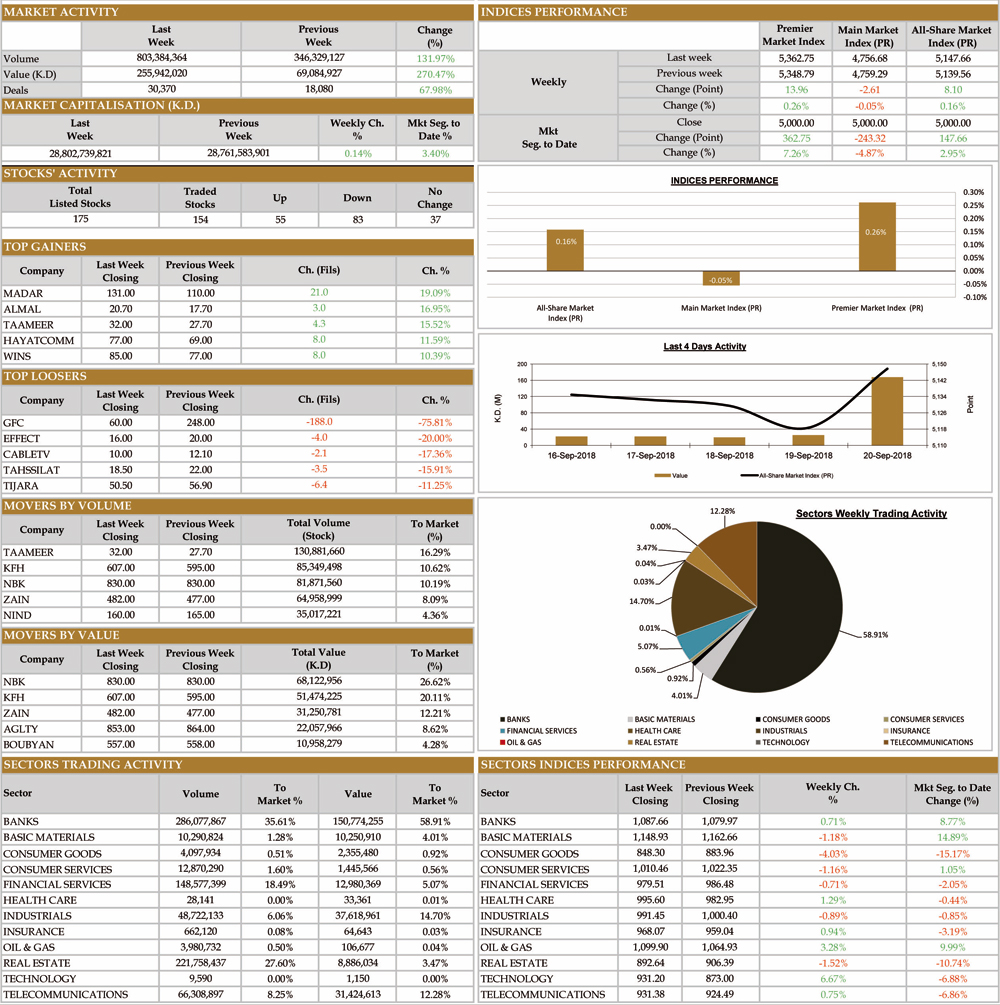

Click to view largerKUWAIT: Boursa Kuwait ended last week with mixed performance. The Premier Market Index closed at 5,362.75 points, up 0.26 percent, the Main Market Index decreased by 0.05 percent after closing at 4,756.68 points, and the All-Share Index closed at 5,147.66 points up by 0.16 percent. Furthermore, last week's average daily turnover increased by 196.38 percent, compared to the preceding week, reaching around KD 51.19 million, whereas trading volume average was about 160.68 million shares, recording an increase of 85.58 percent.

The market capitalization of the Boursa recorded a weekly increase equivalent to KD 41.16 million, as it reached by the end of the week around KD 28.80 billion, up by 0.14 percent of its level in the previous week, where it was KD 28.76 billion. The Boursa gains reached since the launch of the new market segmentation to around KD 945.42 million or 3.40 percent. (Note: The market capitalization for the listed companies in the Market is calculated based on the weighted average number of outstanding shares as per the latest available official financial statements).

The performance of the three indices fluctuated by the end of last week, whereas the Premiere and All-Share indices succeeded in recording increases supported by the continued purchasing powers on the leading and heavy stocks, especially the stocks nominated to be within FTSE Russell Index, while the Main Market Index could not succeed in recording gains, and ended the week's trading in the red zone affected by the continued selling and liquidating operations executed on some small-cap stocks.

Moreover, and despite the fluctuation of the market indices during the last week, the trading volumes and values witnessed a noticeable increase supported mainly by the last trading session of the week, where it witnessed historical trading and noticeable increase in the trading activity, which caused the total trading value to grow on the weekly level by 270.47 percent, while the total traded number of stocks increased by 131.97 percent.

Last week witnessed trading over 154 stock out of 175 listed stock in the Market, where prices of 55 stock increased against prices of 83 stock decreased, and prices of 37 stock remained at no change.

Sectors' indices

Six of Boursa Kuwait's sectors ended last week in the red zone, while the other six recorded increases. Last week's highest loser was the Consumer Goods sector, as its index declined by 4.03 percent to end the week's activity at 848.30 points, The Real Estate sector was second on the losers' list, which index declined by 1.52 percent, closing at 892.64 points, followed by the Basic Materials sector, which index declined by 1.18 percent, closing at 1,148.93 points.

On the other hand, Last week's highest gainer was the Technology sector, achieving 6.67 percent growth rate as its index closed at 931.20 points. The Oil & Gas sector came in the second place, as its index closed at 1,099.90 points recording 3.28 percent increase, followed by Health Care sector, achieving 1.29 percent growth rate as its index closed at 995.60 points.

Sectors' activity

The Financial Services sector dominated a total trade volume of around 286.08 million shares changing hands during last week, representing 35.61 percent of the total market trading volume. The Real Estate sector was second in terms of trading volume as the sector's traded shares were 27.60 percent of last week's total trading volume, with a total of around 221.76 million shares.

On the other hand, the Banks sector's stocks were the highest traded in terms of value; with a turnover of around KD 150.77 million or 58.91 percent of last week's total market trading value. The Industrial sector took the second place as the sector's last week turnover was approx. KD 37.62 million representing 14.70 percent of the total market trading value. - Prepared by the Studies & Research Department , Bayan Investment Co.

BAYAN WEEKLY MARKET REPORT