Bullish sentiment reflects commitment to output cuts

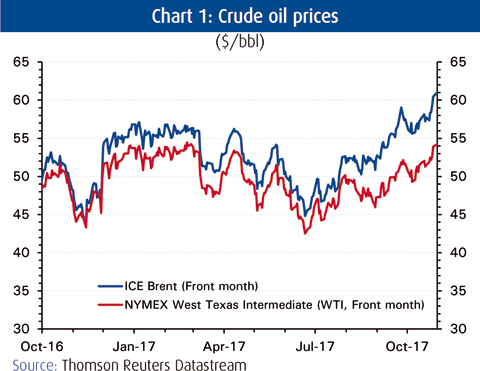

KUWAIT: Oil prices wrapped up a fourth consecutive month of gains in October. Brent crude, the international benchmark, traded above $60 per barrel (bbl) for the first time in more than two years. Indeed, Brent is up almost 35 percent since its 2017-low in mid-June. West Texas Intermediate (WTI), meanwhile, is ranged close to its highest level of the year at $54/bbl. The US marker has returned 27 percent over the same period.

KUWAIT: Oil prices wrapped up a fourth consecutive month of gains in October. Brent crude, the international benchmark, traded above $60 per barrel (bbl) for the first time in more than two years. Indeed, Brent is up almost 35 percent since its 2017-low in mid-June. West Texas Intermediate (WTI), meanwhile, is ranged close to its highest level of the year at $54/bbl. The US marker has returned 27 percent over the same period.

Both crude markers, but Brent especially, have benefited in recent weeks from a combination of bullish signals: tightening crude supply; improving global crude demand; continuing drawdowns in global crude stocks, which is one of OPEC's key objectives; mixed US shale data; and rising geopolitical risk.

The production cut agreement between OPEC and eleven oil producers from outside the group, led by Russia, has been instrumental in draining excess supplies and inventories from the market. Compliance has been at or above 100 percent for most of the ten months of the agreement, and several members, notably Russia and Saudi Arabia, have made a concerted effort to manage the public relations game properly, linking the observed drawdown in commercial crude stocks to their efforts.

OECD commercial crude and product inventories have indeed been declining since their peak in July 2016, but the pace has been glacial. Inventories were down to 3.015 billion barrels in August, a fall of 2.9 percent (90 million barrels) from their peak of 3.104 billion barrels thirteen months earlier. And while August's level brings OPEC to within striking distance (170 million barrels) of its five-year average target level (2.845 billion barrels), truth be told, much of this reflects the fact that the target level itself has increased (as it is a rolling average).

Nevertheless, as the OPEC Secretary General, Mohammad Barkindo, put it recently: "a balanced oil market is now fully in sight". And OPEC and its counterparts should be commended for steadfastly pursuing their goal with a level of unity and compliance hitherto unprecedented. OPEC, through its Joint Ministerial Monitoring Committee (JMMC), pegged its compliance at a record 120 percent in September. September's crude production was 32.75 mb/d, an increase of 90,000 b/d on August's figure, according to OPEC secondary sources.

Production cut

Markets have been further reassured recently by the rhetoric coming out of the OPEC/non-OPEC camps in favor of extending the production cut agreement through to the end of 2018. The group will next meet on 30 November in Vienna to discuss progress, the potential for rolling over the cuts and a possible orderly exit strategy to minimize the likelihood of producers opening the taps on the deal's expiry and flooding the market. It's not clear whether an official communique on either of these will be forthcoming, however. OPEC may opt to wait until closer to the expiration of the agreement in March for an announcement, preferring perhaps to keep the watching US shale industry, which will be keen to capitalize on an extension, in a prolonged state of uncertainty.

In any case, oil's four-month bull run shows that much of this has already been priced in. And over in the futures market, the backdated structure of the Brent forward curve, where prices for immediate delivery of crude are higher than prices for future delivery, is in OPEC's favor, encouraging spot sales and dis-incentivizing crude storage. With crude prices lower further out, hedging, which has been so effectively employed by US shale firms during the oil price downturn to lock in revenues, becomes less viable.

But there is little room for complacency on OPEC's part: anything less than an emphatic commitment to manage supply in the interim could trigger a market sell-off. Speculative positions by hedge funds are overwhelmingly bullish, with almost ten times as many 'longs' as 'shorts' currently on the books. At least $34 billion worth of long positions have been amassed in Brent. This is a record amount which could unwind at the first sign of a misstep from the oil producers' group.

Strong global demand

Global crude demand growth in 2017 has so far proven surprisingly strong, such that by the end of the year, it is more than likely to have outstripped supply by a considerable margin. The IEA pegs demand growth in 2017 at 1.6 mb/d (1.6 percent), which, if OPEC supplies continue at current levels, could mean a gap of 1.3 mb/d over expected global supply growth. (Charts 5 & 6.) Global stocks could have, by year's end, drawn down by 130 million barrels (0.4 mb/d).

Buoyant demand has reflected the improvement in the global economy, as the IMF recently noted in its World Economic Outlook. Importantly for oil, revisions to global GDP growth (+0.1 percent to 3.6 percent and 3.7 percent in 2017 and 2018, respectively) were supported by upwards reassessments to Chinese economic growth. China accounts for 12 percent of global crude oil demand, with LPG, gasoline and diesel the major refined products driving demand.

The story in 2018 could look quite different, however. Supply growth could outpace demand growth - if the IEA is correct in its estimates. The agency projects demand growth of 1.4 mb/d and non-OPEC supply growth of 1.5 mb/d. The US is expected to be the largest contributor to non-OPEC supply growth, with as much as 1.1 mb/d of crude oil coming on stream. This would follow 2017's increase of 0.47 mb/d. US crude production does look like it has finally recovered to pre-Hurricane Harvey levels of around 9.5 mb/d.

Having said that, the tapering off of new oil rigs coming on-line since June does throw up the possibility that US shale growth may underperform as we head into 2018; oil rig counts declined in eight of the last ten weeks. There is usually a lag of up to six months before crude production adjusts to movements in the rig count data.

Were US shale growth to perform in 2018 as the IEA forecasts then there is the possibility that global crude stocks could accumulate rather than draw down. This would postpone once more the market rebalancing that OPEC has so doggedly pursued. Hence the group's focus on extending the production cuts to the end of next year.

Geopolitics to the rescue

October saw oil prices also boosted by the return of the geopolitical risk premium, after months of relative quiet. Markets grew concerned that oil flows from Iraq could be compromised by Baghdad's confrontation with the Kurdistan Regional Government, after the latter staged a controversial independence referendum. The move drew the ire of Iran and, especially, Turkey, which threatened to close the key export pipeline carrying Kurdish crude (but also Iraqi federal crude from Kirkuk's oil fields) through Turkey to international markets. Pipeline exports from Iraq's northern oil fields reportedly fell by 60 percent during the month, from an average of 600,000 b/d to 240,000 b/d.

Market jitters were also in evidence after President Trump decertified the Iran deal (The Joint Comprehensive Plan of Action), handing over the decision whether or not to 'nix' the JCPOA and re-impose sanctions to US Congress. Congress has two months to deliberate, but the US is alone among the P5+1 signatories (Russia, China, the UK, the EU, France and Germany) in viewing the deal with disfavor, so it is unlikely that it could single-handedly terminate it.

Geopolitics and the risk it poses to oil supplies is part and parcel of oil markets dynamics. OPEC, as it deliberates on extending its production cut agreement to keep oil prices steady within the desirable $55-60/bbl range may indeed be taking comfort from it. But it knows not to count on it.

NBK ECONOMIC REPORT