TOKYO: Business confidence fell among Japan's largest manufacturers for the third straight quarter, a closely-watched survey showed Monday, defying analyst expectations for a rise in sentiment. The Bank of Japan's Tankan survey shows major manufacturers are still much more upbeat than during the gloomiest days of the COVID-19 pandemic. But inflation, including higher energy prices fuelled by the war in Ukraine, has weighed on business confidence this year, analysts say.

The quarterly survey, considered to be the broadest indicator of how Japanese businesses are faring, showed confidence among large manufacturers at plus eight, down slightly from the previous reading of plus nine.

A positive figure means more manufacturers see business conditions as favorable than those that consider them unfavorable. The reading has been falling since April after nearly two years of improving sentiment, which had plunged to minus 34 in June 2020 as COVID-19 restrictions pummeled the economy. "While soaring material and energy prices continued to weigh on business sentiment, an easing supply crunch due to the lifting of Shanghai lockdowns would provide a boost", Tsuyoshi Ueno, senior economist at NLI Research, said ahead of Monday's release.

Among large non-manufacturers, business confidence slightly improved to 14 from a previous reading of 13, the Tankan showed. Inflation in Japan hit a seven-year high of 2.8 percent for items excluding fresh products in August, though the figure is much less steep than in many other countries.

The yen has also hit 24-year lows in recent weeks, prompting an intervention last month by the government, which is also preparing another round of stimulus measures to boost the world's third-largest economy.

Meanwhile, Tokyo stocks shed earlier losses and ended higher Monday as investors picked up bargains despite continued concerns over monetary tightening in the United States. The benchmark Nikkei 225 index added 1.07 percent, or 278.58 points, to 26,215.79, while the broader Topix index rose 0.63 percent, or 11.64 points, to 1,847.58.

The dollar was at 145.02 yen, crossing the 145-level at which Japan's government intervened to bolster the currency last month. That was against 144.49 yen in New York on Friday. The Nikkei started under pressure after global shares headed south last week, with the US Federal Reserve continuing its aggressive campaign to hike rates to fight inflation. But by mid-morning, investors started to buy back shares on fears that they might have over-sold them.

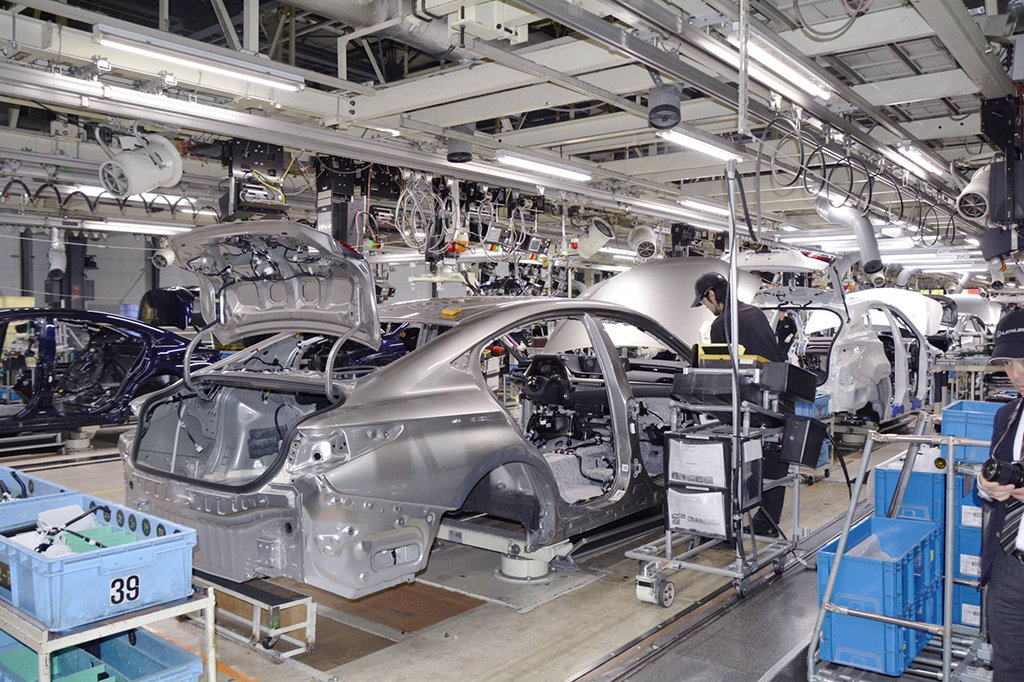

"As the domestic index opened the new week by falling further, investors became cautious about excessive selling," Daiwa Securities said in a commentary. Commodity shares benefited as oil futures rose on news that oil producers were considering a production cut, the brokerage said. Investors also picked up shares that have been targets of recent selling, such as semiconductors and automakers, analysts added. Among major shares, Advantest, a major producer of testing kits for semiconductors, surged 4.78 percent to 7,020 yen. Sony Group, which is also known for its sensors along with games, audio equipment and movies, added 2.40 percent to 9,509 yen.

Automaker Toyota jumped 3.49 percent to 1,941.5 yen. Energy developer Inpex added 3.02 percent to 1,400 yen. Japan Petroleum Exploration rose 2.89 percent to 3,565 yen. Shortly before the opening bell, the Bank of Japan's closely watched Tankan survey was released, showing a worse-than-expected reading of plus eight among large manufacturers.

The figure meant confidence among major manufacturers fell for three consecutive quarters, despite market expectations that the lifting of Shanghai lockdowns would boost their sentiment. Japanese Finance Minister Shunichi Suzuki reiterated Monday that the government was ready to respond to currency volatility, after Tokyo spent around $19 billion on an intervention to stop the currency slumping in late September. At the time, it denied the intervention was triggered by the dollar breaking through the symbolic 145-yen level, but rather was a response to "excessive fluctuations". - AFP