Source: Doing business database

Source: Doing business database

KUWAIT: Doing Business sheds light on how easy or difficult it is for a local entrepreneur to open and run a small to medium-size business when complying with relevant regulations. It measures and tracks changes in regulations affecting 11 areas in the life cycle of a business: starting a business, dealing with construction permits, getting electricity, registering property, getting credit, protecting minority investors, paying taxes, trading across borders, enforcing contracts, resolving insolvency and labor market regulation. Doing Business 2016 presents the data for the labor market regulation indicators in an annex. The report does not present rankings of economies on labor market regulation indicators or include the topic in the aggregate distance to frontier score or ranking on the ease of doing business.

In a series of annual reports Doing Business presents quantitative indicators on business regulations and the protection of property rights that can be compared across 189 economies, from Afghanistan to Zimbabwe, over time. The data set covers 47 economies in Sub-Saharan Africa, 32 in Latin America and the Caribbean, 25 in East Asia and the Pacific, 25 in Eastern Europe and Central Asia, 20 in the Middle East and North Africa and 8 in South Asia, as well as 32 OECD high-income economies. The indicators are used to analyze economic outcomes and identify what reforms have worked, where and why.

THE BUSINESS ENVIRONMENT

For policy makers trying to improve their economy's regulatory environment for business, a good place to start is to find out how it compares with the regulatory environment in other economies. Doing Business provides an aggregate ranking on the ease of doing business based on indicator sets that measure and benchmark regulations applying to domestic small to medium-size businesses through their life cycle. Economies are ranked from 1 to 189 by the ease of doing business ranking.

The 10 topics included in the ranking in Doing Business 2016: starting a business, dealing with construction permits, getting electricity, registering property, getting credit, protecting minority investors, paying taxes, trading across borders, enforcing contracts and resolving insolvency. The labor market regulation indicators are not included in this year's aggregate ease of doing business ranking, but the data are presented in the economy profile.

THE BUSINESS ENVIRONMENT

For policy makers, knowing where their economy stands in the aggregate ranking on the ease of doing business is useful. Also useful is to know how it ranks relative to comparator economies and relative to the regional average. The economy's rankings and distance to frontier scores on the topics included in the ease of doing business ranking provide another perspective.

Just as the overall ranking on the ease of doing business tells only part of the story, so do changes in that ranking. Yearly movements in rankings can provide some indication of changes in an economy's regulatory environment for firms, but they are always relative.

Moreover, year-to-year changes in the overall rankings do not reflect how the business regulatory environment in an economy has changed over time-or how it has changed in different areas. To aid in assessing such changes, Doing Business introduced the distance to frontier score. This measure shows how far on average an economy is from the best performance achieved by any economy on each Doing Business indicator.

STARTING A BUSINESS

Formal registration of companies has many immediate benefits for the companies and for business owners and employees. Legal entities can outlive their founders. Resources are pooled as several shareholders join forces to start a company. Formally registered companies have access to services and institutions from courts to banks as well as to new markets. And their employees can benefit from protections provided by the law. An additional benefit comes with limited liability companies. These limit the financial liability of company owners to their investments, so personal assets of the owners are not put at risk. Where governments make registration easy, more entrepreneurs start businesses in the formal sector, creating more good jobs and generating more revenue for the government.

What do the indicators cover?

Doing Business records all procedures officially required, or commonly done in practice, for an entrepreneur to start up and formally operate an industrial or commercial business, as well as the time and cost to complete these procedures and the paid-in minimum capital requirement. These procedures include obtaining all necessary licenses and permits and completing any required notifications, verifications or inscriptions for the company and employees with relevant authorities. The ranking of economies on the ease of starting a business is determined by sorting their distance to frontier scores for starting a business. These scores are the simple average of the distance to frontier scores for each of the component indicators.

Where does Kuwait stand

What does it take to start a business in Kuwait? According to data collected by Doing Business, starting a business there requires 12.00 procedures, takes 31.00 days, costs 2.30 percent of income per capita and requires paid-in minimum capital of 8.20 percent of income per capita (figure 2.1). Most indicator sets refer to a case scenario in the largest business city of an economy, except for 11 economies for which the data are a population-weighted average of the 2 largest business cities. See the chapter on distance to frontier and ease of doing business ranking at the end of this profile for more details.

Globally, Kuwait stands at 148 in the ranking of 189 economies on the ease of starting a business. The rankings for comparator economies and the regional average ranking provide other useful information for assessing how easy it is for an entrepreneur in Kuwait to start a business.

Economies around the world have taken steps making it easier to start a business-streamlining procedures by setting up a one-stop shop, making procedures simpler or faster by introducing technology and reducing or eliminating minimum capital requirements. Many have undertaken business registration reforms in stages-and they often are part of a larger regulatory reform program. Among the benefits have been greater firm satisfaction and savings and more registered businesses, financial resources and job opportunities.

What are the details?

Underlying the indicators shown in this chapter for Kuwait is a set of specific procedures-the bureaucratic and legal steps that an entrepreneur must complete to incorporate and register a new firm. These are identified by Doing Business through collaboration with relevant local professionals and the study of laws, regulations and publicly available information on business entry in that economy. Following is a detailed summary of those procedures, along with the associated time and cost. These procedures are those that apply to a company matching the standard assumptions (the "standardized company") used by Doing Business in collecting the data (see the section in this chapter on what the indicators measure).

STANDARDIZED COMPANY

To register, the entrepreneur must submit a completed standard application form to the Department of Companies of the Ministry of Commerce and Industry (MOCI), accompanied by the following documents:

1. Copy of the entrepreneur's identity card (ID)

2. Certificate issued by the Social Security Authority attesting that the Kuwaiti partners are not civil servants

3. Lease contract, a receipt of rent payment, and a certificate from the Public Authority for Civil Information (PACI) confirming that the premises are registered with PACI The completed application must include the names of the founding partners and their respective shares; the capital, scope and objective of the company; and the name of the manager.

Once the application is approved, it is stamped and signed by the Department of Companies, and allocated a reference number. The MOCI electronically sends an inspection request to the Municipality to proceed with the inspection of the company premises at the relevant point of incorporation process. The MOCI also sends a request to the Ministry of Interior to run background checks verifying that the founding partners do not have a criminal record.

Reserve a unique company name

The entrepreneur submits a company name reservation application to the Commercial Registry. The Commercial Registry searches the computer database to ensure that the proposed company name(s) does not already exist or resemble other reserved names. The Commercial Registry has certain guidelines to follow with respect to the company name selection, such as: the chosen name must not be in breach of "public morals." Once approved, the Commercial Registry issues a letter confirming the proposed name and reserves it for 3 months.

In deference to the Department of Companies' letter, the bank open an account in the name of the company with the term "under formation" annexed to the account. The deposited capital remains frozen until the bank receives the notarized deed of incorporation and the commercial license of the company, following which the term "under formation" is removed and the account is activated. The bank issues a deposit certificate in the name of the company addressed to the Ministry of Commerce and Industry, detailing the amount deposited by each partner against his/her share in the company.

Once the municipality receives the request for inspection of the company premises from the Ministry of Commerce and Industry, it contacts the entrepreneur to schedule an inspection date in order to verify that the premises comply with municipal health and safety regulations. This includes an inspection by the Fire Department to check for compliance with fire regulations. If the company premises successfully pass inspection, the municipality issues a certificate of no objection in the name of the company, allowing the use of the indicated premises as the company location. This process usually takes 5 to 14 days.

Obtain the approval of the memorandum of association from the Department of Companies

The entrepreneur proceeds to the Department of Companies to submit the draft memorandum of association. If the entrepreneur does not use the standard form of the memorandum of association, the amendments or additions to the standard memorandum must be accepted by the MOCI before it approves the company incorporation. Once the final draft is signed, the Department of Companies issues a letter addressed to the Ministry of Justice (MOJ) requesting the authentication of the company incorporation, accompanied by the draft memorandum of association.

Notarize the MoA

The entrepreneur submits the draft memorandum of association along with Department of Companies' letter and the bank capital deposit certificate to the Notary Public Department at the Ministry of Justice. The officer verifies that the required documents are complete and schedules an appointment for signing before the notary public at the Company Formation Department of the Ministry of Justice, during which the memorandum of association is signed by the founding partners and notarized on the set date in 3 originals: one for the company, one for the Ministry of Justice, and one to be field with the Ministry of Commerce and Industry.

The entrepreneur files a signed and notarized copy of the memorandum of association at the Department of Companies of the Ministry of Commerce and Industry. A copy thereof is then submitted to the Commercial Registry and a certificate of registration is obtained. The certificate of registration includes the company's full name and commercial registration number.

The company must apply for membership at the Chamber of Commerce and Industry by submitting copies of its commercial license and memorandum of association, and filling out a specimen signature form signed by the company's authorized signatories. The membership is a pre-requisite to dealing with other government authorities, banks and participation in public tenders.

The Ministry of Labor may inspect the premises to determine whether the size of the company premises and its business scope are commensurate with the number of employees declared at the Ministry.

DEALING WITH CONSTRUCTION PERMITS

Regulation of construction is critical to protect the public. But it needs to be efficient, to avoid excessive constraints on a sector that plays an important part in every economy. Where complying with building regulations is excessively costly in time and money, many builders opt out. They may pay bribes to pass inspections or simply build illegally, leading to hazardous construction that puts public safety at risk. Where compliance is simple, straightforward and inexpensive, everyone is better off.

What do the indicators cover?

Doing Business records all procedures required for a business in the construction industry to build a warehouse along with the time and cost to complete each procedure. In addition, this year Doing Business introduces a new measure, the building quality control index, evaluating the quality of building regulations, the strength of quality control and safety mechanisms, liability and insurance regimes, and professional certification requirements.

The ranking of economies on the ease of dealing with construction permits is determined by sorting their distance to frontier scores for dealing with construction permits. These scores are the simple average of the distance to frontier scores for each of the component indicators.

Where does the economy stand today?

What does it take to comply with the formalities to build a warehouse in Kuwait? According to data collected by Doing Business, dealing with construction permits there requires 22.00 procedures, takes 216.00 days and costs 0.30 percent of the warehouse value. Most indicator sets refer to a case scenario in the largest business city of an economy, except for 11 economies for which the data are a population-weighted average of the 2 largest business cities. See the chapter on distance to frontier and ease of doing business ranking at the end of this profile for more details.

Globally, Kuwait stands at 133 in the ranking of 189 economies on the ease of dealing with construction permits (figure 3.2). The rankings for comparator economies and the regional average ranking provide other useful information for assessing how easy it is for an entrepreneur in Kuwait to legally build a warehouse.

The indicators reported here for Kuwait are based on a set of specific procedures-the steps that a company must complete to legally build a warehouse-identified by Doing Business through information collected from experts in construction licensing, including architects, civil engineers, construction lawyers, construction firms, utility service providers and public officials who deal with building regulations. These procedures are those that apply to a company and structure matching the standard assumptions used by Doing Business in collecting the data. According to No. 30/2012 issued by Kuwait Municipality on August 2012, the building permit will not be granted unless the Ministry of Electricity and Water (MEW) gives its approval on the electric supply. A site inspection must be conducted before the approval can be issued. MEW is understaffed and therefore, it can take anywhere from 1 week to 1 month for the site inspection to happen. Approval of the plans can take 1-2 months after the inspection takes place.

Once the Kuwait Municipality is satisfied with the information and documentation concerning the building's specifications and construction works, it will grant the necessary approvals.

Building Quality Control Index

The building quality control index is the sum of the scores on the quality of building regulations, quality control before construction, quality control during construction, quality control after construction, liability and insurance regimes, and professional certifications indices.

The index ranges from 0 to 15, with higher values indicating better quality control and safety mechanisms in the construction permitting system. The indicator is based on the same case study assumptions as the measures of efficiency.

What does it take to obtain a new electricity connection in Kuwait?

According to data collected by Doing Business, getting electricity there requires 8.00 procedures, takes 64.00 days and costs 52.20 percent of income per capita.

Most indicator sets refer to a case scenario in the largest business city of an economy, except for 11 economies for which the data are a population-weighted average of the 2 largest business cities. See the chapter on distance to frontier and ease of doing business ranking at the end of this profile for more details.

Globally, Kuwait stands at 128 in the ranking of 189 economies on the ease of getting electricity. The rankings for comparator economies and the regional average ranking provide another perspective in assessing how easy it is for an entrepreneur in Kuwait to connect a warehouse to electricity.

What are the details?

The indicators reported here for Kuwait are based on a set of specific procedures-the steps that an entrepreneur must complete to get a warehouse connected to electricity by the local distribution utility-identified by Doing Business. Data are collected from the distribution utility, then completed and verified by electricity regulatory agencies and independent professionals such as electrical engineers, electrical contractors and construction companies. The electricity distribution utility surveyed is the one serving the area (or areas) in which warehouses are located. If there is a choice of distribution utilities, the one serving the largest number of customers is selected.

Ensuring formal property rights is fundamental. Effective administration of land is part of that. If formal property transfer is too costly or complicated, formal titles might go informal again. And where property is informal or poorly administered, it has little chance of being accepted as collateral for loans-limiting access to finance.

What do the indicators cover?

Doing Business records the full sequence of procedures necessary for a business to purchase property from another business and transfer the property title to the buyer's name. The transaction is considered complete when it is opposable to third parties and when the buyer can use the property, use it as collateral for a bank loan or resell it. In addition, this year Doing Business adds a new measure to the set of registering property indicators, an index of the quality of the land administration system in each economy. The ranking of economies on the ease of registering property is determined by sorting their distance to frontier scores for registering property. These scores are the simple average of the distance to frontier scores for each of the component indicators. To make the data comparable across economies, several assumptions about the parties to the transaction, the property and the procedures are used.

What does it take to complete a property transfer in Kuwait? According to data collected by Doing Business, registering property there requires 8.00 procedures, takes 49.00 days and costs 0.50 percent of the property value.

What are the details?

The indicators reported here are based on a set of specific procedures-the steps that a buyer and seller must complete to transfer the property to the buyer's name-identified by Doing Business through information collected from local property lawyers, notaries and property registries. These procedures are those that apply to a transaction matching the standard assumptions used by Doing Business in collecting the data (see the section in this chapter on what the indicators cover). The procedures, along with the associated time and cost, are summarized below.

The seller must request a Cadastral Description Certificate from the Municipality providing the details of the property in question (i.e. its size, the developments on it, the zoning, etc) and confirming that the property is in compliance with all the Municipality regulations. This document is prepared following an inspection of the property by an architect of the Municipality. The warehouse is likely to be in one of the following areas; Shuwaikh, Sulaibiya, Sabhan, Al Rai, Anghara and Ardiya. This is however not an exclusive list. The Kuwait Municipality, which is the authority responsible for zoning, may authorize the construction of a warehouse in an area that is not ordinarily used for warehousing.

Once the No Objection letter is received from the Municipality, the parties receive an SMS to come to the Ministry of Justice to complete the transaction. The seller must prepare an application requesting a transfer of title to be filed with the Contracts Control Department of the Real Estate Registration Office of the Ministry of Justice. The Contracts Control Department reviews the application and the attached documents internally (3-7 days). After reviewing the application, the Contracts Control Department will take an extra 17-28 days to check all the documentation and approve the transfer. If approved, the form of the sale agreement is transferred to the notarization department for review. Once approved, the same is printed on the official green papers used by the Ministry and becomes ready for signature. The 0.5 percent registration fee is paid to the Department of Real Estate Registration & Authentication (Ministry of Justice) upon the completion of the registration Procedures, who approves the submitted documents before parties sign the notarized sale contract. The documentation shall include: a) Form of the sale agreement (available at the Real Estate Registration Office) b) Form I 15 calendar days .

GETTING CREDIT

Two types of frameworks can facilitate access to credit and improve its allocation: credit information systems and borrowers and lenders in collateral and bankruptcy laws. Credit information systems enable lenders' rights to view a potential borrower's financial history (positive or negative)-valuable information to consider when assessing risk. And they permit borrowers to establish a good credit history that will allow easier access to credit. Sound collateral laws enable businesses to use their assets, especially movable property, as security to generate capital-while strong creditors' rights have been associated with higher ratios of private sector credit to GDP.

The ranking of economies on the ease of getting credit is determined by sorting their distance to frontier scores for getting credit. These scores are the distance to frontier score for the strength of legal rights index and the depth of credit information index.

How well do the credit information system and collateral and bankruptcy laws in Kuwait facilitate Globally, Kuwait stands at 109 in the ranking of 189 economies on the ease of getting credit (figure 6.1). The rankings for comparator economies provide other useful information for assessing how well regulations and institutions in Kuwait support lending and borrowing.

What are the details?

The getting credit indicators reported here for Kuwait are based on detailed information collected in that economy. The data on credit information sharing are collected through a survey of a credit registry and/or credit bureau (if one exists). To construct the depth of credit information index, a score of 1 is assigned for each of 8 features of the credit registry or credit bureau .

The data on the legal rights of borrowers and lenders are gathered through a survey of financial lawyers and verified through analysis of laws and regulations as well as public sources of information on collateral and bankruptcy laws. For the strength of legal rights index, a score of 1 is assigned for each of 10 aspects related to legal rights in collateral law and 2 aspects in bankruptcy law.

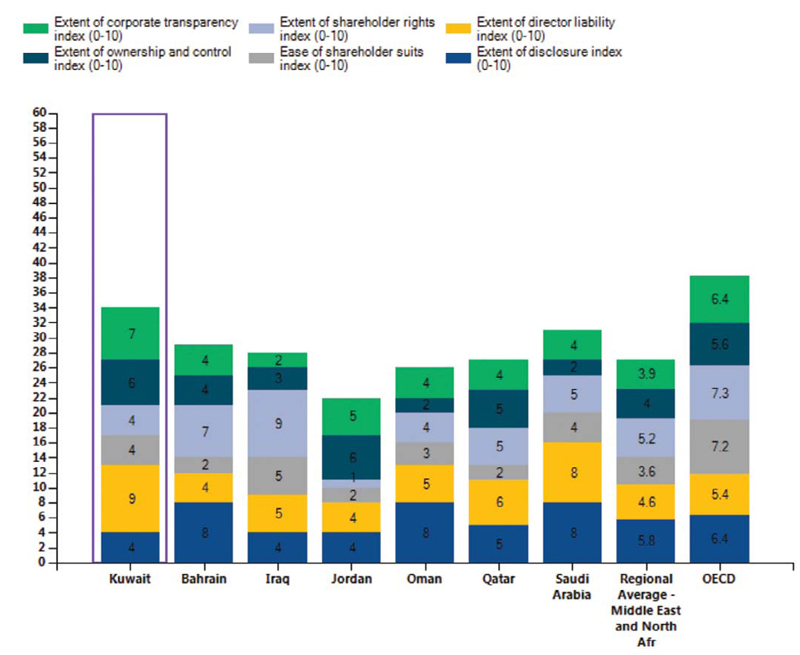

PROTECTING MINORITY INVESTORS

Protecting minority investors matters for the ability of companies to raise the capital they need to grow, innovate, diversify and compete. Effective regulations define related-party transactions precisely, promote clear and efficient disclosure requirements, require shareholder participation in major decisions of the company and set detailed standards of accountability for company insiders.

What do the indicators cover?

Doing Business measures the protection of minority investors from conflicts of interest through one set of indicators and shareholders' rights in corporate governance through another. The ranking of economies on the strength of minority investor protections is determined by sorting their distance to frontier scores for protecting minority investors. These scores are the simple average of the distance to frontier scores for the extent of conflict of interest regulation index and the extent of shareholder governance index. To make the data comparable across economies, a case study uses several assumptions about the business and the transaction.

How strong are minority investor protections against self-dealing in Kuwait? The economy has a score of 5.70 on the strength of minority investor protection index, with a higher score indicating stronger protections.

One way to put an economy's scores on the protecting minority investors indicators into context is to see where the economy stands in the distribution of scores across comparator economies.

Economies with the strongest protections of minority investors from self-dealing require detailed disclosure and define clear duties for directors. They also have well-functioning courts and up-to-date procedural rules that give minority shareholders the means to prove their case and obtain a judgment within a reasonable time. As a result, reforms to strengthen minority investor protections may move ahead on different fronts-such as through new or amended company laws, securities regulations or civil procedure rules. What minority investor protection reforms has Doing Business recorded in Kuwait.

Kuwait strengthened investor protections by making it possible for minority shareholders to request the appointment of an auditor to review the company's activities.

PAYING TAXES

Taxes are essential. The level of tax rates needs to be carefully chosen-and needless complexity in tax rules avoided. Firms in economies that rank better on the ease of paying taxes in the Doing Business study tend to perceive both tax rates and tax administration as less of an obstacle to business according to the World Bank Enterprise Survey research.

What do the indicators cover?

Using a case scenario, Doing Business records the taxes and mandatory contributions that a medium-size company must pay in a given year as well as measures of the administrative burden of paying taxes and contributions. This case scenario uses a set of financial statements and assumptions about transactions made over the year. Information is also compiled on the frequency of filing and payments as well as time taken to comply with tax laws. The ranking of economies on the ease of paying taxes is determined by sorting their distance to frontier scores on the ease of paying taxes. These scores are the simple average of the distance to frontier scores for each of the component indicators, with a threshold and a nonlinear transformation applied to one of the component indicators, the total tax rate3. All financial statement variables are proportional to 2012 income per capita.

Globally, Kuwait stands at 11 in the ranking of 189 economies on the ease of paying taxes (figure 8.1). The rankings for comparator economies and the regional average ranking provide other useful information for assessing the tax compliance burden for businesses in Kuwait.

What are the details?

The indicators reported here for Kuwait are based on the taxes and contributions that would be paid by a standardized case study company used by Doing Business in collecting the data (see the section in this chapter on what the indicators cover). Tax practitioners are asked to review a set of financial statements as well as a standardized list of assumptions and transactions that the company completed during its 2nd year of operation. Respondents are asked how much taxes and mandatory contributions the business must pay and how these taxes are filed and paid.

TRADING ACROSS BORDERS

In today's globalized world, making trade between economies easier is increasingly important for business. Excessive document requirements, burdensome customs procedures, inefficient port operations and inadequate infrastructure all lead to extra costs and delays for exporters and importers, stifling trade potential.

What do the indicators cover?

Doing Business records the time and cost associated with the logistical process of exporting and importing goods. Under the new methodology introduced this year, Doing Business measures the time and cost (excluding tariffs) associated with three sets of procedures-documentary compliance, border compliance and domestic transport-within the overall process of exporting or importing a shipment of goods. The ranking of economies on the ease of trading across borders is determined by sorting their distance to frontier scores for trading across borders. These scores are the simple average of the distance to frontier scores for the time and cost for documentary compliance and border compliance to export and import.

ENFORCING CONTRACTS

Effective commercial dispute resolution has many benefits. Courts are essential for entrepreneurs because they interpret the rules of the market and protect economic rights. Efficient and transparent courts encourage new business relationships because businesses know they can rely on the courts if a new customer fails to pay. Speedy trials are essential for small enterprises, which may lack the resources to stay in business while awaiting the outcome of a long court dispute.

What do the indicators cover?

Doing Business measures the time and cost for resolving a standardized commercial dispute through a local first-instance court. In addition, this year it introduces a new measure, the quality of judicial processes index, evaluating whether each economy has adopted a series of good practices that promote quality and efficiency in the court system. This new index replaces the indicator on procedures, which was eliminated this year. The ranking of economies on the ease of enforcing contracts is determined by sorting their distance to frontier scores. These scores are the simple average of the distance to frontier scores for each of the component indicators.

Globally, Kuwait stands at 58 in the ranking of 189 economies on the ease of enforcing contracts (figure 10.1). The rankings for comparator economies and the regional average ranking provide other useful benchmarks for assessing the efficiency of contract enforcement in Kuwait. The data on time and cost reported here for Kuwait are built by following the step-by-step evolution of a commercial sale dispute within the court, under the assumptions about the case described above. The time and cost of resolving the standardized dispute are identified through study of the codes of civil procedure and other court regulations, as well as through questionnaires completed by local litigation lawyers (and, in a quarter of the economies covered by Doing Business, by judges as well).

Quality of judicial processes index

The quality of judicial processes index measures whether each economy has adopted a series of good practices in its court system in four areas: court structure and proceedings, case management, court automation and alternative dispute resolution. The score on the quality of judicial processes index is the sum of the scores on these 4 sub-components. The index ranges from 0 to 18, with higher values indicating more efficient judicial processes.

RESOLVING INSOLVENCY

By clarifying the expectations of creditors and debtors about the outcome of insolvency proceedings, well-functioning insolvency systems can facilitate access to finance, save more viable businesses and sustainably grow the economy.

What do the indicators cover?

Doing Business studies the time, cost and outcome of insolvency proceedings involving domestic legal entities. These variables are used to calculate the recovery rate, which is recorded as cents on the dollar recovered by secured creditors through reorganization, liquidation or debt enforcement (foreclosure or receivership) proceedings. To determine the present value of the amount recovered by creditors, Doing Business uses the lending rates from the International Monetary Fund, supplemented with data from central banks and the Economist Intelligence Unit.

The ranking of economies on the ease of resolving insolvency is determined by sorting their distance to frontier scores for resolving insolvency. These scores are the simple average of the distance to frontier scores for the recovery rate and the strength of insolvency framework index. The Resolving Insolvency indicators do not measure insolvency proceedings of individuals and financial institutions. The data are derived from questionnaire responses by local insolvency practitioners and verified through a study of laws and regulations as well as public information on bankruptcy systems.

Globally, Kuwait stands at 122 in the ranking of 189 economies on the ease of resolving insolvency. The resolving insolvency indicators are based on detailed information collected through questionnaires completed by insolvency experts, including lawyers, practitioners (administrators, trustees), accountants and judges. Data on the time, cost and outcome refer to the most likely in-court insolvency procedure applicable under specific case study assumptions. Data on provisions applicable to judicial liquidation and reorganization is based on the current law governing insolvency proceedings in each economy.

LABOR MARKET REGULATION

Doing Business has historically studied the flexibility of regulation of employment, specifically as it relates to the areas of hiring, working hours and redundancy. This year Doing Business has expanded the scope of the labor market regulation indicators by adding 16 new questions, most of which focus on measuring job quality.

Over the period from 2007 to 2011 improvements were made to align the methodology for the labor market regulation indicators (formerly the employing workers indicators) with the letter and spirit of the International Labour Organization (ILO) conventions. Ten of the 189 ILO conventions cover areas now measured by Doing Business (up from four previously): employee termination, weekend work, holiday with pay, night work, protection against unemployment, sickness benefits, maternity protection, working hours, equal remuneration and labor inspections.

Between 2009 and 2011 the World Bank Group worked with a consultative group-including labor lawyers, employer and employee representatives, and experts from the ILO, the Organisation for Economic Co-operation and Development (OECD), civil society and the private sector-to review the methodology for the labor market regulation indicators and explore future areas of research.

Doing Business 2016 presents the data for the labor market regulation indicators in an annex. The report does not present rankings of economies on these indicators or include the topic in the aggregate distance to frontier score or ranking on the ease of doing business.

The data on labor market regulation are based on a detailed questionnaire on employment regulations that is completed by local lawyers and public officials. Employment laws and regulations as well as secondary sources are reviewed to ensure accuracy.

Employment laws are needed to protect workers from arbitrary or unfair treatment and to ensure efficient contracting between employers and workers. Many economies that changed their labor market regulation in the past 5 years did so in ways that increased labor market flexibility. What changes did Kuwait adopt that affected the Doing Business indicators on labor market regulation.

Kuwait increased the number of days of paid annual leave and increased the notice period applicable in case of redundancy dismissals. The data reported here for Kuwait are based on a detailed survey of labor market regulation that is completed by local lawyers and public officials. Employment laws and regulations as well as secondary sources are reviewed to ensure accuracy.

Hiring

Data on hiring cover five areas: (i) whether fixed-term contracts are prohibited for permanent tasks; (ii) the maximum cumulative duration of fixed-term contracts;

(iii) the minimum wage for a cashier, age 19, with one year of work experience; (iv) the ratio of the minimum wage to the average value added per worker (the ratio of an economy's GNI per capita to the working-age population as a percentage of the total population), and (v) the availability of incentives for employers to hire.

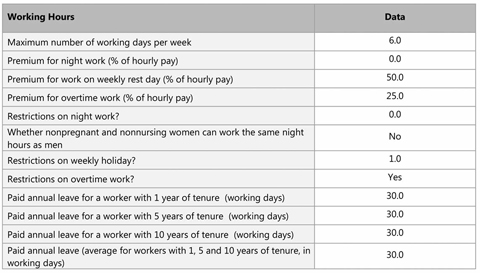

Working hours

Data on working hours cover nine areas: i) the maximum number of working days allowed per week; (ii) the premium for night work (as a percentage of hourly pay);

(iii) the premium for work on a weekly rest day (as a percentage of hourly pay); (iv) the premium for overtime work (as a percentage of hourly pay); (v) whether there are restrictions on night work; (vi) whether non-pregnant and non-nursing women can work the same night hours as men*; (vii) whether there are restrictions on weekly holiday work; (viii) whether there are restrictions on overtime work; and (ix) the average paid annual leave for workers with 1 year of tenure, 5 years of tenure, and 10 years of tenure.

Redundancy rules

Data on redundancy cover nine areas: (i) the length of the maximum probationary period (in months) for permanent employees; (ii) whether redundancy is allowed as a basis for terminating workers; (iii) whether the employer needs to notify a third party (such as a government agency) to terminate one redundant worker;

(iv) whether the employer needs to notify a third party to terminate a group of nine redundant workers; (v) whether the employer needs approval from a third party to terminate one redundant worker; (vi) whether the employer needs approval from a third party to terminate a group of nine redundant workers; (vii) whether the law requires the employer to reassign or retrain a worker before making the worker redundant; (viii) whether priority rules apply for redundancies; and (ix) whether priority rules apply for reemployment.

Redundancy cost

Redundancy cost measures the cost of advance notice requirements and severance payments due when terminating a redundant worker, expressed in weeks of salary. The average value of notice requirements and severance payments applicable to a worker with 1 year of tenure, a worker with 5 years and a worker with 10 years is considered. One month is recorded as 4 and 1/3 weeks.

Job quality

Doing Business 2016 report presents, for the first time, data on 12 job quality areas:

(i) whether the law mandates equal remuneration for work of equal value;

(ii) whether the law mandates nondiscrimination based on gender in hiring,

(iii) whether the law mandates paid or unpaid maternity leave;

(iv) the minimum length of maternity leave in calendar days (minimum number of days that legally have to be paid by the government, the employer or both);

(v) whether employees on maternity leave receive 100 percent of wages; (vi) the availability of five fully paid days of sick leave a year;

(vii) the availability of on-the-job training at no cost to the employee;

(viii) whether a worker is eligible for an unemployment protection scheme after one year of service;

(ix) the minimum duration of the contribution period (in months) required for unemployment protection;

(x) whether an employee can create or join a union;

(xi) the availability of administrative or judicial relief in case of infringement of employees' rights; and

(xii) the availability of a labor inspection system. If no maternity leave is mandated by law, parental leave is measured if applicable.