Wage growth softens, household borrowing eases

KUWAIT: Consumer spending growth remains healthy, supported by high levels of confidence, a decent pick-up in employment, and an improving economic backdrop helped by higher oil prices. However, some downside pressures remain: wage growth is soft, household borrowing growth is easing, and the number of expatriate dependents is declining. Overall we still expect the consumer sector to remain supportive of the broader economic climate over coming quarters, but may moderate somewhat from recent strong levels.

KUWAIT: Consumer spending growth remains healthy, supported by high levels of confidence, a decent pick-up in employment, and an improving economic backdrop helped by higher oil prices. However, some downside pressures remain: wage growth is soft, household borrowing growth is easing, and the number of expatriate dependents is declining. Overall we still expect the consumer sector to remain supportive of the broader economic climate over coming quarters, but may moderate somewhat from recent strong levels.

Central Bank of Kuwait, National Bank of Kuwait

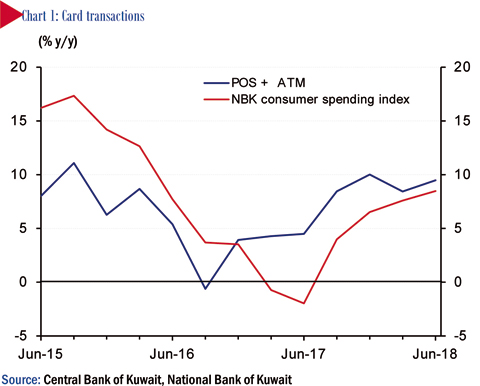

As of 2Q18, consumer spending growth had recovered to near pre-fiscal consolidation era levels. The value of spending on credit and debit cards at POS machines increased by 16.6 percent y/y, its strongest in over four years. Total spending, which also includes ATM withdrawals, increased by a still notable 9.5 percent y/y, outpacing its performance from the previous quarter. This is in line with the NBK consumer spending index, which grew by 8.5 percent at the end of Q2.

Underpinning the pick-up in spending is optimism over the current state of the economy and its future prospects, fostered by expansionary budgets and higher oil prices. Ara's consumer confidence index stood at 117 points in August and averaged 111 over the last 12 months, a level not seen since November 2014.

Another contributing factor is improving employment prospects, with the impact of austerity measures implemented over the last two years and the earlier slowdown in economic growth beginning to fade. Jobs were up 2.9 percent y/y in June, with an increase in hiring of both Kuwaitis and expatriates.

In fact, Kuwaiti job growth in June was the strongest in more than two years at 2.5 percent y/y. Public sector hiring continues to be the main driver (+2.9 percent y/y), while growth in private sector employment still lags behind (+0.5 percent y/y). It is, however, displaying some signs of improvement.

Similarly, expat employment growth, which has slowed sharply over the past three years, appears to have bottomed out thanks to steady hiring of both skilled and unskilled labor, expanding by 3 percent overall. Expatriates account for more than 80 percent of Kuwait's labor force.

However, some aspects of the consumer sector still exhibit softness. For instance, growth in household debt has moderated recently, easing to 6.5 percent y/y in July, from 7.2 percent a year ago on less borrowing for the purchase of houses, as well as for the purchase of durable goods.

Wage growth has also been weak, with recorded average basic incomes for Kuwaitis enrolled in state pension plans little changed since 4Q16. Growth in gross average income - which includes basic wage income and benefits - eased to 0.6 percent in 1Q18, from a yearly average of 1.8 percent in both 2016 and 2017.

Meanwhile, although the total expatriate population is rising, the number of expatriate dependents continues to decline following increases in living expenses and still relatively soft employment growth. The female expatriate population was down 1.9 percent y/y as of June, its third consecutive decline in a year and a half, while the number of expatriate children below the age of 15 decreased by 1.1 percent. Overall, the consumer sector will continue to see decent growth going forward but could moderate slightly from recent strong levels, affected by modest wage growth and a slight pick-up in inflation (from a very low base). An expected steady pick-up in non-oil growth, rising government spending and especially capital spending, as well as improved private sector investment - reflected recently by increased borrowing by businesses - will provide further support to the consumer sector.

NBK ECONOMIC REPORT