KUWAIT: Egypt’s economic situation has come under renewed pressure so far in 2023. Economic reforms have paused just months after the IMF approved the $3 billion loan deal in December 2022. The pound is back to being tightly managed and fixed at EGP30.9/$1 versus 38-40 on the unofficial market, while the authorities have so far been unable to execute any substantial privatization deals due to difficulties including asset valuation.

The postponement has led to the IMF putting its first program review (originally scheduled for March) on hold and postponing it until June. The government faces a thin timeframe to meet a key IMF requirement of executing deals worth of $2bn before the end of June 2023. Currency stability has prevented a further spike in inflation but the associated import controls (non-oil imports fell 12% y/y in 1H22/23) have revived the backlog of goods at ports and disrupted growth.

Recent developments suggest that a fresh devaluation will happen only in tandem with strong promises of US dollar proceeds or progress on asset stake sales, which will strengthen reserves. Amid these pressures, economic growth over coming quarters will slow, albeit at face value remain somewhat resilient at 3-4% and still well clear of recession. A pickup is expected in FY2024/25 helped by a more competitive currency and as interest rates and inflation come down.

Slower economic growth

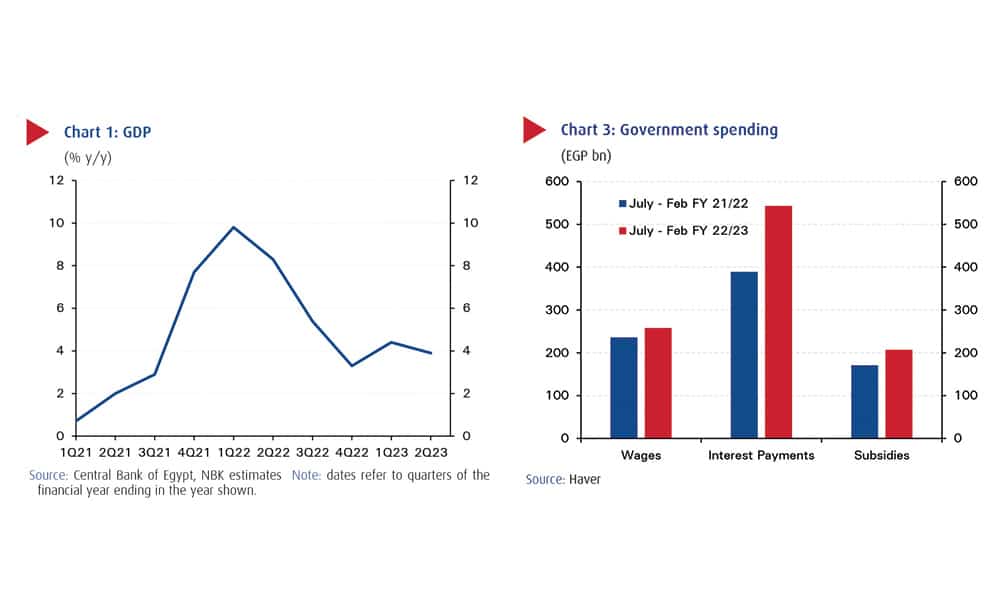

Economic growth slowed in 2Q FY22/23 (Oct-Dec) to 3.9% y/y (from 4.4% the previous quarter and 8.3% 2Q FY21/22) with activity severely pressured by shortages in major goods and services, an acceleration in inflation and higher borrowing costs. These factors have led to a squeeze in consumers’ purchasing power and therefore private consumption, as well as a pullback in business investment. So far this year (January to April), the purchasing managers’ index of activity has averaged 46.6, down slightly from 46.8 in Oct-Dec 2022.

It included figures of around 44 for both the current output and new orders subcomponents, although employment held up better. Consequently, we expect growth to come in slightly softer for 2HFY22/23 at 3-3.5% as this period would encompass January’s 19% depreciation of the pound, a rise of the parallel market exchange rate to EGP40/$1, high inflation rates averaging at 31% (Jan-Apr), and tighter monetary policy, with policy interest rates hiked by 5% from December to March.

Looking ahead into FY23/24, we expect that growth will remain pressured absent reforms and with the authorities potentially opting to continue to compress imports and utilize reserves to defend the currency and buy time. However, a major window for key policy changes could emerge after the elections expected for early 2024, as political certainty improves. Actions required (as reflected in the IMF agreement) include a shift to a durable flexible exchange rate regime, execution on the government/quasi-government stake sales, and fiscal reforms needed to keep the ballooning deficit under control.

Import and debt servicing costs

A mixture of currency devaluation, interest rate hikes, and global inflation has put the fiscal position under pressure. The cumulative fiscal deficit widened 36% y/y in 8M FY22/23 to EGP501bn, with expenditure growth (+24%) outpacing revenue growth (+18%). This is mainly due to an acceleration in government goods and services purchases and higher subsidy and social benefits outlays, triggered by a combination of EGP devaluation, increased global food and energy prices and the rolling out of social programs to mitigate the impact of rising inflation on lower income groups.

Higher interest rates in FY22/23 were also a contributing factor with debt servicing up by 40% y/y and now worth 42% of all spending. The fiscal deficit as a share of GDP stood at 5.1%, compared to 4.6% for the same period a year earlier. The deficit is forecast to widen further for the full year of 22/23 as it encompasses another 2% policy rate hike that took place in March 2023 and further rises in costs. We expect the deficit to reach 8.5% of GDP during FY22/23 from 6.1% of GDP in FY21/22. As for FY23/24, the economic policy direction will play a key role in the public finances.

In the scenario we imagine materializing (slower reforms up until 2024) then we see limited pressures on the fiscal front as we would expect interest rates to remain on hold or not move too far, and similarly for the EGP. Recent balance of payments results indicate significant improvement as the current account deficit contracted to only $1.7bn in 1HFY22/23, versus $7.8bn in 1HFY21/22. This came on the back of non-oil imports compression by 12% to $37bn and a strong recovery in tourism revenues by 26% to $7.3bn. It is worth noting that worker remittances witnessed a 20% drop y/y to $11.9bn from $15.5bn. We now expect the FY22/23 deficit to narrow to $6-7bn (around 2.1% of GDP) from our earlier expectations of $11bn.

Such positive external developments will help narrow Egypt’s external financing needs, if sustained until FY23/24. However, aside from the current account deficit, large external debt maturities ($16bn) remain a key challenge for the coming year. With the pause in privatization deals delaying fresh FX proceeds, we expect to see a drawdown in reserves over the course of the year, absent fresh overseas support. Additionally, although a weaker currency is still widely anticipated and possible, it now looks plausible that there will be no major currency adjustment until there are clearer guarantees on implementation of the privatization program and thus the availability of US dollar proceeds.

Interest rates on hold

Inflation has jumped so far this year as the impact of the goods shortage and January’s devaluation filtered through. Inflation averaged 30.8% y/y during January to March versus 18.8% in October to December, and reached a six-year high of 32.7% in March 2023. However, it eased slightly in April to 30.5%, helped by the absence of further currency moves or subsidy cuts. On that basis, we expect inflation figures over coming months to be highly driven by government actions. For example, we see inflation within the 29-31% range in the coming months on the condition that no major policy moves take place. But if the authorities decide to recommit to a flexible exchange rate then inflation could move higher later this year.

Pound exchange rate

In response to rising inflation over the past quarter, the Central Bank of Egypt hiked policy interest rates by 200 bps on 30 March, taking the discount rate to 18.75% from 8.75% a year earlier. Yields on local currency treasury bills have followed and are now up 200 bps since January, standing at 22.5% for the 1-year maturity. However, as inflation rates have started to soften, the central bank kept rates on hold at its meeting on May 18th.

On the bank lending front, total credit to customers grew by 3.2% m/m on average for the period Nov 22-Jan 23, higher than 2.8% recorded for the period Aug-Oct 22. In year-on-year terms, credit rose 36% in January. Local currency (LCY) credit to the private sector (businesses and households) grew by 1.3%m/m on average for Nov-Jan and 1.8% in January alone, the highest since June 2022. On the other hand, LCY credit to the government only grew by 0.5% during the assessed period versus 0.4% for the period before and shrank by 8.0% m/m in January. The obvious slowdown in the government sector reflects to a certain extent the government approach towards limiting public investments.

Another leading factor for the strong growth in credit is the EGP adjustment that took place in January leading to a surge in foreign currency (FCY) credit to government by 24.7% m/m in January and 23.0%m/m for the private sector. It is worth noting that FCY credit represents 28% of total credit activity as of January 2023. For the period Feb-Apr, we expect credit to continue to grow strongly especially on the corporate front as high inflation increases firms’ needs for working capital. However, further out we expect to see a slowdown in monthly growth of credit as the EGP remains fixed along with peaking inflation.

Meanwhile, deposits grew by 3.4% m/m on average for Nov 22-Jan 23 versus 2.9% for the previous period. Year-on-year growth stood at 38% in January. The majority of the recent deposit growth came on the back of FX revaluation whereby government FCY deposits grew by 14.4% m/m on average in local currency terms and private FCY deposits grew by 9.1% m/m in local currency terms. Government LCY deposits grew by 4.2% m/m on average while private LCY deposits grew by 1.4%.