WASHINGTON: European countries face a power crunch if there is a complete shutdown of Russian gas supplies, with their economies facing the threat of contraction, although the impact varies widely by country, according to the International Monetary Fund.

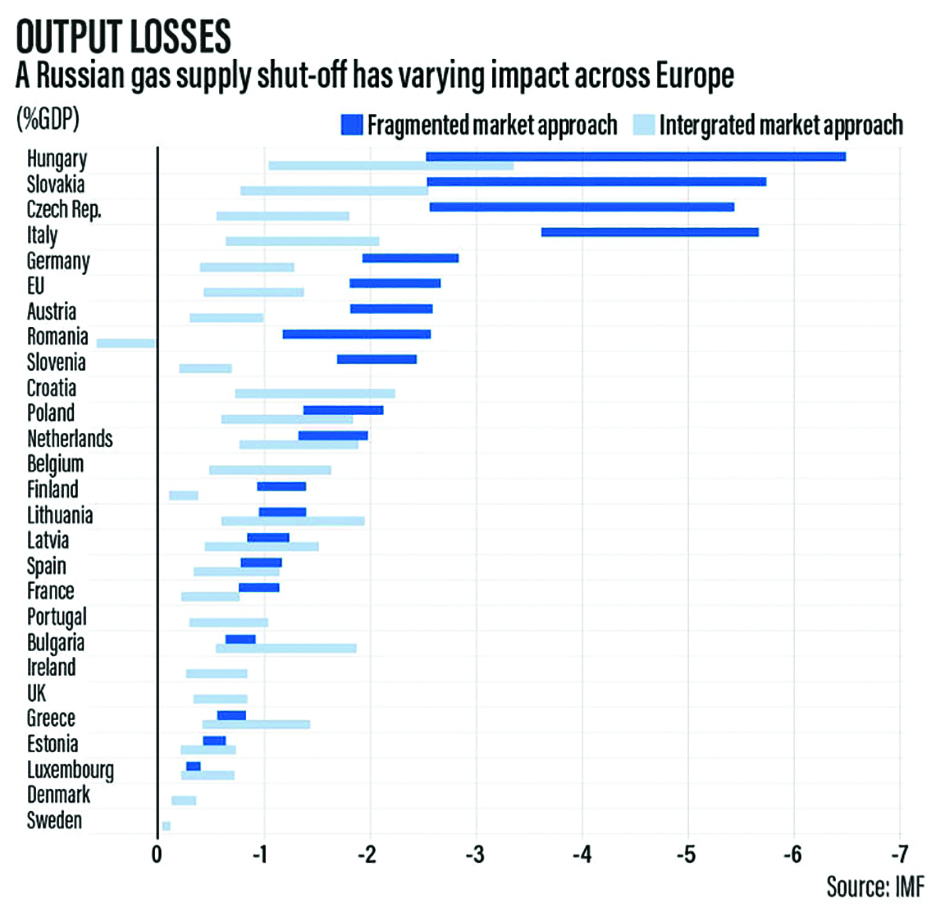

The most-affected countries in central and eastern Europe - Hungary, Slovakia and the Czech Republic - could register a gross domestic product decline of up to 6 per cent amid gas shortages of up to 40 per cent of normal consumption, the IMF said in a working paper released on Tuesday. The effect on Austria, Germany and Italy will also be "significant" but would depend on policy responses, the remaining bottlenecks at the time of the shutdown and the market's ability to adjust.

Other European countries are not expected to face such constraints and the impact on gross domestic product would be moderate - possibly under 1 per cent. "The impacts, however, could be mitigated by securing alternative supplies and energy sources, easing infrastructure bottlenecks, encouraging energy savings while protecting vulnerable households, and expanding solidarity agreements to share gas across countries," the authors said in a blog post.

Halting Russian gas supplies to the EU could potentially reduce the bloc's GDP by as much as 1.5 per cent if the next winter is severe and the region fails to take preventive measures to save energy, Bloomberg reported, quoting a draft EU document. The EU's GDP would fall by 0.6 per cent to 1 per cent if the winter is ordinary, the news wire reported. Europe is locked in a stand-off with Moscow, its biggest gas supplier, over its military intervention in Ukraine.

The EU has voiced its growing concerns that Russia will completely shut off supplies to the bloc in response to several rounds of sanctions. Russian state-owned energy company Gazprom declared force majeure on gas supplies to at least one major customer in Europe, Reuters reported on Monday.

This adds to concerns that Russia, which shut down its main Nord Stream 1 pipeline for 10 days starting from July 11 for planned maintenance, will use the opportunity to close it permanently. If Russian gas flows from Nord Stream 1, a 1,224-kilometre pipeline under the Baltic Sea, do not resume, there will be an "intensification of energy-saving measures, higher prices and reduced production in some industries, especially in late autumn and during winter", across Europe, rating agency Fitch Ratings said last week.

European infrastructure and global supply have coped so far, with a 60 per cent drop in Russian gas deliveries since June 2021. Total gas consumption in the first quarter was down 9 per cent from a year earlier, and alternative supplies are being tapped into, especially liquefied natural gas from global markets.

A reduction of up to 70 per cent in Russian gas could be managed in the short term by securing access to alternative supplies and energy sources, given reduced demand as a result of previously high prices, and this explains why some countries could unilaterally halt Russian supplies, said the IMF working paper. However, diversification would be much harder in the event of a total shutdown, the Washington-based fund said.

"Bottlenecks could reduce the ability to reroute gas within Europe because of insufficient import capacity or transmission constraints," it said. These factors could lead to shortages equal to 15 per cent to 40 per cent of annual consumption in some countries in central and eastern Europe. - Agencies