Oil rally continues amid Trump's accusations

KUWAIT: After the turmoil in various emerging economies that rocked financial markets in August, global conditions were slightly firmer in September and early October, with the embattled Turkish lira staging a partial recovery following the announcement of the government's support package, and crisis-hit Argentina securing additional bailout funds from the IMF. There was also some positive news on global trade, with the US and Canada agreeing a revamped NAFTA deal (now titled 'USMCA') and some analysts hoping for a modest de-escalation of US-China tensions after the US congressional elections in November. Benchmark government bond yields shifted significantly higher on strong US economic data and on the continued gradual withdrawal of global market liquidity as monetary policy is tightened.

Fed hikes rates

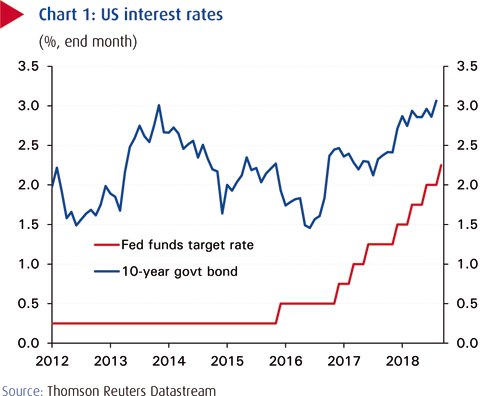

Buoyed by strong economic growth and inflation at close to the 2 percent target, the Federal Reserve took a further step on the path of monetary normalization by raising interest rates by 25 bps to 2.00-2.25 percent at its September meeting, the eighth hike of the current economic cycle. In a fairly bullish assessment of the outlook, the central bank also upgraded its growth forecasts for this year and next, removed its commitment to maintain an 'accommodative' policy stance and signaled the likelihood of one further rate hike this year and three in 2019. Financial markets took the widely-anticipated move more or less in stride at first, relieved that the Fed did not outline a still-more hawkish set of projections.

Supporting the Fed's decision, recent economic data suggests that growth remained robust in 3Q18, perhaps close to the super-strong 4.2 percent (annualized) recorded in Q2. The ISM activity index for manufacturing slipped slightly in September, but remained exceptionally strong at 59.8 with strong output levels offsetting concerns over tariffs and cost pressures due to capacity shortages. More eye-catching still was the surge in the equivalent non-manufacturing survey to an all-time high of 61.6, on higher readings for output and employment. These sectors account for 88 percent of US GDP.

The stronger-than-expected data and comments made by the Fed Chairman that the benchmark rate may go beyond the "neutral rate" pushed the yield on the benchmark 10-year government well above the 3 percent mark by early October, though this was helped by a change in tax policy that had previously helped prop up demand for long-term US government debt by pension funds

Key to the ongoing strength of the economy is the tight labor market. Unemployment remained close to 18-year lows in August at 3.9 percent and growth in jobs was a very solid 201,000 m/m. There were also at last some signs of a pick-up in wage growth with private sector earnings rising 2.9 percent y/y - the strongest since the financial crisis - though it remains low for this stage of the economic cycle. The Conference Board reported that consumer confidence surged to an 18-year high in September, while consumer spending rose by more than 5 percent y/y for the third successive month in August compared to an average of 4.3 percent last year.

Although most near-term economic metrics are looking positive, key risks to the outlook include more aggressive Fed policy tightening and a stronger US dollar, rapid economic growth leading to capacity pressures and higher wage and price inflation, a sharp drop in the stock market following its now record-breaking bull-run, and an intensification of the trade war with China. The impact of the latter so far has been limited, with domestic drivers still providing the main source of economic growth.

Eurozone growth shows

In the Eurozone, the outlook for growth is tilting to the downside with the external sector showing increasing vulnerability to slower global trade and domestic activity far from firm. According to September's manufacturing PMI, new export orders in the common currency area fell to their lowest in over five years; business sentiment fell on concerns over geopolitical developments and trade protectionism.

Other developments were mixed in September. The services PMI improved on the month to 54.7, headline inflation rose unexpectedly to 2.1 percent, the strongest since 2012, and 2Q18 wages, at 1.9 percent y/y, were the firmest in a year. Nonetheless, core inflation remains stubbornly weak, dipping to 0.9 percent in September, consumer sentiment eased to its lowest in over a year, while retail sales faltered for a second consecutive month in August.

However, signs of weakening activity have not yet derailed the ECB from unwinding its QE program. It announced at its latest meeting that it is still set to reduce its asset purchases by half to EUR 15 billion per month in October, and expects to end the program in December. Meanwhile, turmoil arose in Italy following the government's announcement that it would raise the budget deficit to 2.4 percent of GDP next year. The move is set to put Rome on a collision course with Brussels, which will review Italy's draft budget in mid-October. Later, Italy announced that it would reduce the deficit beginning in 2020 providing some assurances to the markets.

Japanese Q2 growth

Japan's economy remains supported by strong levels of capital spending and an improvement in domestic demand. GDP growth for 2Q18 was revised up from 1.9 percent to 3.0 percent, its fastest in over two years, on the back of better-than-expected capital expenditure data. While a slowdown in industrial activity is likely to weigh on growth in Q3 as the effects of higher borrowing costs were compounded by a series of natural disasters, the improvement in domestic demand will help offset some of that slowdown. Indeed, growth in retail sales rose to an eight-month high of 2.7 percent y/y in August.

Separately, both headline and core consumer price inflation rose in August, but remained far below the Bank of Japan's 2 percent target. In light of the continued weakness in inflation, the bank stood pat on its loose monetary policy last month.

The manufacturing sector continues to struggle to eke out substantial gains amid softening domestic and external demand. The Caixin/Markit manufacturing PMI, which surveys small to medium sized private firms, retreated more than expected in September, from 50.6 in August to 50.0 (the borderline which demarks expansion from contraction), after export orders fell at their fastest pace in over two years. Export orders are poised to weaken further on the back of the recently-introduced US tariffs. The official index, which tracks the larger state owned companies, also fell, from 51.3 to a seven-month low of 50.8. However, a pickup in the services (which makes up more than half of China's economy) index to 54.9 offered encouragement.

Oil rally continues

Oil's bull-run continued in September, with the international benchmark, Brent crude, gaining 6 percent during the month to close at a new four-year high of $82.7/bbl. Prices have since increased further to almost $85/bbl. Driving the rally has been the concern that stringent implementation of US sanctions on Iran and a so far inadequate supply response from OPEC+ is causing the market to tighten significantly. Combined with robust global demand and doubts over the size of the global spare production capacity buffer, this has heightened market anxieties and led to a spate of upward oil price revisions and even talk of oil at $100/bbl. High prices and OPEC's underperformance on oil supplies led to accusations by US president Trump that OPEC is "ripping off the world".

NBK INTERNATIONAL MARKET REPORT