KUWAIT: GCC yields moved mostly lower in 3Q15 as an expected US Fed interest rate increase was delayed, and in spite of new government debt, actual and expected. For the more fiscally vulnerable, risk premiums appeared to jump on the decline in oil prices. The stock of outstanding conventional bonds saw a healthy expansion on the back of increased sovereign issuance. However, this may have led to some crowding-out of private sector activity, with the latter being largely absent in 3Q15. Nonetheless, we expect GCC issuance to pick up in the coming months across the board.

KUWAIT: GCC yields moved mostly lower in 3Q15 as an expected US Fed interest rate increase was delayed, and in spite of new government debt, actual and expected. For the more fiscally vulnerable, risk premiums appeared to jump on the decline in oil prices. The stock of outstanding conventional bonds saw a healthy expansion on the back of increased sovereign issuance. However, this may have led to some crowding-out of private sector activity, with the latter being largely absent in 3Q15. Nonetheless, we expect GCC issuance to pick up in the coming months across the board.

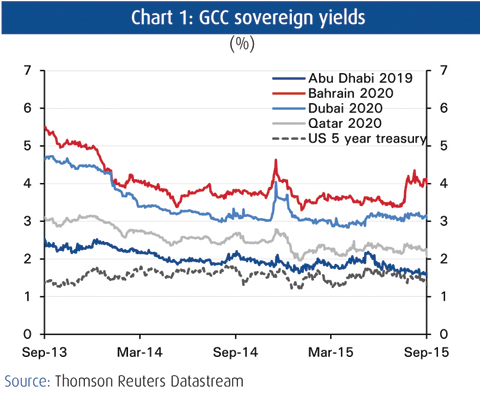

GCC bond markets appeared to be expecting a US rate hike for most of 3Q15 before easing slightly after the Fed chose to wait last September. Expectations of a rate hike by the Fed saw GCC yields rise in anticipation early 3Q15. However, the lackluster global environment saw the probability of a rate increase in September diminish. When the decision to delay a Fed move came, GCC yields moved down further.

Yields on some GCC bonds rose as oil prices declined to new lows in 3Q15 and concerns over fiscal sustainability reemerged. Fears of slower oil demand growth, led by weaker Chinese economic data, and an ongoing supply glut saw oil prices hit new lows in August. This caused some to review the fiscal vulnerability of the GCC countries. Yields rose for the more fiscally vulnerable sovereigns such as Bahrain.

Despite the volatility, yields declined in 3Q15 for most GCC sovereigns. Rates on 4-5 year paper were down between 12 and 28 bps for Abu Dhabi, Dubai, and Qatar to settle at 1.60 percent, 3.11 percent, 2.14 percent, respectively. Meanwhile, Bahrain saw its yield increase by 37 bps on the back of fiscal and political concerns.

GCC yields are still expected to rise with a federal funds rate hike, if and when it happens. The prospect of a US rate hike before yearend seems increasingly unlikely as global developments are being given more weight in the Fed's decision making. Fear of triggering mass emerging market capital outflows and global financial volatility, combined with increased weakness in China, have added another layer of complexity to the Fed's decision making. Still, with 13 of the 17 FOMC participants indicating a willingness to raise the fed funds target in 2015, a hike is still a slight possibility.

Credit default swap (CDS) rates have risen on concerns over GCC government finances, led by Saudi Arabia's. After recovering from OPEC's decision in late 2014, oil producers saw their CDS rates shoot up once again late in 3Q15, following further decline in oil prices during the quarter. CDS rates were up between 12 and 20 bps quarter on quarter for the more vulnerable, Bahrain and Dubai, as well as for Abu Dhabi and Qatar, which have more comfortable fiscal conditions.

Meanwhile, Saudi Arabia saw its risk premium diverge from the rest of the GCC, rising by 73 bps, to settle at 134 bps at the end of 3Q15. Weaker oil prices have seen Saudi Arabia draw down its foreign reserves at a faster than expected pace, as it financed ambitious development spending and an ongoing ground war in Yemen. This has raised new concerns about the adequacy of the country's fiscal buffers, which was further aggravated by recent declines in oil prices during 3Q15.

The stock of outstanding conventional GCC bonds was boosted by sovereign issuance in 3Q15, driven by Saudi Arabia, while bank and corporate activity was virtually absent. Outstanding conventional bonds were up 9.6 percent y/y at the end of 3Q15, following almost two years of slower growth. GCC sovereigns have turned to debt markets to help finance budget deficits. Saudi Arabia led the issuance, offering its first bonds since 2007. Concerned with the rapid drawdown of reserves, Saudi Arabia opted to access its domestic debt market to help sustain expenditure plans. So far, Saudi Arabia has issued $20 billion in domestic debt and aims to issue a total of $36 billion in 2015. Bahrain and Oman returned to debt financing as well, each issuing government development bonds to the tune of $925 million and $780 million, respectively. Meanwhile Qatar continued to issue its usual government bonds in an ongoing effort to develop its local debt market.

With most GCC sovereigns now turning to debt markets for financing, maintaining investor confidence is becoming paramount. Despite recent downgrades, all of the GCC countries seem to have maintained relatively healthy ratings with a slight bias to the downside for the fiscally vulnerable. At their current low levels of debt, GCC countries have plenty of room for credit growth, strongly backed by their sovereign funds, positive economic outlooks, and stable FX regimes.

Rising sovereign issuance risks crowding out private sector debt. Banks across the GCC have been keen buyers of recent sovereign issues. As a result, this has absorbed some of the excess liquidity on their balance sheets, pushing up interbank rates. Liquidity in the system has already come under pressure as government revenues from oil receipts declined. The perception that risks in the region are on the rise could also see investors ask for higher returns. A recent primary offering by an Emirati corporate and another by an Emirati bank were priced out as a result.

GCC issuance activity is expected to pick up as regional financing needs remain large and issuers maintain robust ratings. Sovereigns will turn to debt markets in a bid to protect their reserves, while banks will continue to issue debt to meet their needs from adherence to capital regulations and to financing future credit growth. Meanwhile, corporates will continue to look to debt markets to diversify their funding and finance future growth.