Muted growth, geopolitical tensions and structural challenges

KUWAIT: Our outlook for sovereign creditworthiness in 2018 in the Gulf Cooperation Council (GCC) is negative overall, reflecting our expectations for the fundamental credit conditions that will drive sovereign credit over the next 12-18 months. Unlike other regions of the world, higher and more stable global growth will not provide much uplift to the GCC's growth outlook. Although oil prices have risen significantly from their trough in early 2016, most sovereigns in the region will continue to run sizable fiscal deficits and record an increase in their debt burdens. Moreover, long-standing geopolitical event risks have come to the fore again and will play an important role in defining sovereign credit quality in 2018.

Three of the six GCC sovereigns hold negative rating outlooks, while the remaining three have stable outlooks. This marks a slight improvement compared to the start of 2017 when four of the six sovereigns carried negative outlooks, pointing to the likelihood of fewer downward rating adjustments in 2018 compared to 2017.

To recap, in 2017, we took negative rating actions on Qatar, Oman and Bahrain. We stabilized the outlooks on Kuwait and the United Arab Emirates.

" In late May 2017, we downgraded Qatar (Aa3 negative) by one notch to reflect its weakening external position and uncertainty over the sustainability of the country's growth model. In a follow-up rating action in early July, we changed the outlook to negative from stable in response to the ongoing diplomatic crisis involving Qatar, some of its GCC neighbors, and some other, mostly Arab, countries.

In late May, we stabilized the outlooks on the ratings of the United Arab Emirates (UAE, Aa2 stable) and Abu Dhabi (Aa2 stable), as well as Kuwait (Aa2 stable). This reflects our view that all three were able to withstand the oil price shock and have been able to maintain their credit profiles in a lower-for-longer oil price environment, largely because of their large reserve buffers, but also in light of their ability to effectively implement fiscal and economic reforms.

In late July 2017, we downgraded Oman (Baa2 negative) by one notch due to the country's weaker-than-expected progress towards addressing structural vulnerabilities to a lower oil price environment, reflecting institutional capacity constraints to address large fiscal and external imbalances.

We also downgraded Bahrain (B1 negative) by two notches given the absence of a clear and comprehensive consolidation strategy in light of the unabated sharp deterioration of the sovereign's balance sheet. In particular, we expect the government's debt burden and debt affordability metrics to undergo a further significant weakening from already very weak levels. The negative outlook reflects continued downside risks related to heightened government and external liquidity risks.

GCC growth will remain muted

We forecast a slight pick-up in GDP growth of close to 2 percent in 2018 for the GCC as a whole. While this will mark an improvement from 2017 (0 percent), aggregate growth will remain well below the average 5 percent per year that had been recorded between 2010 and 2015 given flat production in the hydrocarbon sector and slow recovery in non-oil growth.

Extension of the OPEC+ crude oil production freeze will keep real growth in the hydrocarbon sector flat. In late November 2017, OPEC members and several non-OPEC countries6 agreed to extend until the end of 2018 a crude oil production freeze originally scheduled to end in March 2018. As a result, and assuming similarly strong compliance as in 2017, crude oil production in the GCC will remain flat throughout 2018 at around 17.4 million barrels per day (mbpd). While some countries in the region, such as Qatar and Oman, will see an up-tick in hydrocarbon real GDP growth due to an expansion of gas production, the region as a whole will continue to record broadly flat production in the hydrocarbon sector in 2018.

Healthy global growth will have a very limited impact on output in the GCC, given the small share of tradable non-oil sectors in the regional economy overall. On a country-by-country basis, only Bahrain and the UAE have meaningful shares of nonhydrocarbon goods and services exports in relation to the overall size of the economy (averaging between 30 percent and 50 percent of GDP over the past five years for the UAE and more than 50 percent for Bahrain). By comparison, these shares are small for Kuwait and Saudi Arabia at less than 10 percent on average, while Oman and Qatar have shares of 25 percent and 17 percent of GDP, respectively.

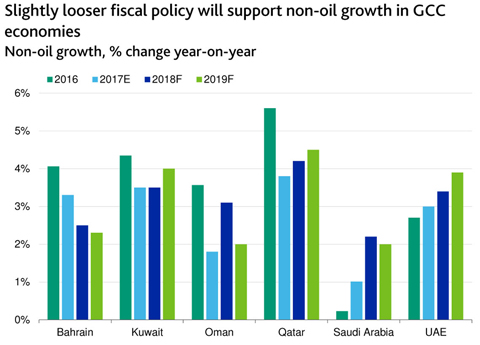

Continued fiscal consolidation - albeit more gradual - will keep non-oil growth below historical averages. Growth performance in most GCC countries has been driven by domestic demand over the past few years, and has largely been linked, both directly and indirectly, to fiscal spending. While we believe that the pace of fiscal consolidation will likely slow somewhat, we see very limited potential for a rapid recovery in government consumption and public investment. Moreover, we expect that private consumption will be negatively affected by the introduction of the value-added tax (VAT) in some countries from early 2018.

Faster-than-envisaged monetary policy normalization in the rest of the world - especially in the US - poses a downside risk to growth. Given the US dollar pegs in all the GCC countries except Kuwait, central banks in the region will continue to follow interest rate moves by the Federal Reserve. A faster increase in borrowing costs than we currently assume would dampen already weak credit growth and limit private-sector growth prospects.

Real GDP growth in the UAE, Qatar and Oman will stay above the regional average, supported by public investment in mega-projects such as Expo 2020, the FIFA World Cup 2022, and stepped-up gas production at the Khazzan gas field, respectively. Bahrain will be the only GCC sovereign whose growth will slow in 2018, while Kuwait and Saudi Arabia will return to positive growth after contractions in 2017.

Growth in Saudi Arabia will recover only slowly. The 0.7 percent contraction in 2017 was mainly driven by reduced crude oil production, while low growth in the non-oil sector highlights the government's challenges in diversifying the Saudi economy.

We expect real GDP to grow by around 1 percent in 2018 and to gradually increase in the following years. The more gradual fiscal consolidation approach, as outlined in the government's 2018 budget, offers some upside to our growth forecasts. "Resilient non-oil-related growth offsets Kuwait's lower hydrocarbon production. Kuwait's average daily oil production fell to around 2.7 mbpd between January and November 2017, which is around 8.5 percent below the level recorded in the previous year. Similar to Saudi Arabia, we expect Kuwait's crude oil production to remain flat in 2018, and forecast that relatively robust non-hydrocarbon sector growth will lift total real GDP growth to 1.6 percent in 2018.

Qatar's economy has been affected by the blockade, but remains relatively resilient. Growth will pick up in 2018 to 2.5 percent from 2 percent in 2017, and will again be driven by the non-hydrocarbon sector. Construction will remain the largest contributor to nonoil growth on the back of the government's sizable investment program, mainly linked to the 2022 FIFA World Cup. Growth effects from the lifting of the self-imposed gas production moratorium in the North Field will only start to materialize from 2020.

Gas production increases and delayed VAT introduction will support Oman's growth in 2018. Although not an OPEC member, Oman is voluntarily participating in the production cuts. However, gas production in the Khazzan field, which started in late September 2017, will offset the negative effect of crude oil production cuts and support real GDP growth in 2018. We expect the Omani economy to expand by 2.7 percent in 2018, with somewhat stronger growth in the non-hydrocarbon sectors due to the delayed VAT implementation.

"Robust non-oil growth to slow in Bahrain. Despite Bahrain's severe fiscal pressures, real GDP growth remained relatively robust in 2017, at an estimated 2.6 percent. The non-hydrocarbon sector continued to be the main growth driver, whereas the hydrocarbon sector has been contracting. In 2018, we expect that the fiscal constraints will bind more clearly. We forecast that real GDP growth will slow to 2 percent in 2018.

Higher oil prices, domestic politics

A stabilization of oil prices at the upper end of our medium-term price range of $40-$60 per barrel (see box at the end of the report for more details) could slow the pace of proactive fiscal consolidation given that government revenues will be bolstered. For some GCC sovereigns, domestic political gridlock and social stability considerations are also likely to affect the reform outlook. " No further revenue measures beyond those announced and implemented so far. GCC countries have introduced a mix of higher fees for government services, adjustments to expat levies, and excise taxes on certain products throughout 2017. Some governments introduced new property taxation (for instance, Saudi Arabia on unused land). However, there are no plans to change the current structure of direct taxation of income and profits.8 VAT is the only major non-oil revenue measure, but is too small to change the structural weakness in government revenues, which will remain dominated by oil and gas revenues for most of the GCC sovereigns.

"Revenue diversification will progress only slowly in the coming years. Revenues from hydrocarbon sources will account for almost 60 percent of GCC-wide government revenues in 2018. While lower than the 80 percent on average between 2010 and 2015, the reduction in revenue dependency on oil and gas shows a mixed picture. The UAE and Saudi Arabia report the largest decrease, with the share of oil and gas revenues in total government revenues projected to be approximately 30 percentage points lower by 2019 than its 2010-15 average. Bahrain and Qatar, on the other hand, are expected to show the smallest reduction, with shares of around 70 percent, which is only 10-15 percentage points lower than during the period of high oil prices.

MOODY'S INVESTORS SERVICE RATING OUTLOOK