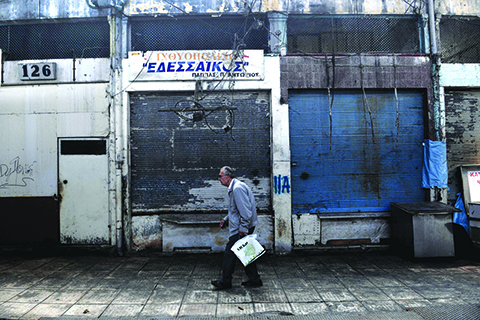

THESSALONIKI, Greece: A man walks past closed shops in the center of this city yesterday. – AFP

THESSALONIKI, Greece: A man walks past closed shops in the center of this city yesterday. – AFPLUXEMBOURG: Eurozone ministers yesterday neared an agreement to set the terms of Greece’s departure from eight years of bailout programs, despite splits over the degree of debt relief needed by cash-strapped Athens. Greece is slated to exit its latest rescue on August 20 and finance ministers from the 19 countries that use the single currency are looking to send off Athens with a sustainable debt level and enough cash to reassure financial markets.

If successful the talks will mark an important milestone for Europe nearly a decade after Greece stunned the world with out-of-control debts and set the scene for three bailouts and a near collapse of the euro single currency. “We will deliver today, I’m optimistic we will find a debt relief package that will promote sustainability in Greek debt for the future,” said Portuguese Finance Minister Mario Centeno, who heads the Eurogroup. Greece’s €86-billion program was agreed in 2015 after six contentious months of negotiation and is set to end this summer, bringing the level of assistance received by Athens to €273 billion since 2010.

“Greece has really done the job and has delivered its commitments,” said French Finance Minister Bruno Le Maire as he arrived for the talks. As ever in the Greek debt crisis, Germany and northern eurozone states are the most resistant to debt relief and have demanded that Athens be closely tracked on reform implementation after the program ends this summer. Under German demands, Greece’s debt relief in the short-term will be conditional on the continued implementation of reforms, which if successful could inject about one billion euros to the government’s underfunded budget every year. “We will ensure that the pressure to implement further reforms remains strong... in the medium and long term,” said Austrian Finance Minister Hartwig Loger.

Meanwhile, a government report seen by AFP showed yesterday Germany has earned some €2.9 billion ($3.5 billion) since 2010 on Greek debt bought to help the struggling country. “Contrary to all the rightwing myths, Germany profited massively from the crisis in Greece,” said Sven-Christian Kindler, a Greens party MP whose question to the finance ministry uncovered the figure. “It cannot be the case that the federal government is cleaning up the German budget with billions of interest earnings from Greece,” he added.

The finance ministry document shows the Bundesbank (German central bank) had by the end of last year earned €3.4 billion of interest on Greek bonds it bought in 2010-11. Officials at the Frankfurt institution bought Greek debt under a scheme known as the Securities Markets Programme, created by the European Central Bank (ECB) to calm financial markets in troubled eurozone economies. At a Feb 2012 Eurogroup meeting, eurozone finance ministers agreed that interest on those bonds should be paid back to Athens via the single currency area’s crisis firefighter, the European Stability Mechanism (ESM). The Bundesbank duly sent €527 million to Greece in 2013.

But a 2014 tranche of €387 million was held by the ESM, part of a €1.8 billion total earmarked to cover some Greek debt payments in exchange for the government pressing ahead with reforms demanded by its creditors. That reciprocal arrangement ended in June 2015, when the Eurogroup suspended the transfers during a standoff with Greek Prime Minister Alexis Tsipras. Taking all the twists and turns into account, Germany’s federal government has raked in €2.5 billion of profit on Greek debt, while public investment bank KfW has notched up €400 million of interest payments on a loan to Athens - a total of €2.9 billion. – AFP