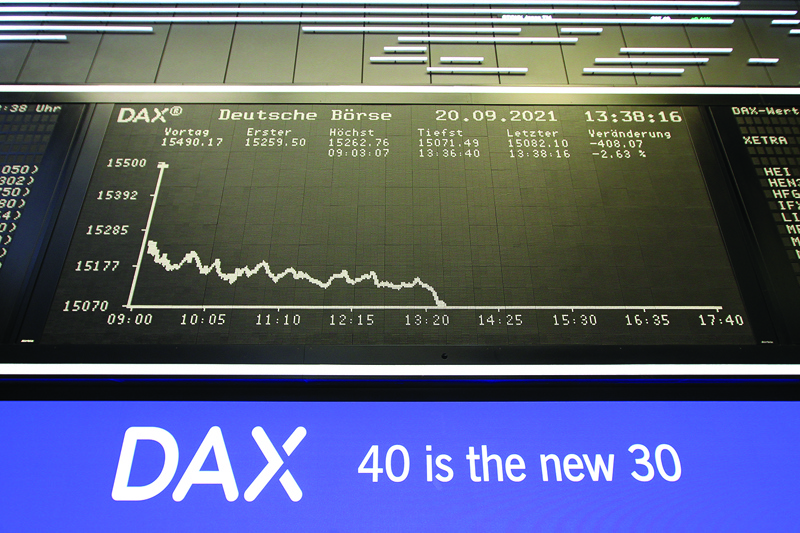

FRANKFURT, Germany: A display showing the chart of Germany's share index DAX is pictured at the stock exchange in Frankfurt am Main, western Germany, yesterday.-AFP

FRANKFURT, Germany: A display showing the chart of Germany's share index DAX is pictured at the stock exchange in Frankfurt am Main, western Germany, yesterday.-AFPFRANKFURT: The DAX fell 2.6 percent in trading yesterday to its lowest level since July, as market turmoil marred the German blue-chip stock market index's expansion from 30 to 40 companies. The majority of the 10 new companies in the DAX were down shortly after 1100 GMT, with aerospace giant Airbus and e-commerce company Zalando both sinking around four percent, while the value of the revamped index sat at 15,080 points.

The negative development, driven indirectly by the struggles of Chinese real-estate giant Evergrande, meant the "euphoria around the redesigned DAX has fizzled out after one day of trading", said Andreas Lipkow, analyst at Comdirect. The new additions are intended to revitalize the index after a turbulent 2020 that saw national carrier Lufthansa drop out under pressure from the coronavirus pandemic and the collapse of payments company Wirecard after revelations of large-scale fraud.

The updated line-up is also meant to reflect the changing face of the German economy, bringing in tech companies like Zalando and the meal-kit supplier HelloFresh. Both companies have benefitted from people staying at home more during the pandemic, buying clothes online and ordering in food. The newcomers make the DAX "more attractive", said Norbert Kuhn from the German Stock Institute (DAI), which represents stock market participants. A number of the companies in the DAX were "founded in the century before last", he said, and younger companies would give the index more "momentum" going forward.

Frankfurt stock exchange operator Deutsche Boerse was "following international standards" with a broader and longer list of companies that better reflected the German corporate landscape as the "concentration of automotive and chemical companies is reduced," Kuhn said. Some of the new names are nonetheless familiar, including Porsche SE, which holds a large stake in top German car group Volkswagen. Likewise, Siemens Healthineers joins parent company Siemens and spin-off Siemens Energy.

New rules

Deutsche Boerse and the DAX suffered a reputational blow last year after digital payments provider Wirecard admitted to a 1.9-billion-euro ($2.2 billion) hole in its accounts. Wirecard filed for insolvency, executives were arrested and its share price plummeted 98 percent before it was booted off the index, becoming the first DAX-listed company to fail. New rules to better regulate entry into the DAX will be implemented during the expansion, with the aim of preventing another damaging scandal.

In particular, all companies hoping to join the elite will have to demonstrate an operating profit in the past two years-a test not all current members would have passed were the rules to apply retroactively. The mid-tier mDAX shrank from 60 to 50 values as some of its members were promoted to the top index. It began the day down 1.7 percent.

Meanwhile, world stocks sank yesterday as trading floors were gripped by contagion fears from the expected collapse of debt-plagued Chinese property giant Evergrande, with investors also on red alert over spiking wholesale gas costs. Sentiment is being dented by strong inflation, the Federal Reserve's plans to taper monetary policy, surging infections with the Delta variant of coronavirus, and signs of weakness in the global recovery.

Hong Kong dived 3.3 percent, spearheading Asian losses, with Evergrande widely expected to default on upcoming interest payments this week. Europe tanked, with London losing 1.6 percent and Paris down 2.2 percent, while Frankfurt's newly expanded index dropped 2.3 percent in early afternoon deals. World oil prices shed about two percent on energy demand worries. "Contagion risks from the Evergrande meltdown are the prime cause of today's sell-off," said Markets.com analyst Neil Wilson. "It is definitely though a major cause for investor concern right now and it is possible we see further losses." - AFP