KUWAIT: Global trade remained at the forefront of the economic agenda over the past month, with the further ratcheting up of tensions between the US and China joined by attempts to reshape the tripartite NAFTA agreement. US President Trump was due to announce tariff increases on a further $200 billion in imports from China following the end of a consultation period in early-September, with retaliation from China likely. Meanwhile, although the US and Mexico agreed a bilateral trade pact, President Trump said that without concessions, "Canada will be out" and threatened to terminate the existing deal.

There is also heightened concern about stability across emerging markets, with economic crises in Turkey and Argentina triggering sharp currency sell-offs and the latter forced to raise interest rates to 60 percent. A combination of trade war worries, a strong US dollar and contagion fears also pressured currencies in India, Indonesia and South Africa.

US data

Despite some domestic political rumbling and continuing trade war fears, the domestic economic news flow in the US has remained consistently upbeat over the past month. Annualized GDP growth for 2Q18 was even revised up to 4.2 percent from an already strong 4.1 percent, led by robust (albeit slightly downgraded from the previous estimate) growth of 3.8 percent in consumer spending. The consensus view is that economic growth will moderate to around 3 percent in the third quarter, but the dispersion around this forecast is considerable, with some analysts looking for another 4 percent+ figure given the continued strength of recent high frequency data.

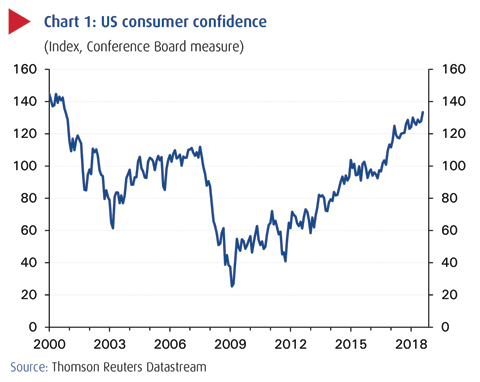

The consumer sector - more than two-thirds of the economy - is forging ahead, buoyed by low unemployment, tax cuts, the rising stock market and with little sign as yet of fallout from either higher interest rates or trade war fears. Indeed consumer confidence in August reached its highest since the dotcom fever of October 2000, jobs growth has ticked up again in recent months after decelerating last year and unemployment stood at 3.9 percent in July, close to May's 18-year low of 3.8 percent. Consumer spending in July rose 5.2 percent y/y (in cash terms) versus 4.6 percent in 1H18, pointing to a strong start to the third quarter.

Businesses, meanwhile, are also reporting strong growth, despite a slight softening in ISM and PMI activity survey readings for July (in both manufacturing and service sectors) and the flash August PMI. Firms are reporting rising cost and price pressures not just due to tariff effects but also increasingly skills and materials shortages. Nevertheless after-tax profits surged 16 percent y/y in 2Q18, helped of course by the cut in corporation tax to 21 percent from January.

The Federal Reserve is overwhelmingly expected to increase interest rates by 25bps for the third time this year at its 25-26 September policy meeting, which would put its target rate at 2.00-2.25 percent. The chances of a further hike in December however are more even, with futures market pricing in a 71 percent probability. Minutes from the central bank's previous meeting showed that officials, although concerned about overheating, remain committed to only gradual policy tightening partly due to uncertainty over what constitutes a "neutral" level for interest rates - possibly in the range of 2.5-3.0 percent - but also that the spread between long and short rates is approaching negative levels that has in the past foretold an economic downturn. Moreover, price pressures have been relatively contained, with core inflation edging up to 2.0 percent in July and in line with the bank's target.

Economic growth for Q2 in the Eurozone, meanwhile, was revised up to 0.4 percent q/q from 0.3 percent before (annualized 1.5 percent, see chart 3), thanks to stronger growth in Germany. This eased fears of a sharper downturn - growth was at 0.7 percent through most of last year - but survey evidence shows that confidence particularly in the important export sector is being hit by weak demand and concern over tariffs. The manufacturing PMI for example eased to 54.6 in August, the lowest since November 2016. There is also particular concern over prospects in Italy, where slow growth, high debt and political turmoil has seen government bond yields surge and Fitch attach a negative outlook to its current BBB credit rating.

The European Central Bank remains optimistic that the economic recovery is on a solid footing, but in the minutes of its latest policy meeting confirmed that it would maintain a cautious approach to removing monetary stimulus, with interest rates on hold until at least 2H19. Although headline inflation stood at 2 percent y/y in August, core inflation was a much weaker 1.0 percent. The bank argues that decent economic growth and recent signs of higher wage deals will help inflation converge back towards its "close to but below" 2 percent target over the medium term.

Japanese growth rebounds in Q2

GDP rebounded and expanded by a better-than-expected annualized 1.9 percent in 2Q18, a significant improvement from the 0.9 percent contraction in 1Q18, as stronger consumer spending (which accounts for about 60 percent of GDP) and healthy corporate investment offset ongoing weakness in export growth. Despite the strong rebound, downside risks to growth persist. Indeed preliminary estimates of growth in Japan are typically volatile and a revision is due in mid-September. Global trade woes are expected to continue to hamper export growth in at least the near-to-medium term.

China faces headwinds

Despite escalating trade tensions with the US, Chinese export growth stood in July at 12.2 percent y/y, thanks in part to a weaker yuan. But other indicators have pointed to downward pressure on the economy, as the effects of government efforts to temper risky lending and debt are compounded by the deterioration in trade relations. Industrial production growth held steady at 6.0 percent y/y in July, while growth in fixed asset investments eased to 5.4 percent. Meanwhile the Caixin/Markit manufacturing PMI data (which focuses on small-to-medium sized firms) fell to a 14-month low of 50.6 in August on the back of a decline in export orders.

The government announced a spate of fiscal measures to bolster economic activity, including tax cuts for research and development, speeding up special bond sales aimed at increasing government infrastructure spending and also urged local governments to spend unused funds. Economic growth slowed to 6.7 percent in 2Q with the government targeting 6.5 percent for 2018 overall.

Oil prices rebound

Brent crude oil prices rebounded in August, climbing 4.3 percent m/m to $77.4/bbl. Price rises have been driven by signs that the physical market is tightening and despite fears about the impact on global growth of deteriorating US-China trade relations. Global demand has been robust, while global supplies have been affected by outages in the North Sea and falling production in Libya, Venezuela and Iran. Iran's exports were thought to have plummeted by at least 600,000 b/d, or 28 percent in August amid the start of US financial sanctions on Iran. With further energy-specific sanctions due in November, it is possible that more Iranian barrels will be withdrawn from the market. This has motivated a flurry of upward oil price revisions by analysts, with the consensus now averaging around $72 for both this year and 2019.

Gulf region quiet

Major economic developments in the GCC region were sparse amid the usual summer lull, although the rise in oil prices has improved near-term fiscal performance and prompted some more optimism over the growth outlook. August PMI index readings for Saudi Arabia and the UAE, at 55.1 and 55.0 respectively, were in line with solid conditions in the non-oil economy. Meanwhile it was reported that the Saudi Aramco IPO had been suspended or at least delayed until conditions were more "optimum". Aramco was also reported to be in the process of acquiring the Public Investment Fund's (PIF) 70 percent stake (worth $70 billion) in Saudi petrochemicals producer SABIC. The PIF itself also secured its first commercial bank loan, of $11 billion, to finance its activities.

NBK INTERNATIONAL ECONOMIC UPDATE