General outlook for US economy projects mild slowdown

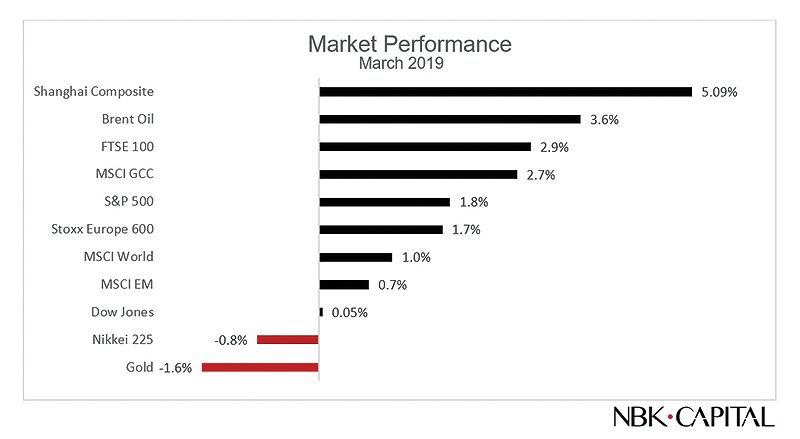

KUWAIT: Equity markets continued to build on the positive performance since the beginning of the year and managed to end the first quarter of 2019 deep in positive territory. Dovish central banks policies across major economies and renewed hopes of progress in the US-China trade talks helped keep the markets afloat. The MSCI All Countries World Index added 1 percent during March to end the quarter with an advance of 11.6 percent, while the MSCI Emerging Markets Index added 0.68 percent bringing its first quarter returns to a little under 10 percent at 9.56 percent.

As was expected, the FOMC summary of economic projections following the March Fed meeting showed a downgrade of the general outlook of the US economy. Real GDP for the current year and next is now expected to grow at 2.1 percent and 1.9 percent compared to December projections of 2.3 percent and 2.0 percent.

The rate of unemployment is now expected to edge up to 3.7 percent and 3.8 percent in 2019 and 2020 compared to previous estimates of 3.5 percent and 3.6 percent respectively. Actual fourth quarter GDP for the US was revised down to 2.2 percent from a previous estimate of 2.6 percent. Real GDP for 2018 is now up by 2.9 percent compared to 2.2 percent for 2017. The deceleration in the fourth quarter reflects a slowdown in momentum caused, at least partially, by the fading effect of the tax cut stimulus and government spending.

Manufacturing activity picked up in March as the ISM manufacturing PMI advanced to 55.3 compared to 54.2 in February. Inflation remained subdued with the Core Personal Consumption Expenditures (PCE) increasing only 0.1 percent month-on-month in January against expectations of an increase of 0.2 percent. On a year-over-year basis, Core PCE recorded 1.8 percent in January down from a revised 2.0 percent the previous month.

US Indices had a solid quarter with the S&P 500 and Nasdaq Composite posting quarterly returns of 13.1 percent and 16.5 percent after a returning 1.8 percent and 2.6 percent in March. The Down Jones Industrial Average, on the other hand, remained practically unchanged at 0.05 percent during March and underperformed for the quarter with a gain of 11.15 percent. The 10-year Treasury yields declined steadily during the month, retreating from 2.75 percent at the beginning of March to 2.4 percent as of month-end hitting a 15-month low.

Markets in Europe joined the rally with the Stoxx Europe 600 Index adding 1.7 percent for a first quarter performance of 12.3 percent. The German Dax and French CAC40 added 0.09 percent and 2.1 percent respectively bringing their first quarter returns to 9.16 percent and 13.10 percent respectively. Manufacturing activity extended its weakness as the Markit Manufacturing PMI for March declined further to 47.5 from 49.3 in February. European inflation remained weak as the headline Consumer Price Index (CPI) registered 1.4 percent in March against expectations of it remaining stable at 1.5 percent and the core CPI declining to 0.8 percent against expectations of 0.9 percent and a February reading of 1.0 percent.

In the UK, equity markets seemed to ignore the chaos caused by the Brexit as the parliament rejected the Prime Minister's plan for the third time. The FTSE 100 advanced by 2.89 percent during March boosting the first quarter performance to 8.2 percent. Recent data showed that the UK GDP advanced by 0.2 percent during Q4 of 2018 bringing its overall growth for last year to 1.4 percent. Industrial activity, on the other hand, picked up markedly during March with the Markit Manufacturing PMI climbing to a 12-month high of 55.1 up from a revised 52.1 for February.

Japanese equities underperformed most developed markets during March as the Nikkei 225 Index retreated by -0.84 percent resulting in a first quarter performance of 5.95 percent. The Nikkei manufacturing PMI improved marginally compared to the previous month but remained below the 50 level at 49.2. Unemployment, on the other hand, improved to 2.3 percent in March compared to 2.5 percent for the previous month.

Emerging markets were mostly up during March. The MSCI Emerging Markets Index rose 0.68 percent during the month boosting its performance for the first quarter to 9.56 percent. MSCI Asia Ex-Japan Index added 1.52 percent during the month pushing its Q1 returns to 11.21 percent. Notable decliners included Turkey as the Borsa Istanbul 100 Index declined by 10.3 percent shrinking its year-to-date return to 2.75 percent. Russian equities advanced by a marginal 0.48 percent, while Asian markets were mostly positive with India's NIFTY 50 and Shanghai Composite leading with advances of 7.70 percent and 5.1 percent respectively.

Meanwhile oil markets continued their recovery and posted their strongest quarter in almost a decade. Markets were supported by the OPEC+ production cut, tensions in Venezuela, and renewed pressures on Iranian oil exports. Brent closed the quarter at $68.4/bbl, up 3.6 percent in March and 27.12 percent for the quarter. WTI ended March at $60.14/bbl, adding 5.1 percent during the month and 32.44 percent over the first quarter.

GCC markets had a solid month overall. The S&P GCC Composite added 2.93 percent supported by robust performance in Saudi and Kuwait. The Tadawul All Share Index advanced by 3.85 percent for a year-to-date gain of 12.7 percent.

Boursa Kuwait All Share Index, however, was the clear leader with a monthly advance of 7.38 percent boosting its returns so far this year to 10.6 percent. After a solid performance in February, the UAE markets took a breather with Dubai DFM general Index virtually unchanged at -0.03 percent and the Abu Dhabi ADX General Index down -1.23 percent. Both Indices are still positive for the year with 4.15 percent and 3.25 percent respectively. The broader S&P Pan Arab Index managed to advance by 2.31 percent during March despite the marginal decline of -0.45 percent in Egypt's EGX 30 and declines of -2.07 percent and -3.14 percent in Morocco and Jordan respectively.

NBK Capital Global Markets Commentary