KUWAIT: The Indian economy has been resilient in an environment of slowing global growth and market volatility, with GDP growth estimated to accelerate to more than 7 percent YoY in the current fiscal year ending in March. The IMF and the Indian government expect GDP to keep accelerating next fiscal year. According to the IMF, lower commodity prices and a pickup in investment as a result of recent policy reforms will benefit growth. In our view, these projections may have to be trimmed down.

KUWAIT: The Indian economy has been resilient in an environment of slowing global growth and market volatility, with GDP growth estimated to accelerate to more than 7 percent YoY in the current fiscal year ending in March. The IMF and the Indian government expect GDP to keep accelerating next fiscal year. According to the IMF, lower commodity prices and a pickup in investment as a result of recent policy reforms will benefit growth. In our view, these projections may have to be trimmed down.

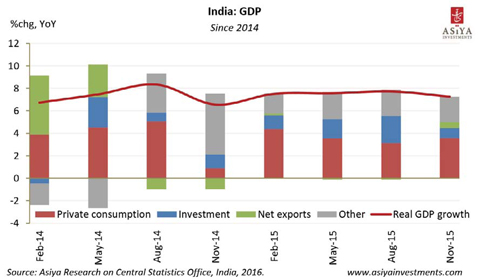

GDP for the fourth quarter of 2015 was released last week and registered a growth rate of 7.3 percent YoY, a deceleration from an upwardly revised 7.7 percent in the third quarter. Investments grew by the least in over a year, exports witnessed the sharpest decline in more than four years and imports contracted by the most in two years. The main positive take away from the latest release was the increase in private consumption growth. Also, imports contracted more than exports which led to an increase in the trade balance, an encouraging development regarding India's plans to reduce its current account deficit. Overall, the latest release of GDP showed that external factors were benefiting the economy - the IMF expects them to continue doing so - but that the domestic economy was facing hurdles, which in our view will hold back growth next fiscal year.

On the external front, two key factors will contribute positively to growth next fiscal year. First, as a net oil importer, the decline in the price of oil is benefiting India. The government, which has been having to pay less for subsidies, will find it easier to reduce its fiscal deficit. Wholesale energy prices have also been falling sharply in the economy, which has helped boost manufacturing. Second, the Indian rupee depreciated around 10 percent in the last twelve months. The improvement in competitiveness should help strengthen India's weak export sector. Major forecasters do not expect oil prices and the rupee to recover, which should continue to have a positive impact on growth in the fiscal year 2016-17.

Domestic economic conditions are a bit more mixed. Inflation and policy rates are at the lowest levels since the global financial crisis. The central bank is widely expected to reduce interest rates further in the first half of 2016, with potentially more cuts as the US economic slowdown delays the Federal Reserve's plans to raise interest rates. On the fiscal front, lower subsidy expenses will give room for the government to spend more freely on other matters, which should be confirmed in the budget later this month. Moreover, an expected increase in public worker salaries will support household consumption growth, but the wage raises might take time to be implemented. Monetary and fiscal policies will help create a business-friendly domestic environment. However, two key factors need to change in order for growth to pick up next fiscal year.

First, the Bharatiya Janata Party (BJP), which leads the government, needs to hold a majority in the Rajya Sabha, India's upper house. The lack of a majority there has hampered the government's ability to implement large-scale reforms. State elections will continue to take place in the next fiscal year, which will determine whether the BJP will get hold of the upper house majority. Second, more rainfalls are needed. Rural areas have suffered from two consecutive years of drought, hurting the agricultural sector. A better harvest would give a much-needed boost to the primary sector. Overall, both factors are out of the government's hands and will have to improve before the IMF's and the government's projections can materialize.

By Camille Accad,