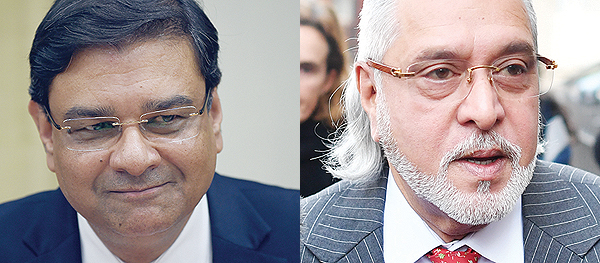

NEW DELHI/LONDON: The head of India's central bank resigned yesterday following a public spat with Prime Minister Narendra Modi's administration about alleged government interference. Reserve Bank of India (RBI) governor Urjit Patel cited "personal reasons" for his decision, but media reports have said that he was annoyed by repeated government efforts to influence central bank policy. It comes after Patel's deputy, Viral Acharya, warned the government in a strongly worded speech in October that undermining the bank's independence could be "potentially catastrophic".

Patel's short statement yesterday made no mention of the rift, highlighting only what he called the RBI's "considerable accomplishments in recent years". "On account of personal reasons, I have decided to step down from my current position effective immediately," Patel said in the statement which was posted on the bank's website. The governor and finance ministry officials were reported to be at loggerheads in recent months over claims that the government was trying to influence the bank's decision-making.

Indian business dailies reported in October and November that Modi's government had invoked never-before-used powers to send at least three letters to Patel seeking to direct policy. Newspapers suggested that Patel was close to quitting over the issue at the time, but the tension was believed to have been diffused following clear-the-air talks three weeks ago. "The RBI and the government had numerous differences but Patel's resignation is shocking," Sujan Hajra, an economist at Anand Rathi securities, told AFP. "There was a belief both were ironing out their differences but the resignation raises issues about the RBI's independence," he added.

The government is believed to be unhappy with the RBI over a number of issues including interest rates, how to deploy reserves and how to respond to India's sliding rupee. The rupee has been one of Asia's worst performing currencies this year, although it has bounced back in the past fortnight, while economic growth slowed to under eight percent in the last quarter. It is understood the government is pressuring the bank to enact policies to help spur growth ahead of next year's elections, when Modi will run for a second term. The government would like the RBI to lower interest rates and free up more of its cash reserves to invest in Asia's third-largest economy, analysts say.

Finance minister Arun Jaitley in October hit out at the RBI over a multibillion-dollar bank loan crisis that is hampering India's corporate sector. Jaitley accused the RBI of failing to stop indiscriminate lending from 2008 to 2014, saying it had "looked the other way" while banks issued loans that turned sour. The rift flared up again when economic hardliners from a powerful Hindu nationalist group linked to Modi's ruling Bharatiya Janata Party (BJP) told Patel to fall in line with the government or quit.

Patel served as a deputy governor at the bank for three years before succeeding Raghuram Rajan in the top job in Aug 2016. His term at the helm was due to end in Sept 2019. Jaitley tweeted yesterday that the government "acknowledges with deep sense of appreciation" Patel's time at the bank. "It was a pleasure for me to deal with him and benefit from his scholarship. I wish Dr Patel all the very best and many more years of public service," he wrote. Modi described Patel as a "thorough professional with impeccable integrity". "He leaves behind a great legacy. We will miss him immensely," he wrote on Twitter.

"Quite clearly the resignation of Urjit Patel shows that nothing has changed," Yashwant Sinha, a former finance minister and member of the ruling Bharatiya Janata Party, told CNBC-TV18. "The resignation is a clear sign of the government trying to interfere with the working of the RBI," he added.

Meanwhile, a British court yesterday ruled Indian tycoon Vijay Mallya, the owner of Kingfisher beer and head of the Force India Formula One team, can be extradited to his homeland to face fraud charges. Mallya has been fighting to remain in Britain but judge Emma Arbuthnot said he had misrepresented how loans received from banks would be used and therefore had a case to answer. She said bankers had been "charmed" by a "glamorous, flashy, famous, bejewelled, bodyguarded, ostensibly billionaire playboy" into losing their common sense.

Mallya will be able to make a final appeal against the ruling to Home Secretary Sajid Javid. Mallya left India in March 2016 owing more than $1 billion after defaulting on loan payments to a state-owned bank and allegedly misusing the funds. The loans from the state-owned IDBI bank were intended to bail out his failed carrier Kingfisher Airlines. Arbuthnot said Mallya had used the loans, among other things, for "vanity projects" such as Force India, which had received payments at a time when it was struggling in 2010.

"I have found that on the face of it, (Mallya) was doing everything he could by using honest or dishonest means to keep the company going," she told Westminster Magistrates' Court. Arbuthnot rejected his defense team's argument that the case was motivated by political considerations or that he would not receive a fair trial in India. She said the cell where he would be held was large and would be able to cater for his medical needs, dismissing claims extradition would infringe his human rights. "A spell in custody is likely to help him cut down on alcohol," she added.

An extradition would be a huge win for Modi months before an election, after opposition parties said the government had given a "free passage" to Mallya to flee, an accusation it denies. Modi has faced pressure from political opponents to bring to justice several people who have fled India in recent years to escape prosecution in an array of cases, many of them loan defaults.

Mallya said in July that he had made an "unconditional offer" to an Indian court in a bid to settle the charges, but denies that was an admission of guilt. "I cannot understand how my extradition decision… and my settlement offer are linked in any way," he wrote on Twitter on Thursday. "Wherever I am physically, my appeal is 'please take the money'. I want to stop the narrative that I stole money," he added.

Lawyer Mark Summers, representing the Indian authorities, said during an earlier hearing, that "the focus of our case is on his conduct, how he misused the banks". He told the court that Kingfisher Airlines had been incurring losses and was forced to defer payments to its creditors. It sought loans in Oct 2009 and hoped to emerge from the global financial crisis as a profitable venture. "This was an airline in trouble at this stage, which is why it was seeking financial assistance from a large number of banks," for large amounts of money, Summers said.

Known for his lavish lifestyle, Mallya made Kingfisher beer a global brand. He stepped down as the director of the Indian Premier League cricket team Royal Challengers Bangalore last year. His financial dealings are being investigated by the federal Central Bureau of Investigation and the Enforcement Directorate, a financial crimes agency. Mallya was once known as the "King of Good Times" but dropped off India's most wealthy list in 2014, engulfed by Kingfisher Airlines' massive debts. He has been living in a sprawling $15 million mansion in southeast England but has denied absconding. - Agencies