Figuring out how to fund a startup can be very difficult at times. The phrase often repeated is "You need money to make money", although true, how you get that money can be as important as what you do with that money, and having a solid legal structure can assist you with figuring out what are the best opportunities for your startup. Since I work with startups very often, I have decided to do a startup series of articles. This is part two in the series and will focus on investment for startups.

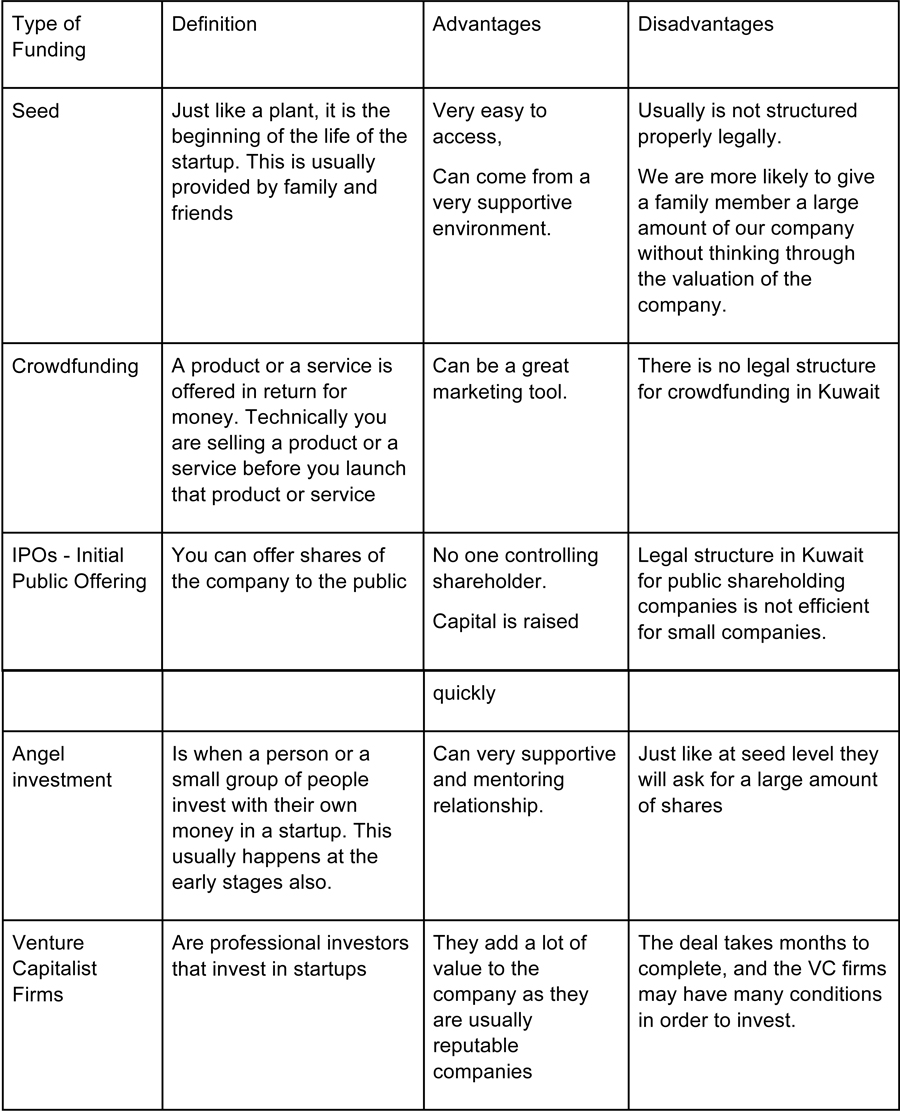

The are many options for raising funds for startups, here is a few of the popular ones, including the pros and cons for each:

Click to view larger

Click to view largerQuestion: What should I keep in mind before approaching investors?

1. Know your options: Consider all the options mentioned above and understand that you can work with more than one, or be open to more than one option.

2. Know what you will do with the money: It is important for investors to know where the funds are going and how will the funds help the company expand.

3. Know when to ask: Something that you would need to consider is the timing. Timing is vital. Usually investors want to provide funds in the first few years of a startup because the potential for growth is much larger than an already well established company and therefore the returns are much larger.

4. Have a solid legal structure: Investors wouldn't want to invest in companies unless they know what the structure of the company is and that includes all the shareholders, the type of shares they have and their rights.

5. Register your intellectual property rights: This is very important, make sure you have trademarked your logo, and if you have an innovation then you have patented that innovation, copyright any designs, that you own all the websites you are using and so on. A mistake that startups do all the time is think that they need to copyright their source code, you do not need to do that. Don't give it to anyone and make sure no one has access to it.

6. Know what the investor will be wanting: Know how your investor is expecting their returns, this will help you negotiate!

7. Prepare for Due Diligence: Usually investors will ask for Due Diligence. Due Diligence is a an investigation where the investor digs really deep into the company to see if it is worth investing in,this will be from an accounting side and a legal side. Lawyers that are conducting due diligence will usually look for red flags such any cases against the company, any debts or legal obligations on the company, any contracts signed that might put the company at risk in the future.

To read part one of the special series 'Starts Up in Kuwait', check out the Legalese section on the KuwaitTimes.com website (https://kuwaittimes.com/shareholder-agreements-startups-in-kuwait/)

For more questions or comments, email: info@ftl-legal.com

By Attorney Fajer Ahmed