Kuwait Finance House celebrates 40th anniversary

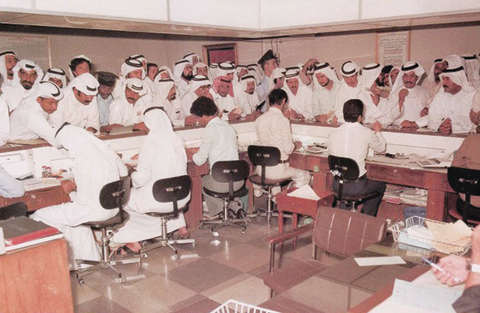

High demand from customers on Islamic transactions

High demand from customers on Islamic transactionsKUWAIT: On 23rd March 1977, an Amiri decree was issued to establish Kuwait Finance House (KFH) as a Kuwaiti shareholding company, where the government holds 49 percent. These shares were divided as follows: The Ministry of Finance 20 percent, Ministry of Justice 20 percent, Ministry of Awqaf and Islamic Affairs 9 percent, while the remaining 51 percent were to be offered as initial public offering with a capital of KD 10 million (KD 1 per share). The establishment of KFH was a result of the visions of intellectuals who were seeking Sharia compliant banking alternatives.

The dream of establishing an Islamic bank has come true, and after 4 decades of establishment, KFH became the one of the largest Islamic banks in the world and a leader of the Islamic finance industry.

Signing the decree

The Minister of Finance at that time Abdul Rahman Al-Ateeqi called Dr. Eissa and told him that he is keen on executing the project. He also sent him an employee from the ministry to receive the files related to the studies conducted by the committee since 1968. The Minister of Awqaf and Islamic Affairs at that time Youssef Al-Haji assisted Al-Ateeqi in overcoming any obstructions that faced them. Later on, Al-Ateeqi discussed with the late Amir Sheikh Jaber A-Sabah the importance of this project, since it is the only solution for people who seek Islamic banking products and services, which prompted Sheikh Jaber Al-Sabah to sign the decree that was issued by the late Amir at that time Sheikh Sabah Al-Salem A-Sabah.

IPO

Many Kuwaitis were eager to acquire shares in the initial public offering, since KFH was the first and only local Islamic bank, and the first board was formed by Ahmed Bazea Al-Yasseen as the Chairman and Managing Director, Mohammed Bu Hendi as Deputy Chairman, Khaled Al-Ateeqi, Abdul Hameed Al-Obeid, Abdul Mohsen Al-Toweiresh, Ali Al-Fozan, the late Fahad Al-Dabbous who was replaced by Ali Al-Modaf, Mohammed Al-Roumi, Mereikhan Saqer, Hadi Al-Huweila, and Bader Al-Mukhaizeem was appointed as General Manager.

It took KFH 9 months since it was enlisted in the Trade Registry in December 1977 until the end of August 1978, where its management succeeded in such a short time to provide the bank with all means, tools and manpower required to start working.

On 28th of Ramadan, 1978 KFH opened its doors to its clients, where 170 accounts were opened during the first day. In 1983, KFH moved out from its temporary offices in Ahmed Al-Jaber Street to Al-Emad Commercial Center on the same street, until it finally settled in its current building in Abdullah Al-Mubarak Street in 1986.

KFH’s Bo Nejbel and Bo Nasser at a staff member’s social occasion

KFH’s Bo Nejbel and Bo Nasser at a staff member’s social occasionSuccess partner

KFH is known to be an Islamic institution made by its customers who are considered to be partners in the success. The past 4 decades were not easy, but they were definitely effective because of the accomplishments done, which turned KFH into an icon for Islamic banking, and made governments ask KFH to operate on their lands by offering it facilities and benefits, which reveals the value of its achievements that were a result of the sterling efforts of a group of men.

KFH offers more than 200 different advanced and sharia- compliant services in all commercial, investment, financing, and banking fields. During the past years, KFH has leaped to be the first in the local market, and reinforced its presence in global markets, in addition to its social role and its participation in many major developmental plans in Kuwait and the world. KFH currently seeks to innovate more products and services to meet the growing demand of its clients.

Three points distinguished the period that proceeded after KFH's establishment in the late 1980s, which are overseas investments and KFH global expansion, offering clients prime investment opportunities and innovating products that suit the investors and achieves good revenues.

Moreover, KFH prioritizes global expansion to cement its plans to become international, diversify investment opportunities, and offer new fields of business.

In 1988, KFH established an Islamic bank in Turkey; KFH-Turkey that has now over 400 branches

KFH-Bahrain works in all economic fields, and is rendered to be an added value to the economic business in Bahrain as a result of its banking, commercial, investment, and financing businesses. One of its famous projects in Durrat Al-Bahrain, which is a $3 billion real estate investment project, and Diyar Al-Muharraq.

The Malaysian government granted KFH a license to establish an Islamic bank in Malaysia, which comes as an appreciation of its pioneer role in Islamic banking. KFH-Malaysia is one of the most important banks in Malaysia, has 12 branches, and takes part in the biggest two real estate projects in south East Asia and China.

Al-Sharjah Islamic Bank was the first attempt to transfer a traditional bank into an Islamic, where KFH led the bank to become Islamic in a matter of two years.

In 2015 KFH penetrated the Euro zone market by establishing KT Bank AG "KFH-Germany" as the first Islamic bank. KFH is the first bank to operate according to sharia in Kuwait, offer women their own branches, issue credit cards with chip technology, provided it clients with three banking services in one machine, issues prepaid cards for the family's expenses, issues quarterly reports about the local real estate rates, offer more than 150 free services through its website kfh.com, issue Ijarah card that allows its holder to own commodities in Bahrain, offers cooperative marketing with the full support of the merchants, gathers all car agents in one place, and offer electronic sharia-compliant trading services, and it has the largest network of social media among peers.

Deals

KFH participated in the first tranche of financing worth KD1.2 billion for the KNPC where it that has been the leader of Islamic lenders. KFH is continuing its efforts in playing a key role in the development process in the country.

Also, Kuwait's debt issuance program is good for KFH. This opens new horizons for financing and increases the credit growth.

KFH also acted as Program Arranger for sukuk offering under the $2.0 billion Trust Certificate ("Sukuk") Issuance Program for EQUATE. KFH has strongly contributed in financing the Kuwait's budget deficit through Islamic Tawarruq issues.

Digital banking

KFH offers over 200 e-services. KFH lately launched a state-of-the-art banking service; XTM, in addition to several innovative e-services such as KFH Wallet, Visa Checkout for innovative payment, Banking transaction Push notifications through KFH mobile app, open gold account online, buy/sell gold, Login to KFH mobile app using Face ID feature, new innovative service for the CRM, Euro Vostro Account Services etc.