Budget revenues could score KD 14.9bn on higher oil price

KUWAIT: By the end of November 2017, the 8th month of the current fiscal year 2017/2018 ended and the average Kuwaiti oil price for the past part of the current year scored $50.4 per barrel and for most of November it scored $59.4 per barrel, up by $5.1 per barrel, 9.4 percent, from October's average price of $54.3 per barrel. It is higher by $14.4 per barrel, 32 percent, than the new budget hypothetical price of $45 per barrel. It is also higher by $9 per barrel than the average price for the past part of the current fiscal year. The last fiscal year 2016/2017 which ended on March 31, 2017 scored an average price for Kuwaiti oil by $44.7 per barrel. The average price of oil for the past part of the current fiscal year is higher by 12.8 percent compared to the average price for past fiscal year but it is lower by $ -20.6 per barrel compared to the parity price for the current budget at $71 per barrel, according to the Ministry of Finance estimates after deducting the 10 percent for the Future Generations Fund.

According to the monthly follow up report of the State's Financial Administration issued by the Ministry of Finance for October 2017/2018, actual oil revenues scored about KD 7.532 billion until the end of last October. Kuwait is supposed to be achieving oil revenue at KD 1.3 billion in November. Therefore, Kuwait's total oil revenues would score an amount of KD 13.6 billion for the entire fiscal year, which is higher by KD 1.9 billion than the budget estimate in the amount of KD 11.7 billion. An additional amount of KD 808.4 million has been collected from non-oil revenues for the same period and might reach KD 1.3 billion for the entire fiscal year. Therefore, projected budget revenues would score KD 14.9 billion for the current fiscal year. Comparing this figure with KD 19.9 billion for expenditures allocations, 2017/2018 budget would face a hypothetical deficit at KD 5 billion.

Assume 6.3 percent saving in total public expenditures as in last fiscal year, actual expenditures would drop to KD 18.6 billion, which is a mere estimate. If this happens, public budget then would score a KD 3.5- KD 4 billion deficit. The Central Bank's periodical statistical bulletin (April to June 2017) which is published on its web page provides some economic and monetary indicators whose developments worth follow up and documentation. The bulletin indicates that balance of trade -exports minus imports- achieved surplus in the second quarter of 2017 in the amount of KD 1.472 billion, a drop by -9.4 percent from the surplus of the first quarter of 2017. Kuwait's exports during this second quarter scored about KD 3.906

billion, 89.2 percent of which were oil exports. Value of its commodity imports in Kuwait excluding the military- scored about KD 2.433 billion, a drop by -4.2 percent vis-à-vis the first quarter. Kuwait's balance of trade surplus in the first quarter of this year scored KD 1.625 billion, i.e. the balance of trade surplus in the first half of this year scored an amount of KD 3.097 billion, or KD 6.194 billion if calculated for the entire 2017 year. This surplus will be higher by 33 percent compared to what was achieved in 2016 at KD 4.658 billion due to oil price improvement.

Consumers' price index during the second quarter achieved positive growth by about 0.3 percent. Its average scored 112.1 (2013=100) rising from an average of 111.8 in the first quarter of the current year which is tolerable. This growth is attributable to the dominance of the impact of rising prices of commodities and miscellaneous services from an average of 100.6 to an average 103.4 (+2.8 percent).

The bulletin indicates drop in the weighted interest rates of balances on deposits from 1.632 percent in the first quarter of 2017 to 1.606 percent in the second quarter of this year, a quarterly drop rate by -1.6 percent. The weighted interest rates of balances on loans continued its rise from 4.583 percent to 4.714 percent, 2.9 percent quarterly growth rate, for the same period.

Volume of private sector deposits at local banks scored about KD 34.599 billion (KD 35.058 billion in the end of 2017), a 1.3 percent quarterly drop rate. Finally, local banks' claims on private sectors rose to KD 37.404 billion up from KD 36.922 billion in the end of the first quarter of the current year, a quarterly rise rate by 1.3 percent.

Boursa Kuwait Performance

Boursa Kuwait performance during November of the current year was less active and achieved a drop in the average value of daily trading by -22.9 percent and it scored KD 15.6 million versus KD 20.2

million in October. AlShall index dropped by -6.4 percent in one month. Its highest reading scored 410.4 points and its lowest reading during November scored 372.6 points. This slowness was common among most of the GCC stock markets due to their sensitivity to geopolitical events.

The weak performance during November affected the three main Boursa indexes; Kuwait 15 index dropped by -6.1 percent and closed at 908.5 points (967.8 points in the end of October). The Boursa weighted index closed at 398.8 points (419.9 points in the end of October) losing -5 percent. The price index scored 6,196.5 points (6,513.8 points in the end of October), a drop by 4.9 percent.

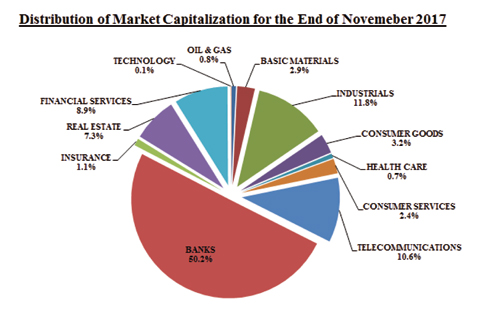

Traded value of shares (during 21 working days) dropped to KD 327.6 million, $1.084 billion, KD 137.6 million decline, 29.6 percent below October's level, when the value scored KD 465.3 million, though it's higher by 27 percent of the liquidity in the same month of 2016. The highest value scored in one day during the month was KD 38.5 million on 07/11/2017 and the lowest trading value in The Banking sector obtained the highest share from trading value -liquidity- which valued KD 148 million, 45.2 percent, of total liquidity and the Financial Services sector came next by KD 57.4 million, 17.5 percent, of total trading value.

Market value of all listed companies -157 companies- scored KD 27.270 billion during November a drop by -5 percent versus October 2017; it lost KD 1.446 billion of the investors' therein which is reflected by the drop in the weighted index. But when we compare their value with that in the end of December 2016, we note they rose by KD 1.521 billion, 5.9 percent. It is worth pointing out that number of gainers vis-à-vis the end of 2016 was 79 companies (out of 157 common companies). 76 companies recorded varying drops and only two companies retained its value and did not change. After excluding the companies which increased/decreased their capital, "Al-Madar Finance and Investment Co", scored the highest rate in value (100.8 percent increase), followed by "National Petroleum Services Company (NAPESCO)" with (69.1 percent increase).

"YIACO Medical Co." scored the highest loss in its value by -51.4 percent drop. "Burgan Wells Drilling" came next in losses by 48.5 percent on its value. 7 sectors out of 12 ones rose and the Basic Materials sector scored the highest rise by 29 percent. The Industry sector scored the second highest rise at 22.5 percent and the Oil and Gas sector came third by 13.6 percent rise. On the other hand, the Consumer Goods sector scored the highest drop at -38.1 percent.

Weekly performance of Boursa Kuwait

The performance of Boursa Kuwait for the last week (4 working days due to the Prophet's Birthday Holiday) was mixed compared to the previous one, where the traded value index, the traded volume index, and the general index showed an increase, while the number of transactions index showed a decrease, AlShall Index (value weighted) closed at 384.5 points at the closing of last Wednesday, showing an increase of about 1.9 points or about 0.5 percent compared with its level last week and it increased by 21.5 points or about 5.9 percent compared with the end of 2016.

AL-SHALL WEEKLY ECONOMIC REPORT