.

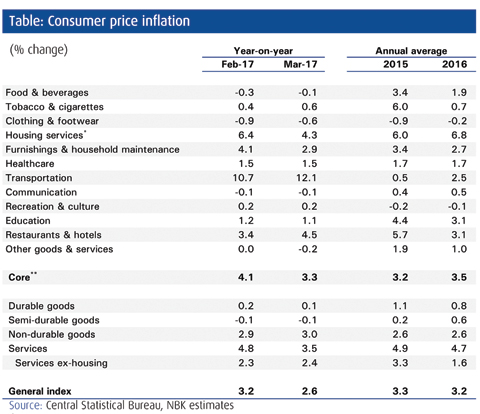

.KUWAIT: Inflation in consumer prices eased from 3.2 percent year-on-year ( percent y/y) in February to 2.6 percent y/y in March amid a slowdown in housing inflation and weak food inflation. Housing inflation slowed in March in tandem with some softness in the housing market and local food inflation remained weak after global food price inflation slipped back into deflationary territory. Core inflation, which excludes food prices, was also dragged lower, from 4.1 percent y/y to 3.3 percent y/y during the same period.

Inflation is expected to face some upward pressures from May onward, as the government hikes electricity and water tariffs. The tariffs are set to rise to 3-5 fils per kilowatt-hour for the various sectors from the current 2 fils. This could lead to annual inflation averaging close to 3.0 percent in 2017, lower than the 3.2 percent reading in 2016.

Inflation in food prices remained weak in March. Local food prices declined by 0.1 percent y/y after global food price inflation slipped back into deflationary territory. According to the Commodity Research Bureau, international prices of commodity foods fell by 0.8 percent y/y in March.

Inflation in housing services retreated to a multi-year low in line with some softness in the real estate market. Inflation in the housing component, mostly comprised of housing rents (updated quarterly), slowed from 6.4 percent y/y in 4Q16 to a three-year low of 4.3 percent y/y in 1Q17. However, we expect momentum in this segment to pick up in the second half of 2017 on the back of higher utility prices.

Inflation in the retail sector continued to be weighed down by softer consumer demand. At -0.6 percent y/y, the clothing & footwear component remained in deflationary territory in March, as the ongoing weakness in consumer demand has prompted more frequent and extended promotions. Inflation in the other goods & services component continued to trend lower on weaker gold inflation. Inflation in the furnishings & household maintenance segment took a U-turn and decelerated from the multi-month high of 4.1 percent y/y in February to 2.9 percent y/y in March.

Inflation in services excluding housing continues to be relatively strong. Price growth has been stronger in the hospitality sector in particular. In March, inflation in the restaurants & hotels segment jumped to 4.5 percent y/y from 3.4 percent y/y in February. After declining for several months, flight fares increased in March, by a multi-year high of 1.1 percent y/y.

Inflation in the transportation sector trekked higher to 12.1 percent y/y in March, on higher transport service fees. After months of deflationary prices, the fuel price hike in September pushed inflation in this sector above 10 percent y/y and it has hovered above that rate since. We may continue to see some upward pressures in this sector in the short to medium-term as transport services readjust their fees to account for the higher fuel charges. Inflation in transport services fees rose from a mere 0.3 percent y/y in February to a multi-year high of 3.2 percent y/y in March. However, given the ongoing decline in car prices, which weigh more heavily on the transportation index, upward pressures will be contained.

Wholesale price inflation appears to have peaked in 1Q17. After accelerating in the second half of 2016 due to stronger upward pressures from all its components - manufacturing in particular - following the fuel price hike in September, inflation in the wholesale price index peaked at 5.1 percent y/y in early 1Q17.

NBK ECONOMIC REPORT