Lending still lagging with only KD 0.8 billion borrowed in 1H18

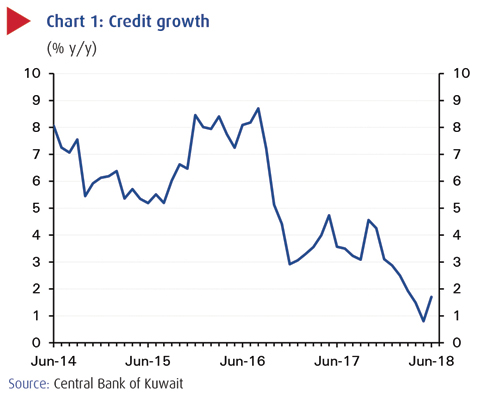

KUWAIT: Credit saw its strongest month-on-month gain in two years in June, and finished 1H18 up 1.7 percent y/y from 0.8 percent in May. This followed seven consecutive months of declines affected by lackluster growth in business lending, slightly softer household borrowing and continued deleveraging by non-bank financial firms. Year-to-date, however, lending is still lagging, with only KD 0.8 billion borrowed in 1H18 compared to an average of KD 1.1 billion during similar periods in the last five years. Credit growth also eased a touch from March's 1.9 percent.

KUWAIT: Credit saw its strongest month-on-month gain in two years in June, and finished 1H18 up 1.7 percent y/y from 0.8 percent in May. This followed seven consecutive months of declines affected by lackluster growth in business lending, slightly softer household borrowing and continued deleveraging by non-bank financial firms. Year-to-date, however, lending is still lagging, with only KD 0.8 billion borrowed in 1H18 compared to an average of KD 1.1 billion during similar periods in the last five years. Credit growth also eased a touch from March's 1.9 percent.

June saw strong business lending - up KD 482 million m/m and 1.3 percent y/y - overturning months of little to no growth in that segment. There was improving appetite for credit from key sectors - oil, trade, industry, and construction. Catalysts included the conclusion of a major financing deal for a government oil project, and possibly increasing issuance of commercial business licenses in recent months (up more than 60 percent y/y in 1H18) and an improving operating environment.

Household borrowing growth however edged down, ending June up 6.7 percent y/y compared to 7 percent in March, on softer demand for home financing. This perhaps reflected recent firmness in housing prices and seasonal softness usually associated with the holy month of Ramadan (mid-May to mid-June). Meanwhile, consumer loans - of shorter duration - contracted by 6.4 percent y/y in June compared to March's 5.9 percent. But the pace of decline steadied through the quarter, perhaps reflecting early signs of improved consumer sentiment and consumption.

Meanwhile, the pace of deleveraging by non-bank financial firms slowed in June to 9.9 percent y/y from 11.6 percent in March, thanks to a pick-up in net borrowing late in the quarter. Investment companies may be looking to take advantage of the rebound in the domestic stock market, helped by a recent index reclassification and restructuring.

Private deposits

Private deposits finished 2Q18 up 5.7 percent y/y in June, the strongest growth in almost three years, and up KD 1.2 billion over the quarter. Strong earnings and solid dividend payments supported the increase. This propelled growth in M2 money supply to 5.3 percent y/y. The increase was across the board and led by KD sight and KD time deposits. Meanwhile, government deposits, which have been weakening over the past year, rose in 2Q18, with year-on-year growth at -0.6 percent in June versus -1.3 percent in March, helped by higher oil revenues.

Bank reserves (cash, deposits with the CBK, and CBK bonds) increased by KD 754 million to KD 6.1 billion or 9.4 percent of bank assets in 2Q18. This coincided with KD 650 million in public debt maturing without any new issuance as the new debt law has yet to be approved. KD 350 million in public debt is still set to mature in 2018, and this is expected to continue increasing liquidity this year.

Domestic deposit rates were higher in 2Q18, pricing in March's rate hike and some of June's increase in the repo rate. The Central Bank of Kuwait left the discount rate unchanged in June, opting not to follow the Fed's latest move. The repo rate, however, was raised by 25 bps to 2.00 percent. Customer deposit rates were up 25-28 basis points across the board in 2Q18. The average 3-month interbank rate rose 8 basis points to 2.0 percent. Rates have held relatively steady since.

Credit is projected to finish the year up 4 percent, supported by capital spending and moderate economic growth. Project financing, in light of the government's budgeted 14 percent increase in construction capital spending this year, as well as its commitment to reduce delays in execution, is seen providing a vital boost to borrowing.

NBK ECONOMIC REPORT