.

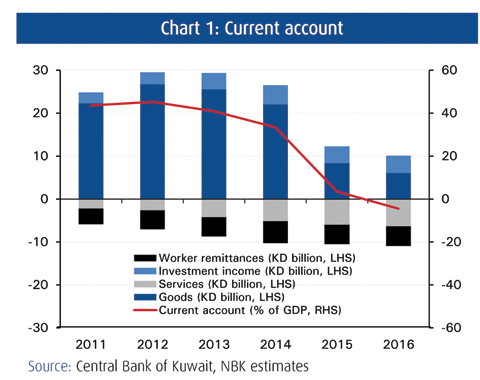

.KUWAIT: Kuwait’s current account recorded its first deficit in 2016, on the back of a decline in export earnings. The balance on Kuwait’s current account fell from a surplus of 3.5 percent of GDP in 2015 to a deficit of 4.5 percent in 2016. The deficit was largely a result of a continued deterioration in the goods balance, as oil export earnings declined on weaker oil prices. Despite the deficit, Kuwait’s external position remains strong, with a high level of external asset holdings and low external breakeven oil price.

We expect the balance on the current account to return to a surplus in 2017 as oil prices improve. The current account is projected to return to a surplus of around 2 percent of GDP in 2017.

The goods balance retreated to a 12-year low of KD 6.1 billion in 2016, primarily due to a continued decline in oil export receipts. Oil exports fell by 14 percent year-on-year (y/y) in 2016 following a 19 percent y/y drop in oil prices. A continued rise in net service outflows also weighed on the balance. The net services deficit widened to KD 6.4 billion in 2016, as strong project activity helped boost imports of construction services by 24 percent y/y.

The absence of growth in imports helped offset some of the deterioration in the current account. Import levels stabilized in part due to softness in the consumer sector. Indeed, imports of consumer goods were down by 9 percent in 2016. However, imports also felt the impact of robust investment levels, with capital goods imports continuing to see healthy growth.

Remittances

Healthy net investment income growth and modest growth in worker remittances also helped offset weakness in the current account. Investment income rose by 5.1 percent in 2016 to an estimated 12 percent of GDP. Meanwhile, worker remittances held steady at around the KD 4.5 billion, keeping outflows on the current transfers account in check.

The deficit on the current account resulted in a net financial account inflow for the first time in over two decades. In a bid to finance the deficit on the current account, Kuwait resorted to liquidating short-term assets. Indeed, government currency and deposit inflows rose to KD 10.5 billion (Chart 4). These are likely to have come from liquidating assets of the General Reserve Fund (GRF) to finance the government’s fiscal deficit and replenish domestic liquidity.

At the same time, portfolio investment outflows remained positive as the Kuwait Investment Authority (KIA) continued to accumulate assets in the Future Generations Fund (FGF). Kuwait continued to invest in foreign securities and foreign debt instruments to the tune of KD 5.7 billion, though the figure was 43 percent lower than the year before.

Direct investment outflows also came in lower, but still held positive at KD 1.4 billion. Net outflows fell after investments by Kuwaitis abroad fell by some KD 0.3 billion. Meanwhile, foreign direct investments in Kuwait jumped by 42 percent, though at 0.4 percent of GDP the figure remains relatively small.

While the government as a whole saw a net decline in foreign assets, the foreign reserves of the CBK increased in 2016, most likely as the KIA sought to replenish domestic liquidity. The overall BOP balance, which reflects the change in foreign assets held by the CBK, recorded its biggest surplus in five years. CBK reserves rose by 14 percent to KD 8.9 billion, or an estimated 11.5 months of imports. Thanks to this increase, Kuwait has managed to maintain more comfortable liquidity levels despite the decline in the price of oil over the last two years.

NBK ECONOMIC REPORT