KUWAIT: Kuwait Stock Exchange (KSE) ended last week with mixed performance. The Price Index closed at 5,766.37 points, down by 0.08 percent from the week before closing, the Weighted Index increased by 1.77 percent after closing at 397.50 points, whereas the KSX-15 Index closed at 954.64 points up by 2.67 percent. Furthermore, last week's average daily turnover increased by 30.15 percent, compared to the preceding week, reaching KD 16.24 million, whereas trading volume average was 145.57 million shares, recording a loss of 3.61 percent.

KUWAIT: Kuwait Stock Exchange (KSE) ended last week with mixed performance. The Price Index closed at 5,766.37 points, down by 0.08 percent from the week before closing, the Weighted Index increased by 1.77 percent after closing at 397.50 points, whereas the KSX-15 Index closed at 954.64 points up by 2.67 percent. Furthermore, last week's average daily turnover increased by 30.15 percent, compared to the preceding week, reaching KD 16.24 million, whereas trading volume average was 145.57 million shares, recording a loss of 3.61 percent.

Kuwait Stock Market ended the week's trading activity with mixed closings, whereas the Price Index recorded light weekly losses affected by the continued presence of some negative indicators represented by the selling pressures and the profit collection operations in addition to the quick speculations concentrated on the small-cap stocks of the companies that did not disclose its third quarter financial results yet, among fears of the possibility of holding such companies' stocks from being traded if not announced its results before the end of the disclosure period which will end on Sunday. Meanwhile, the Weighted and KSX-15 indices were able to end last week's trading activity in the green zone, supported by the purchasing activity that included many large-cap and operational stocks, especially of companies that disclosed positive nine months financial results.

Also, the three stock market indicators were able to realize good gains in the two sessions at the beginning of the week resulted from the purchasing power that included many stocks of different sectors, both of leading and small-cap stocks, among a noticeable increase in the trading activity, especially the liquidity which reached its highest level in more than two months. However, the profit collection operations witnessed by the market on Tuesday's session were able to stop the upward direction initiated by the indicators since the beginning of the week, pushing it to close in the red zone, and somehow lightening its gains.

On Wednesday's session, the market witnessed variance in its closings for the three indices, whereas the Weighted and KSX-15 indices were able to return to the green zone supported by the collection operations that concentrated on the large-cap stocks, especially the companies' stocks that disclosed positive third quarter results, whilst the Price Index continued its decline affected by the profit collection operations executed on some small-cap stocks, losing all its weekly gains, and closing below its last week's level. On the end of week session, the three stock market indicators were able to increase, however of the Price Index decline throughout the whole session, as it was able to end it with very limited increase supported by the positive trading witnessed the last moments; the Weighted and KSX-15 indices were able also to record good growth supported by the continued purchasing operations executed on the operational stocks, enhancing by this its weekly gains.

As far as the listed companies disclosures for the 9 months 2015 results, the total number of the disclosed companies reached 133 by the end of last week, representing 69 percent of the 192 total listed companies in KSE; the disclosed companies realized around KD 1.27 billion net profits for the 9 months 2015, against KD 1.24 billion for the same period of 2014, increasing by 2.29 percent. When comparing the net profits realized by the different market sectors, the Banks sector came in the first place with a total profit of KD 681.06 million, while the Telecommunication sector came in second place with KD 151.75 million in profits, and the Industrial sector came in third with a total profit of KD 126.61 million. However, the Technology sector took the last place among the market sectors in terms of the realized profits, as its companies' profits reached around KD 1.53 million.

Moreover, the KSE market cap reached by the end of last week KD 26.36 billion, increasing by 1.78 percent compared to its level in a week earlier, where it was KD 25.90 billion. On an annual level, the market cap for the listed companies in KSE declined by 5.80 percent from its value at end of 2014 where it was KD 27.98 billion.

As far as KSE annual performance, the Price Index ended last week recording 11.77 percent annual loss compared to its closing in 2014, while the Weighted Index decreased by 9.43 percent, and the KSX-15 contracted by 9.94 percent.

Sectors' Indices

Eight of KSE's sectors ended last week in the green zone, and four recorded declines. Last week's highest gainer was the Insurance sector, achieving 5.45 percent growth rate as its index closed at 1,112.80 points. Whereas, in the second place, the Technology sector's index closed at 883.72 points recording 4.07 percent increase. The Basic Materials sector came in third as its index achieved 2.06 percent growth, ending the week at 1,032.96 points. The Telecommunications sector was the least growing as its index closed at 577.17 points with a 0.04 percent increase.

On the other hand, the Industrial sector headed the losers list as its index declined by 2.30 percent to end the week's activity at 1,051.03 points. The Oil & Gas sector was second on the losers' list, which index declined by 1.18 percent, closing at 781.01 points, followed by the Financial Services sector, as its index closed at 650.85 points at a loss of 0.49 percent. The Health Care sector was the least declining during last week, as its index recorded a weekly loss of 0.15 percent, closing at 951.51 point.

Sectors' Activity

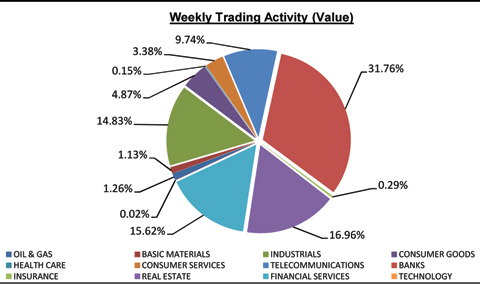

The Real Estate sector dominated a total trade volume of around 288.62 million shares changing hands during last week, representing 39.65 percent of the total market trading volume. The Financial Services sector was second in terms of trading volume as the sector's traded shares were 27.78 percent of last week's total trading volume, with a total of around 202.22 million shares.

On the other hand, the Banks sector's stocks were the highest traded in terms of value; with a turnover of around KD 25.79 million or 31.76 percent of last week's total market trading value. The Real Estate sector took the second place as the sector's last week turnover was approx. KD 13.77 million representing 16.96 percent of the total market trading value. -- Prepared by the Studies & Research Department, Bayan Investment Co.