Click to view larger

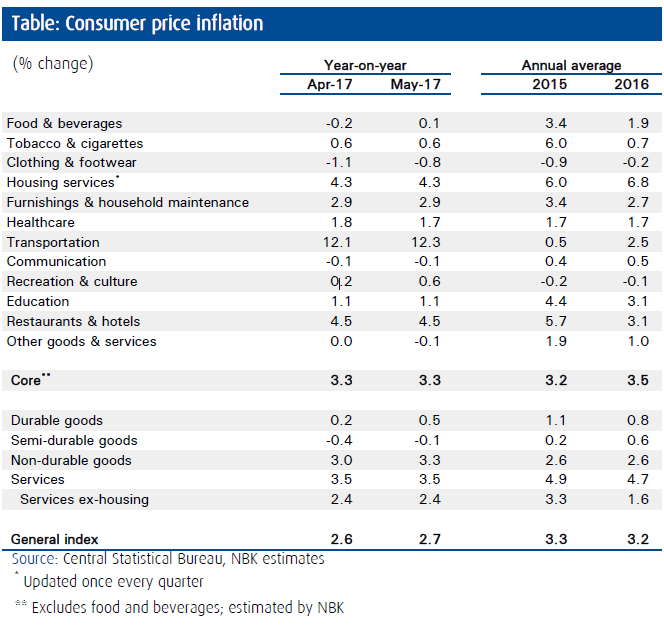

Click to view largerKUWAIT: Inflation in consumer prices stood pat at 2.7% year-on-year (y/y) in May, as inflation across most components came in unchanged from April. Moderating growth in housing rent and weak food inflation has led to lower overall price growth in recent months. Momentum is expected to remain to the downside, as a continued decline in global food prices and a soft real estate market are seen keeping food and housing inflation, respectively, in check.

Nonetheless, hikes in electricity and water tariffs during the second half of 2017 are expected to put some upward pressure on inflation. The tariffs are scheduled to increase from the current 2 fils to 3-5 fils per kilowatt-hour (kWh) for the various sectors. In May, the Ministry of Electricity & Water began applying new utility tariffs in the commercial sector. Tariffs rose from 2 fils to 5 fils/kWh and from KD 0.8 to KD 2per 1,000 imperial gallon of water. The increases in utility prices are expected to push inflation up slightly from current rates to an annual average close to3% in 2017.

Inflation in food prices remained flat in May amid a continued decline in global food prices. Local food prices were flat at0.1% y/y in May and according to the Commodity Research Bureau, international prices of commodity foods were down by 5.1% y/y during the same period. Inflation in housing services remained unchanged in April. Inflation in the housing component, mostly comprised of housing rents and updated quarterly, slowed from6.4% y/y in 4Q16 to a three-year low of 4.3% y/y in 1Q17, in-line with some softness in the housing market.

Inflation in the retail sector remained soft against a backdrop of subdued consumer demand. Clothing & footwear prices continued to decline in May amid soft consumer demand. Car price inflation came in flat at 0.1% y/y. Inflation in "other goods & services" remained weak on the back of lower gold inflation, while inflation in the furnishings & household maintenance component stabilized at 2.9% y/y.

Inflation in services excluding housing held steady at a multi-month high of 2.4% y/y in May. Inflation in both transportation services and the restaurants & hotels segment remained relatively elevated at 12.3% y/y and 4.5%, respectively. Transport services continue to readjust their fees to account for the higher fuel charges that were implemented back in September of 2016. In May, inflation in this segment stood at a comparatively high 3.2% y/y.

NBK ECONOMIC UPDATE