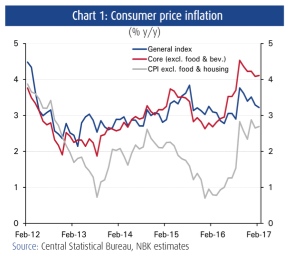

KUWAIT: Inflation in consumer prices stood pat at 3.2 percent year-on-year (y/y) in February, as inflation across most components came in steady or unchanged. Local food inflation maintained its weakness as inflation in global food prices remained subdued. Core inflation, which excludes food prices, was unchanged at 4.1 percent y/y on the back of lower inflationary pressures from the housing component. Inflation is expected to see renewed, albeit limited, upward pressures from May onward, as the government increases electricity and water tariffs.

KUWAIT: Inflation in consumer prices stood pat at 3.2 percent year-on-year (y/y) in February, as inflation across most components came in steady or unchanged. Local food inflation maintained its weakness as inflation in global food prices remained subdued. Core inflation, which excludes food prices, was unchanged at 4.1 percent y/y on the back of lower inflationary pressures from the housing component. Inflation is expected to see renewed, albeit limited, upward pressures from May onward, as the government increases electricity and water tariffs.

The government recently approved new tariffs that are well below those initially approved in legislation last year. Tariffs are now expected to be hiked to 3-5 fils per kilowatt-hour for the various sectors from the current 2 fils. This could push annual average inflation to around 3.5 percent in 2017, up from 3.2 percent in 2016. Inflation in food prices hit a multi-year low in February.

Local food prices declined by 0.3 percent y/y against a backdrop of weak global food price inflation. According to the Commodity Research Bureau, inflation in international prices of commodity foods stabilized at 2.8 percent y/y during the same period. Following some moderation in December, in tandem with softer real estate activity, inflation in housing services was largely steady. Inflation in the housing component, a bulk of which is made up of housing rents and is updated quarterly, eased from 7.4 percent y/y in 3Q16 to 6.4 percent y/y in 4Q16. However, on a quarter-on-quarter basis the 4Q16 increase was still surprisingly strong at 2.8 percent. We expect momentum in this segment to ease in the near term before being led higher by utility hikes in the second half of 2017.

Inflation in the retail sector remained weak in February. The clothing & footwear component continued to face deflationary prices in February, amid continued softness in consumer demand, extended seasonal promotions and a stronger dinar. Inflation in the other goods & services component maintained its descent during the same period, mainly on the back of a slowdown in gold inflation. After surging on higher maintenance service fees in December, inflation in the furnishings & household maintenance segment stabilized at a multi-month high of 4.1 percent y/y in February. Inflation in the transportation sector held at 10-11 percent y/y for the fifth consecutive month in February. Following months of deflationary prices, the fuel price hike in September notched up inflation in this segment above 10 percent y/y and it has held above that rate since. We may see some upward pressures in this segment in the short to medium-term as transport services readjust their fees to factor in higher fuel charges. However, given the continued decline in car prices, which weigh more heavily on the transportation index, any significant upward pressure will be kept at bay.