Yields edge lower in first quarter 2017

KUWAIT: Global yields were range-bound in 1Q17 as markets adjusted to a more optimistic economic outlook and heightened political risk; GCC yields declined on the quarter. Issuance in the GCC was healthy and was led again by sovereigns, with the bulk coming from Kuwait. International issuance remained strong for sovereigns, which helped ease regional liquidity constraints. GCC primary debt market activity is expected to be robust in the coming quarters especially given the need to finance large budget deficits.

KUWAIT: Global yields were range-bound in 1Q17 as markets adjusted to a more optimistic economic outlook and heightened political risk; GCC yields declined on the quarter. Issuance in the GCC was healthy and was led again by sovereigns, with the bulk coming from Kuwait. International issuance remained strong for sovereigns, which helped ease regional liquidity constraints. GCC primary debt market activity is expected to be robust in the coming quarters especially given the need to finance large budget deficits.

Global benchmark 10-year government bonds traded within a 30-40 bps range throughout 1Q17, with the exception of Japanese government bonds. This was despite a Fed move to hike its target rate by 25 bps in March, before earlier expectations. GCC central banks followed suit in support of their USD or quasi-USD pegs, though other major central banks stood pat.

US 10-year Treasuries ended the quarter little changed, only down 3.7 bps, but swung from a low of 2.3 percent on safe haven buys right before Trump's inauguration to a high of 2.6 percent when rising expectations of a March federal funds rate hike fueled a selloff. Yields on US 10-year bonds ended 1Q17 at 2.4 percent. Developments throughout the quarter were mainly driven by Trump's political agenda and his ability to deliver. Recent failures, such as the widely opposed travel ban and the failed attempt at healthcare reform, saw markets revise initially optimistic expectations.

QE program

Meanwhile, German government bond (Bund) yields were up on the quarter as a chorus of soft and hard data pointed to a turnaround in eurozone growth, feeding expectations of a sooner rather than later taper of the ECB's QE program. The increase came despite a quarter riddled with political uncertainty that first began with the Italian banking crisis, followed by the Greek debt review, and then focused on the outcome of key EU elections happening in the wake of a surge in anti-establishment voices. Fears of the latter abated following a pro-establishment win in Dutch elections and a lead by a pro-EU candidate in the upcoming April/May French elections. Yields on 10-year bunds ended 1Q17 up 12.3 bps, to settle at 0.33 percent.

Yields on GCC sovereign bonds declined over the quarter benefitting from relatively stable oil prices and a growing appetite for their debt. Yields on the 2021 paper of five GCC sovereign issuers were down between 15 bps and 35 bps. Kuwait's 2022 bond was down 12 bps since its issuance in mid-March.

The Federal Reserve remained the only major central bank tightening its monetary policy, as it hiked its policy rate again in 1Q17. The Fed increased its target federal funds rate by 25 bps to 0.75-1.00 percent. This was its second rate hike in 3 months and followed firmer national data that pointed to better economic conditions. The Fed's rate outlook, for now, sees only 3 hikes in 2017, although this does not take into account President Trump's potential fiscal stimulus.

The ECB, the BOE, and the BOJ withheld any policy moves awaiting further indications. Despite record setting PMI readings and healthy GDP and inflation numbers, the ECB maintained a dovish outlook, at least on record. Recent remarks by some board members, however, indicate some willingness to tighten monetary policy sooner rather than later. The BOE, on the other hand, is maintaining a cautious footing as it watches with great scrutiny the unfolding of Brexit, while the BOJ is awaiting signals of a pick-up in its still dormant economy.

Rate hikes

GCC central banks followed the Fed, raising their policy rates by 25 bps, with Oman being the only exception. The moves were in line with the need to support USD pegs or, in the case of Kuwait, a quasi-USD peg. As for Oman, this is the second time it passes on hiking its rate, despite its peg to the dollar. However, the Central Bank of Oman's repo rate has been rising, effectively pricing in the rate hikes.

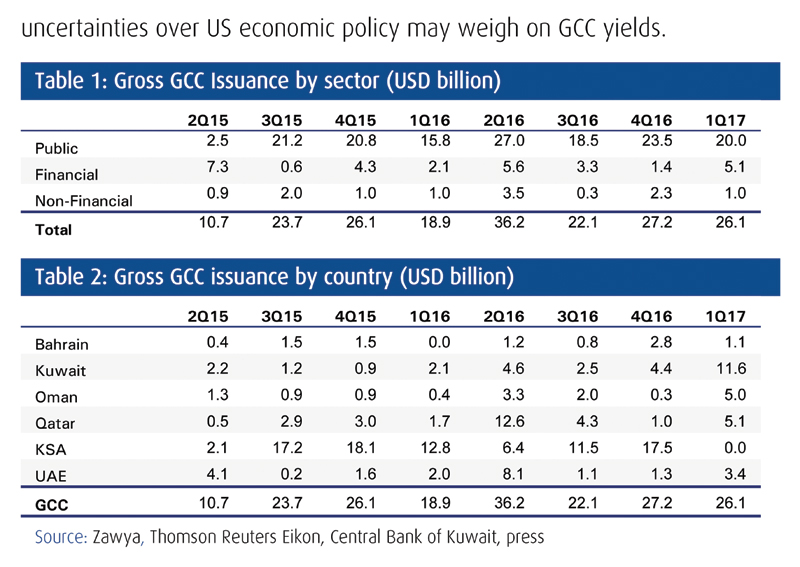

GCC issuance was healthy in 1Q17, with sovereigns leading the way as debt financing remains high on the regional debt agenda. Total issuance amounted to $26 billion in 1Q17, in line with 2016's quarterly average. Sovereigns led the way, with Kuwait issuing half of the $20 billion government bonds issued. As a result, total outstanding bonds stood at $381 billion, up 19 percent y/y.

The quarter saw strong international issuance by sovereigns, with Kuwait, Oman, and Bahrain turning to foreign currency debt markets for financing. Kuwait's international issuance was the largest at $8 billion. It was priced favorably relative to other GCC sovereigns, with the 5-year at 75 bps over equivalent US Treasuries (2.88 percent) and the 10-year at 100 bps over Treasuries (3.62 percent). The spread was below Abu Dhabi's, which until now had been considered the "gold standard" in the GCC. Meanwhile, Oman issued $5 billion in USD bonds, while Bahrain tapped the market for $600 million in USD bonds.

GCC foreign debt

Investors are increasingly showing interest in the GCC's foreign debt, not to mention their growing familiarity with the region. Order books have been observed to be 3 to 4 times oversubscribed, reflecting the strong market appetite and attractiveness of regional debt. CDS rates are also reflecting investors' confidence in the region, with rates across all GCC sovereigns down between 11 bps (Saudi) and 75 bps (Bahrain) in 1Q17.

The continued pick-up in international issuance is helping control liquidity constraints across the GCC. Saudi Arabia saw the biggest improvement. Its 3-month interbank rate was down 30 bps in 1Q17 and 65 bps following its issuance; this is despite a 50 bps hike in its policy rate . Bahrain, the UAE, and Qatar's 3-month interbank rates were up between 15 bps and 20 bps on the quarter, well below the 50 bps hike in their policy rates.

Private sector issuance was relatively better on the quarter, with the financial sector locking in lower coupons in an environment of rising rates. The financial sector added a gross $5.1 billion in debt in 1Q17, above its 2016 quarter average of $3.1 billion. Meanwhile, the non-financial sector issued a total of $1 billion in 1Q17.

GCC debt is expected to remain robust for the rest of 2017, with issuers seeking to take advantage of the still favorable global rate environment supported by improving fiscal sustainability. The GCC's financing needs remain large, estimated at $90 billion for 2017. Saudi Arabia is looking to issue a sizeable international sukuk, while the quasi-sovereign Saudi Aramco raised $3 billion in a recent domestic Sukuk issuance as part of large fundraising scheme. Dubai is also considering tapping international debt markets. However, global risks in the form of continued strength in the dollar and a more hawkish Fed, both driven by uncertainties over US economic policy may weigh on GCC yields.