Sales pick up, property prices stabilize

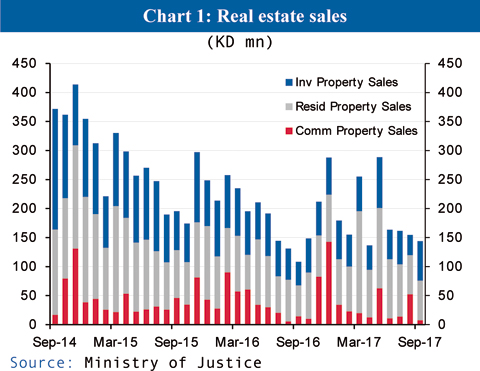

KUWAIT: Activity in the real estate market is gaining traction with a pickup in sales and stabilizing prices. Real estate sales posted healthy 20 percent year-on-year (y/y) growth in 3Q17, the first positive growth since 4Q14, despite the seasonality that customarily reigns over the quarter. The positive pickup in activity also translated into further stabilization in real estate prices, with indices hovering around their 12-month average. Comparable stabilization is seen in other GCC real estate price indices despite slight divergence in trends.

KUWAIT: Activity in the real estate market is gaining traction with a pickup in sales and stabilizing prices. Real estate sales posted healthy 20 percent year-on-year (y/y) growth in 3Q17, the first positive growth since 4Q14, despite the seasonality that customarily reigns over the quarter. The positive pickup in activity also translated into further stabilization in real estate prices, with indices hovering around their 12-month average. Comparable stabilization is seen in other GCC real estate price indices despite slight divergence in trends.

The residential sector remained supportive of the real estate market throughout the first three quarters of the year. Residential sales reached KD 226 million in 3Q17, up 20 percent y/y. Year-to-date (ytd) sales tallied up to KD 879 million over 2,519 transactions. As for the month of September, sector sales were up 28 percent y/y with transactions improving by 36 percent y/y. Renewed interest in the sector was not channeled through a specific type of properties; both home and plot sales advanced, rising by 26 percent and 21 percent, respectively ytd.

Strong third quarter activity helped support residential prices further. The NBK residential home price index reached 153.1 in September, flat from a year ago. The NBK residential land price index soared to 172.8 in September, up 4 percent for the month, though it remains down 5.5 percent y/y. Although residential prices are down around 17 percent from their peaks, their annual pace of decline has come down from double-digit to less than 5 percent, suggesting the end of the price correction.

Investment properties' activity remains off, not in line with the spur in the residential sector, as other markets seem more appealing to investors. 3Q17 sales reached KD 160.5 million, down to a third of what was recorded in 3Q14. The exceptional performance of Kuwait's stock market this year may have deterred investors from investing in real estate. With stocks generating double-digit growth so far this year, the investment sector, plagued by increased vacant apartments, lower housing inflation (i.e. rents) and higher utility bills, was not able to generate comparable returns.

The persistently slow activity in the sector continues to exercise negative pressure on investment property prices. The NBK investment building price index retreated to 171.1 in September, down 5.7 percent y/y. The price index has settled at levels last seen at the end of 2013. The index is off by 25 percent from its peak in July 2015.

The commercial sector witnessed a healthy third quarter. 20 commercial properties were sold during the quarter for a total value of KD 74 million. This quarter's transactions were predominantly commercial buildings and offices. Ytd, the sector is 30 percent short on sales and 20 percent on transactions. Regional real estate residential price indices are exhibiting similar signs of stabilization despite the divergence in trends caused by the heterogeneous macroeconomic and geopolitical outlooks of each of the GCC countries. Abu Dhabi prices appear among the most stable in the region, with prices advancing 5.4 percent y/y in June 2017. Qatar prices on the other hand were the last to correct, with the residential index down 5.5 percent y/y in June. KSA recently launched real estate quarterly indices, which reveal a downward trend since 2016; as of June the general residential index is down 7.9 percent y/y.

NBK ECONOMIC REPORT