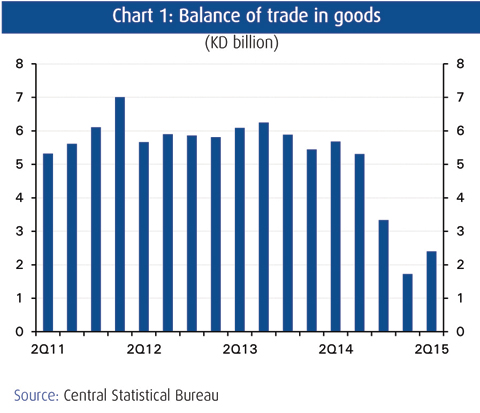

KUWAIT: Kuwait's trade surplus widened for the first time in three quarters in 2Q15, thanks to a temporary recovery in oil prices. The surplus expanded to KD 2.4 billion in the second quarter of 2015. However, it still remains comparatively low. The pickup was mainly due to a rise in oil revenues, given that oil prices improved slightly in 2Q15 and import growth slowed.

KUWAIT: Kuwait's trade surplus widened for the first time in three quarters in 2Q15, thanks to a temporary recovery in oil prices. The surplus expanded to KD 2.4 billion in the second quarter of 2015. However, it still remains comparatively low. The pickup was mainly due to a rise in oil revenues, given that oil prices improved slightly in 2Q15 and import growth slowed.

Oil export revenues edged higher from KD 3.6 billion in 1Q15 to KD 4.3 billion in 2Q15. The international oil price benchmark, Brent, rose from an average of $54 per barrel in 1Q15 to $62 per barrel in 2Q15, which in turn led oil revenues higher. In spite of the marginal rise, revenues were still down by 41 percent year-on-year (y/y). With oil prices hitting new lows in 3Q15 and staying there, we expect oil revenues to come in lower in the coming quarters. Brent averaged $50 in 3Q15.

Non-oil export growth saw some improvement, but continued to contract in 2Q15, declining by 7 percent y/y. Non-oil export growth was propped up by a strong rebound in ethylene prices, but a stronger Kuwaiti dinar against most major currencies (with the exception of the US dollar) kept any significant gains at bay. Growth in non-oil exports is poised to remain in decline in the near-to-medium term, against a backdrop of a stronger dinar and weaker ethylene prices in 3Q15.

Central Statistical Bureau

Import growth held strong at 9.7 percent y/y in 2Q15 and climbed to another record high of KD 2.4 billion. Growth in imports has remained buoyant for a year now, mainly due to robust gains in capital goods imports. Capital goods imports grew by a strong 17.4 percent y/y in 2Q15. The demand for capital goods has been on the rise this year, on the back of a pickup in spending on capital projects. An ongoing recovery in the demand for transport and consumer goods imports, (due in part to the stronger Kuwait dinar) has also propped up overall import growth of late.