Expatriates hold 96 percent of jobs in the retail and wholesale sector

KUWAIT: Buoyed by steady economic expansion, Kuwait's retail sector is expected to see solid growth in the second half of 2019 and beyond, though fluctuating consumer sentiment and policy changes could weigh on turnover.

Kuwait's retail industry is forecast to expand at a compound annual growth rate of 4.2 percent over the coming four years, up from 0.6 percent in 2012-16. This will make it the second-fastest-growing retail market in the GCC, according to a report issued in late April by Alpen Capital, a Dubai-based investment bank.

Growth will mainly be fuelled by increases in tourism activity, GDP per capita and the number of organized retail stores, building on the estimated $16.7 billion in retail sales posted in 2018 and a non-oil GDP contribution of 6.7 percent in current prices in 2017.

Consumers sending mixed messages

While sector growth looks solid in the near term, Kuwaiti consumer confidence has fluctuated in recent months, possibly reflecting shifts in economic expectations. Uncertainty over public spending and revenue, policy proposals affecting expatriates and regional tensions have all weighed on sentiment.

The general consumer confidence index produced by regional research consultancy ARA showed that sentiment rose from 103 points in January to 108 points in February before falling back to 103 the following month.

Among the six subindices, only employment opportunities recorded an improvement between February and March, rising from 146 to 148 points. Future employment growth and higher earnings potential would bode well for the retail industry, as increased labor participation rates could lead to greater spending power.

Expat exodus to impact sales

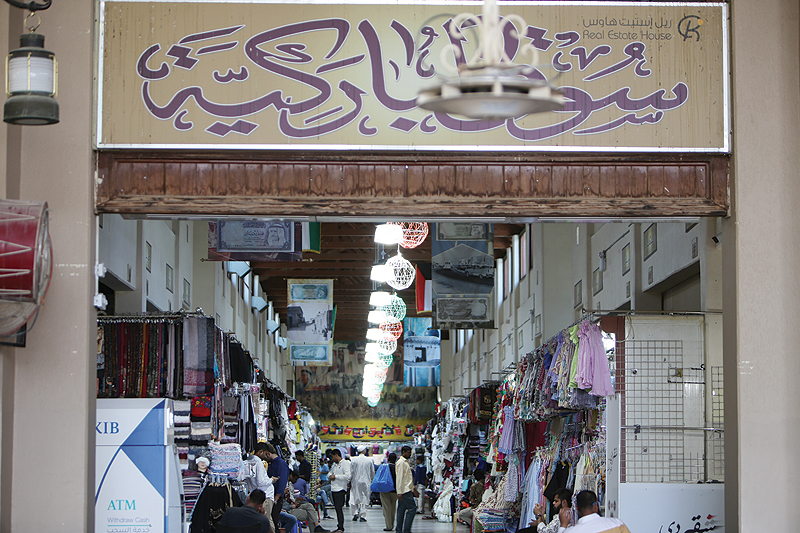

Given their significant disposable income and the fact that they account for roughly 70 percent of the population in Kuwait, expatriates make a considerable contribution to the local retail market in terms of sales and employment.

The retail and wholesale sector accounts for more than 500,000 jobs, second only to the public sector. Of this total, some 480,000 positions were held by foreigners (96 percent). The policy of Kuwaitization - which is aimed at reducing the number of expatriates in the workforce, particularly in the public sector - could therefore have a negative impact on retail sales.

Expatriates employed by the state are increasingly being winnowed down. More than 2,500 foreign employees were removed from the public payroll in the first five months of 2019, in addition to the 3,100 made redundant last year, according to government officials quoted in local media.

While there has been an increase in overall expatriate numbers, this growth has been linked to the rollout of new infrastructure and development projects, with the recruitment of foreign blue-collar workers bolstering employment numbers.

Such workers, who have low levels of pay and remit much of their salaries to their home countries, have less impact on retail sales than expatriate white-collar workers, whose numbers are being reduced by government policies and replaced by Kuwaiti nationals.

The expatriate community has also been impacted by the government's efforts to expand its revenue base and recoup some of the costs of services. This included increasing fees for employment permits and health services for overseas workers. Additionally, there have been calls to increase the tax burden on expatriates, which would further lower their disposable incomes and spending power.

In mid-May the Parliament discussed a proposal to impose a levy of up to five percent on overseas remittances made by foreign workers, with estimates that the new policy could generate tax revenue of KD200 million ($660 million) per year. However, analysts have warned that the levy could accelerate the exodus of skilled professionals from the country.

Though the government's policy would open up more jobs for the local community, the advantages could be offset by nationals seeking higher wages than those paid to the foreign staff they replaced, pushing up operating costs, which could subsequently be passed onto the consumer. - Oxford Business Group