Trade surplus in 1Q18 rose to KD 3.4 billion

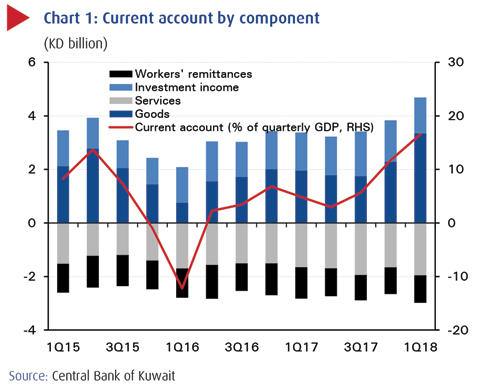

KUWAIT: Kuwait's current account registered its highest surplus in three years in 1Q18 at KD 1.7 billion (17 percent of quarterly GDP), up from KD 1.2 billion in 4Q17. A rise in the trade surplus, supported by higher oil prices, more than offset a widening services deficit, lower investment income, and higher remittances.

KUWAIT: Kuwait's current account registered its highest surplus in three years in 1Q18 at KD 1.7 billion (17 percent of quarterly GDP), up from KD 1.2 billion in 4Q17. A rise in the trade surplus, supported by higher oil prices, more than offset a widening services deficit, lower investment income, and higher remittances.

The trade surplus in 1Q18 rose to KD 3.4 billion from KD2.3 billion in 4Q17, lifted primarily by higher oil receipts and non-oil exports, while imports held steady. The price of Kuwait Export Crude averaged $63 per barrel in 1Q18, a 9 percent q/q increase, helping oil receipts add KD 193 million during the quarter despite the OPEC+ production cap, to reach KD 4.4 billion. Higher petrochemical prices, which move closely with oil prices, and strong demand from Asia also helped support non-oil exports.

Goods imports were little changed on the quarter, with modest growth relative to last year (+4 percent y/y), but still hinting at healthy domestic demand. Implementation of government development projects and the improving business environment kept the import of intermediate goods robust. Meanwhile, stronger consumer spending was reflected in higher vehicle and food imports.

The deficit in the services balance widened to KD 1.9 billion against a backdrop of improving economic prospects. An expansionary fiscal plan, in addition to higher oil prices, helped support domestic confidence. Growth in travel services was also robust, while the ongoing execution of development projects (infrastructure and administrative) fed into higher demand for construction and governmental services. Investment income eased for a second consecutive quarter, weighed down by a wobbly global equity market. 1Q18 witnessed higher financial volatility that negatively impacted the return on foreign financial holdings by domestic investors.

Remittances, on the other hand, increased following two quarters of declines, topping once again KD 1 billion, as the effect of fuel subsidy cuts and various fee increases on income seem to have faded. Growing uncertainty over the outlook of expat employment and living costs, in light of intensified Kuwaitization efforts and a proposed tax on remittance outflows, which never materialized, may have also contributed to the increase in outflows.

Meanwhile, the financial account deficit eased to KD 1.4 billion in 1Q18, from KD 4 billion in 4Q17. Large net portfolio outflows were slightly offset by a positive FDI balance due to divestments by residents from controlling interests abroad. Other investment outflows, however, were minimal in 1Q18, after totaling KD 1.7 billion the previous quarter, as a significant repatriation of currency and deposits by the government (KD 1.1 billion) had offset outflows used for foreign asset accumulation and the settlement of foreign debt by local corporates.

NBK ECONOMIC REPORT