Labor market presents a more mixed picture

KUWAIT: Consumer spending growth continued to moderate in 1Q19 amid an easing in consumer confidence, modest wage growth and pressure on expatriate numbers. While some of these factors will persist this year, we look for other factors - including low inflation, solid employment growth, an expansionary government budget and easing central bank consumer lending regulations - to help maintain spending growth at a reasonable level.

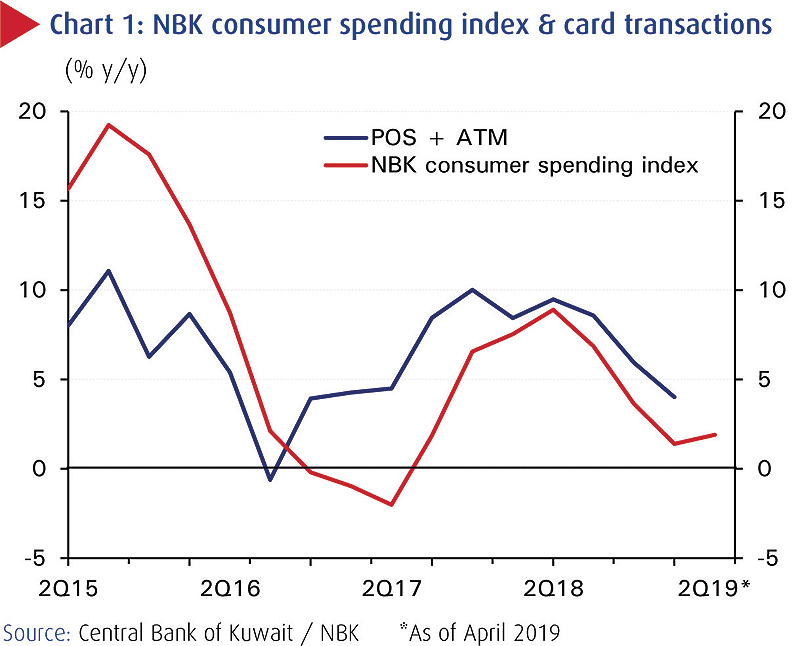

Key indicators of consumer activity eased in 1Q19. Growth in official point-of-sale (POS) transactions and ATM withdrawals slowed to 4 percent y/y in 1Q19 from 6 percent in 4Q18, continuing the softening trend that started in the middle of last year. Growth in the NBK consumer spending index (CSI) has followed a similar path, averaging just 1.4 percent in Q1. Encouragingly however, monthly CSI figures for April show a pick-up in growth to 1.9 percent y/y reflecting a strong month-on-month increase. This could be a sign that the spending slowdown has bottomed out, perhaps as a result of the recent sharp rise in consumer borrowing.

The easing in spending in Q1 was mirrored by a fall in consumer confidence. Ara's consumer confidence index fell to 103 in 1Q19, well below the 12-month average. While lower oil prices and news headlines of a softening global economy may have been a factor, index weakness was led by the 'current employment' subcomponent (possibly linked to news of plans to cut expat numbers), while the 'purchase of durable goods' component was also weak.

A key cause for optimism on the spending outlook is the recent rise in lending. Consumer loan growth climbed to a five-year high of 7.8 percent y/y from 3.9 percent in February. After years of softness, consumer lending has risen strongly in each month since December, coinciding with the loosening of consumer loan limits (to KD 25 000 from KD 15 000 previously) by the Central Bank of Kuwait. The pickup in consumer borrowing will most likely show up in higher spending in the coming months due to lag effects.

In spite of the surge in consumer credit, growth in household debt overall - which includes loans for house purchase - has continued to gradually ease, at 5.6 percent y/y in March. Consumer loans account for less than 10 percent of all household debt, so the latest strength does not imply a large impact on the total household debt burden, or a squeeze on spending potential.

Labor market

The improving jobs picture is also offering some support to consumers. Employment growth recovered in 2018 (end-year), rising to 4.2 percent y/y from a multi-year low of 2.4 percent in 2017, on improvements in hiring of both Kuwaitis and expats. Strong hiring by the public sector saw jobs growth for Kuwaiti nationals reach a high 3.7 percent in 2018, and expat hiring rose by a two-year high of 4.3 percent. However the composition of expat jobs growth may be less favorable than the headline figures suggest: much of it is stemming from the construction sector, where Kuwaitization targets are low and there is a high share of low-skilled laborers. If gains are largely in low-paid jobs, any boost to consumer spending might be limited.

Continued softness in wage growth is also likely to weigh on spending. Growth in the average wage for Kuwaitis enrolled in state pension plans improved slightly but remained weak at 0.2 percent y/y in 4Q18 from -0.6 percent in Q3. Indeed after accounting for inflation, real wage growth was flat in 4Q18, having declined for most of the past two years. However soft wage growth may be partly due to a rising number of new entrants, who typically earn relatively low wages and may therefore be pulling the average wage lower.

Finally, while employment growth for expatriates is broadly favorable, overall population trends are less so thanks to a drop in the number of non-working expats, i.e. dependents. The overall expat population grew 2.8 percent in 2018, less than the growth in employment, due to a 1.3 percent decline in the number of dependents. The drop comes amid increases in certain charges such as health insurance and school fees, previous subsidy cuts, and also some political pressure to limit expat numbers. A drop in dependents would add further downward pressure on consumption.