Click to view larger

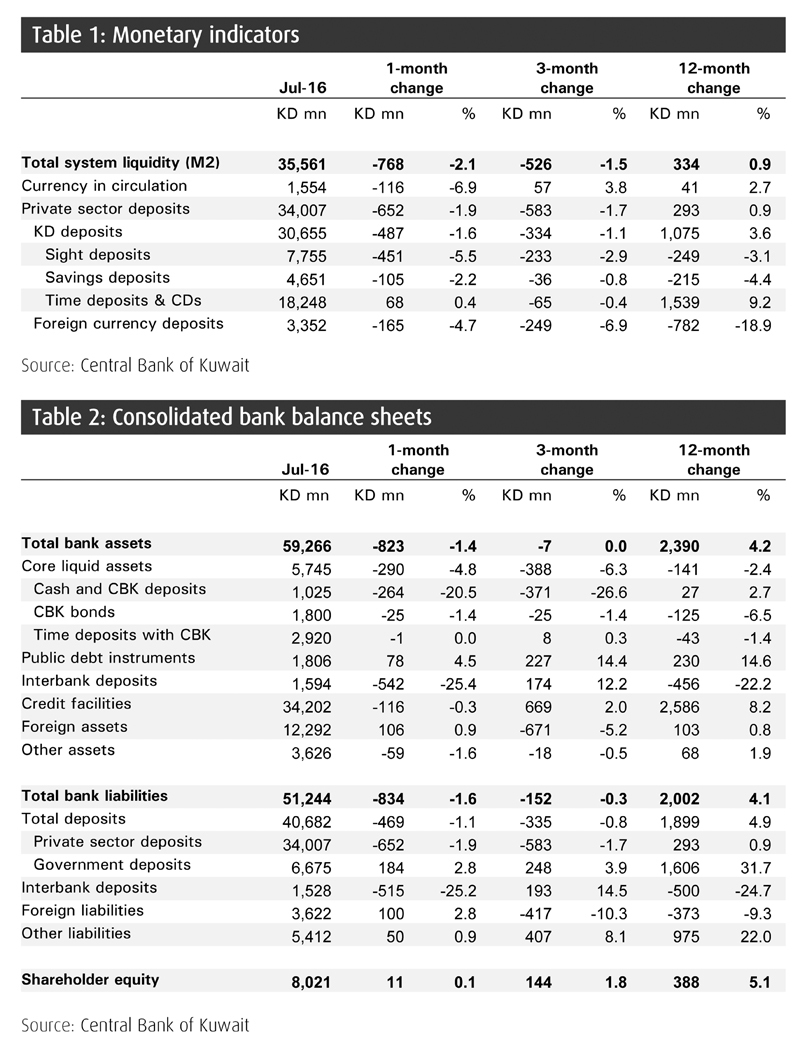

Click to view largerKUWAIT: July saw a drop in credit, though growth maintained an improved pace of 8.2 percent year-on-year (y/y) during the month. Total credit declined by KD 116 million, largely on a decrease in lending for the purchase of securities and the real estate sector. Meanwhile, private deposits saw a large decrease during the month, some of which was offset by gains in government deposits. Domestic interest rates eased slightly in July.

Growth in household lending remained relatively subdued in July, adding KD 55 million. Growth moderated to 9.8 percent y/y, its slowest pace since December 2011. Installment loans continued to largely support the expansion in credit, albeit at a reduced pace, with growth edging lower to 11.7 percent y/y. Shorter-tenor consumer loans registered another small monthly decline and were down by 2.3 percent y/y. Nonbank financial companies saw a net decline in credit, but maintained positive growth compared to a year before. Sector debt shrank by KD 62 million in July, though growth picked up to 3.9 percent y/y thanks to net gains in lending during recent months and an apparent end to a period of deleveraging in the sector since the financial crisis.

Private deposits fall

All remaining credit declined by KD 109 million, though growth held up at 7.6 percent y/y thanks to basis effects. A large part of the July decline was from lending for the purchase of securities, which fell by KD 273 million; another KD 71 million drop came from lending to the real estate sector. Most other sectors did relatively well, including oil & gas, construction, and trade, adding a combined KD 241 million. Indeed, credit growth excluding lending for the purchase of securities and real estate picked up to 13.2 percent y/y.

Private deposits saw a large drop in July. Their decline by KD 652 million pushed growth in broad M2 money supply down to 0.9 percent y/y; growth in narrower M1 money supply recorded a 2.2 percent y/y decline (Chart 3). The largest decline came from KD sight deposits, down KD 451 million, though savings and foreign currency deposits were also lower. Meanwhile, KD time deposits managed to increase by KD 68 million, recording the strongest growth of 9.2 percent y/y.

An increase in government deposits helped offset some of the decline in private deposits. The KD 184 million increase helped push growth in government deposits to 32 percent y/y. Their rise over the last twelve months totaled KD 1.6 billion.

Banking liquidity

Banking system liquidity decreased in July, but maintained a healthy level. Bank reserves (i.e. cash, deposits with the CBK and CBK bonds) contracted by KD 290 million to KD 5.7 billion, or 9.7 percent of total bank assets. The decrease was predominantly in CBK deposits and coincided with a KD 896 million drawdown in CBK foreign reserves, which decreased to KD 8.1 billion.

Interest rates held relatively steady in July. The 3-month Kuwait interbank offered rate (Kibor) dropped 1 basis point (bp) to 1.51 percent in July. Rates have since been relatively steady (Chart 5), with the 3-month Kibor at 1.56 percent in early October. Customer deposit rates also appeared to ease, seeing drops of 1-2 bps across some of the various maturities.