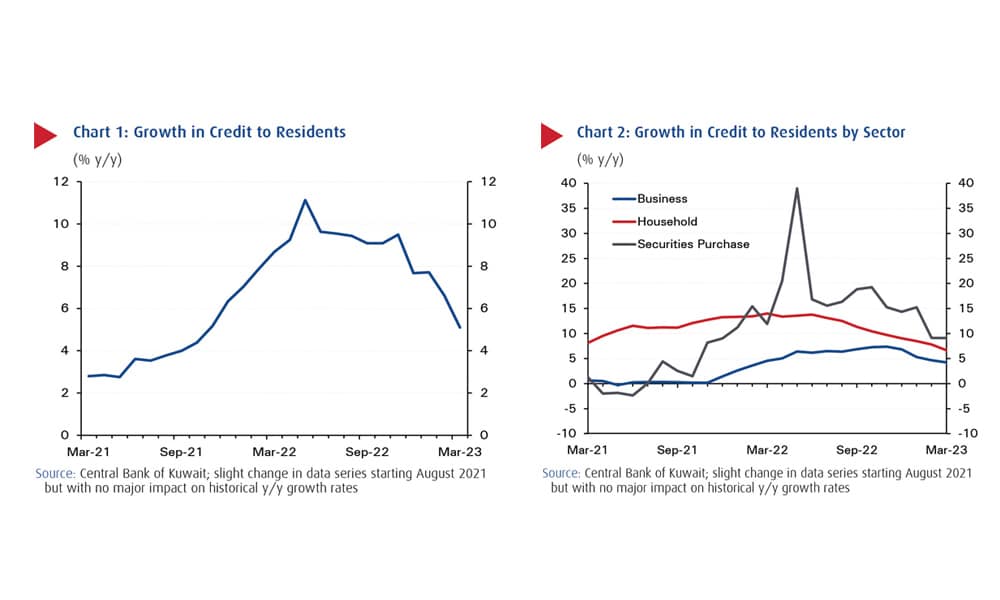

KUWAIT: Domestic credit started the year on a relatively weak note, increasing by 0.6 percent q/q in Q1 2023, cutting the y/y increase to 5.1 percent through March. Higher interest rates, banks’ lower price competition in terms of retail lending, and normalizing growth following a very strong 2022 are some of the factors behind the softening growth so far this year.

Business credit increased by 1.2 percent q/q, cutting the y/y increase to 4.2 percent through March. This follows a strong 6.8 percent growth in 2022, the fastest annual expansion since 2013. Growth of the various sectors differed markedly with the particularly interest rate-sensitive real estate, in addition to oil/gas, being broadly flat in Q1 2023.

On the other hand, industry, construction and other services recorded decent growth of around 3 percent q/q. Excluding real estate and oil/gas, business credit would have increased by 2.3 percent q/q (+8 percent y/y). Looking ahead, business credit dynamics may remain as seen so far this year, especially given the weaker oil price. In contrast, a more optimistic scenario could unfold driven by the major improvement in project awards so far this year, the end (or close to) of the rate-hiking cycle giving corporates more visibility on their borrowing costs, and a stronger appetite by banks to grow business credit given weak household credit demand.

Household credit was flat in Q1 2023 (weakest quarter since the start of the pandemic in Q1 2020), dropping the y/y increase to 6.7 percent. Higher interest rates, easing price competition among the banks given the higher cost of funds, softening consumer spending growth, and lower real estate sales are all factors that have contributed to this major slowdown in household lending. Another factor is the normalizing growth after two very strong years, which saw household credit expand by 23 percent between December 2020 and December 2022.

Finally, relatively weak lending for securities purchase and lending to banks/financial institutions also contributed to the lackluster credit growth in Q1 2023. The former increased by 1.6 percent in Q1 2023, less than half the average quarterly increase recorded in 2022 while the latter fell by 1.9 percent q/q.

Meanwhile, resident deposit trends were stronger than the credit ones with deposits up 1.4 percent q/q (+3.4 percent y/y). Private-sector deposits were particularly resilient, growing by 2.2 percent q/q (+6.5 percent y/y), government deposits continued to inch up (+3 percent q/q), while public-institution deposits remained on a downtrend (-3.9 percent q/q, -12.2 percent y/y). By the end of March 2023, out of total resident deposits (KD 47.6 billion) private-sector deposits accounted for 79 percent, public-institution deposits 14 percent, and government deposits 7 percent.

In line with expectations, among KD private-sector deposits, time deposits continued to increase at a much faster rate than current and saving accounts (CASA). In fact, CASA dropped for the third straight quarter, falling by 9.1 percent (KD 1.7 billion) between June 2022 and March 2023, while time deposits soared by 4.9 percent q/q, the fifth straight quarter of solid growth. By the end of March 2023, among private-sector deposits, CASA accounted for 44 percent of the total, time deposits 51 percent, and foreign-currency deposits 5 percent. This compares to 51 percent, 44 percent, and 5 percent, respectively, in March 2022, when policy interest rates, globally and domestically, started increasing. Looking ahead, given that the rate-hiking cycle is close to its end, if not ended already, it is reasonable to expect that the discrepancy between the growth in time deposits and CASA will start to narrow.

The Central Bank of Kuwait (CBK) has hiked the discount rate by a cumulative 2.5 percent since March 2022, half the cumulative 5 percent increase by the US Federal Reserve (Fed). However, the rate-hiking cycle in the US has either ended or is very close to ending. And while the Fed has repeatedly indicated that there will be no rate cuts in 2023, the futures market continues to reflect cuts commencing in the second half of the year. Whether rate cuts in the US will materialize or not, the big picture for Kuwait is that the rate-hiking cycle is also very close to its end.