July sees a net decline of KD 143 million in credit

KUWAIT: Credit was down in July, with growth slowing slightly to 3.5 percent year-on-year (y/y). The month saw a net decline of KD 143 million in credit. Most of the weakness in July was from the regular start-of-quarter drop in securities lending, though there was also some softness in other business sectors. By contrast, lending to the real estate sector and households was robust. Private deposits were down, while rates climbed.

KUWAIT: Credit was down in July, with growth slowing slightly to 3.5 percent year-on-year (y/y). The month saw a net decline of KD 143 million in credit. Most of the weakness in July was from the regular start-of-quarter drop in securities lending, though there was also some softness in other business sectors. By contrast, lending to the real estate sector and households was robust. Private deposits were down, while rates climbed.

Household lending was strong in July, with growth accelerating to 7.2 percent y/y. Personal facilities excluding securities lending added a net KD 119 million during the month, though this followed a flat month. The gains continued to come from installment loans, while consumer loans were off, contracting by 5.3 percent y/y.

Business credit (excluding nonbanks) dropped by KD 281 million, with growth falling to 1.8 percent y/y. The largest decline was in lending for the purchase of securities, which dropped by KD 211 million; this followed a similar increase the month before, part of a regular quarterly pattern. But there was also weakness elsewhere. The construction and oil and gas sectors saw noticeable declines, with the former contracting by 5.7 percent y/y. Most other sectors were flattish. As a result, growth in "productive" business sectors (excluding real estate and securities lending), which had been quite strong, slowed to 4.4 percent y/y, though this is also due to some base effects.

Meanwhile, real estate sector credit continued to recover in July. The sector, which had seen its borrowing contract by 3.6 percent during 2016, has recorded positive credit growth thus far in 2017. Year-to-date, lending to the sector has grown by an annualized 8.1 percent. The July gain, at KD 109 million, was the largest monthly gain thus far this year. This coincides with some stabilization in the real estate market.

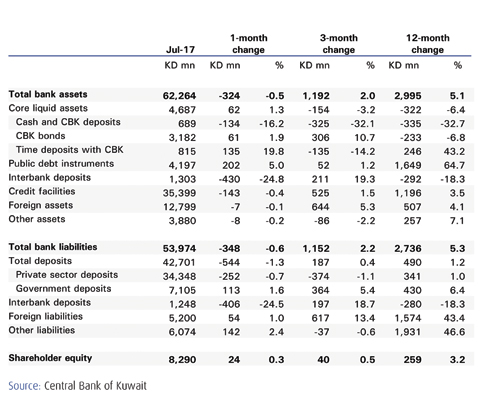

Private deposits declined in July, though once again this was partially offset by a rise in government deposits. Private deposits fell by KD 252 million, most of it from a decline in foreign currency deposits. KD sight and savings deposits were also down, though gains in KD time deposits offset some of that. Money supply (M2) growth benefited from some base effects but remained subdued at 1.2 percent y/y. M1 growth was stronger at 7.1 percent y/y. Government deposits rose by KD 113 million, but growth slowed nonetheless to 6.4 percent y/y due to base effects.

The banking system's liquid reserves, or "excess liquidity", was steady in July at 7.5 percent of bank assets. Bank reserves (cash, deposits with the CBK, and CBK bonds) increased by KD 62 million to KD 4.7 billion. This coincided with KD 200 million in net issuance of public debt. This increased outstanding domestic public debt instruments (PDIs) to KD 4.17 billion, or an estimated 11 percent of GDP.

Domestic interest rates rose in July in line with June's increase of the overnight repo rate by 25 basis points. The 3-month interbank rate was up 9 basis points in July; rates have been mostly steady since. Customer deposit rates also moved up by 7-16 bps during the month. They are now up by 36-48 bps since December 2016.

NBK ECONOMIC REPORT