Foreign investment income reaches KD 6.4bn

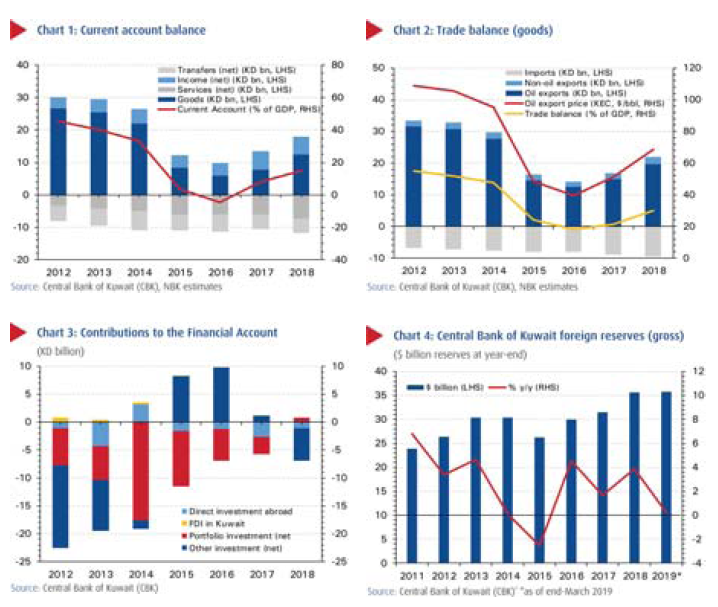

KUWAIT: Kuwait's current account (CA) continued to strengthen in 2018, recording a surplus for the second consecutive year since 2016, when the country posted its first deficit (-4.6 percent of GDP) in more than twenty five years. The current account surplus in 2018 increased to KD 6.2 billion (14.8 percent of GDP), more than double 2017's figure of KD 2.9 billion (8 percent of GDP).

This was primarily due to higher oil export revenues (KD 19.7 billion; +31 percent y/y)-on the back of a 34 percent increase in the price of Kuwait Export Crude (KEC)-and record foreign investment income, of KD 6.4 billion ($21.3 billion). The latter is mainly a reflection of higher returns on the overseas investments of the Kuwait Investment Authority (KIA), the country's sovereign wealth fund.

Kuwait's trade balance, the difference between exports and imports of goods, reached KD 12.4 billion (29.8 percent of GDP), the highest since 2014. Movements in the trade balance are largely a function of movements in the oil price, given that oil exports account for almost 91 percent of total exports.

The increase in oil export revenues last year mirrored the increase in oil prices, roughly around 30 percent. The combined volume of crude and refined product exports actually declined 0.3 percent on an annual average basis, from 2.65 mb/d in 2017 to 2.64 mb/d in 2018. This was mainly due to lower refined products exports rather than crude, and most likely a result of the decommissioning of the 200 kb/d Mina Shuaba refinery in 2017. Oil exports as a share of GDP reached 47.6 percent in 2018.

Non-oil export revenues increased in 2018 by 22 percent, albeit from a small base to KD2.1 billion. These exports are mainly chemicals and machinery equipment. But non-oil exports as a share of total exports have actually declined, falling over three consecutive years to 9 percent in 2018 from 10.2 percent in 2015. This is still quite high by historic standards though.

Imports, meanwhile, continued their steady increase, rising by 5.7 percent in 2018 to KD 9.4 billion. The last time that imports declined was at the height of the financial crisis in 2009; since then they have been rising at an annual average rate of 6.6 percent.

Foreign assets

The balance on the capital and financial accounts is the mirror of the current account, reflecting movements of capital into and out of the country from overseas. Outflows (debit) from the capital and financial accounts increased for the second year in a row in 2018, reaching KD 7.4 billion from KD 5.4 billion in 2017 when Kuwait resumed its historical net creditor status. In contrast, in 2016, the combined capital and financial account recorded a net surplus (or inflow), of KD 1.9 billion, for the first time in over twenty years; the government, facing a current account (and fiscal account) deficit caused by low oil prices, liquidated some of its overseas assets to finance the budget and restore liquidity.

After peaking in 2011 at KD 899 million, foreign direct investment in Kuwait (FDI) has been declining. FDI inflows reached KD 104 million in 2018 (0.3 percent of GDP), which is the second lowest level in ten years. Kuwait's FDI continues to lag its regional peers. However, net portfolio investment turned positive in 2018, reaching KD 726 million, as Kuwaiti residents sold their foreign bond holdings and as foreign investors bought Kuwaiti bonds and equities, the latter stimulated by the country's inclusion in the FTSE Russell Emerging Markets Index.

Central bank reserves rise

With Kuwait's current account and broad balance of payments surplus increasing, the Central Bank of Kuwait's gross international reserves continue to accumulate, reaching $38.5 billion (KD 10.8 billion; 26.2 percent of GDP), or 6.8 months of imports at end-March 2019. Of course, these figures do not take into account the foreign investment assets of the KIA, which are estimated at around $548 billion.