KUWAIT: Kuwait’s economy is expected to slow down in 2023, after performing strongly in 2022, and stabilize over the medium term. The projected economic slowdown is driven by the sluggish global economic activity and OPEC+ cautious production schedule, according to a report by World Bank. Softer energy prices will narrow fiscal surpluses and raise deficit concerns in the medium term. Generous subsidies, tight monetary policy, and falling import prices will keep inflation subdued. Downside risks to the outlook include global oil price volatility, a stronger-than-anticipated global economic slowdown, and continued political deadlock over key reforms, the report said.

Key conditions and challenges Kuwait’s long-term economic challenges are linked to its dependency on oil, domestic consumption as key driver for growth, and slow implementation of its diversification agenda. Nonetheless, sizable foreign assets held through Kuwait’s sovereign wealth fund (KIA), one of the largest globally, continue to underpin the country’s economic resilience. These assets, however, cannot mitigate the risk of low future oil demand. Such risk has to be addressed through deep fiscal and structural reforms. Progress on the diversification agenda has been slow to a large extent, due to the political deadlock and repeated resignations of government which is hindering economic reform implementation, the report said.

The projected elevated oil prices in the medium term could still play a key role in financing economic transformation and promoting sustainable, inclusive, and green growth. Key short- and medium-term risks include the potential impact from a deeper than-expected global economic slowdown, oil price volatility, delay in fiscal and structural reforms, and labor shortages. These could hamper growth in both the oil and non-oil sectors as well as have a significant impact on macroeconomic balances. Direct adverse economic spillovers from the Russian invasion of Ukraine have been contained in Kuwait due to limited financial linkages and trade flow between both countries.

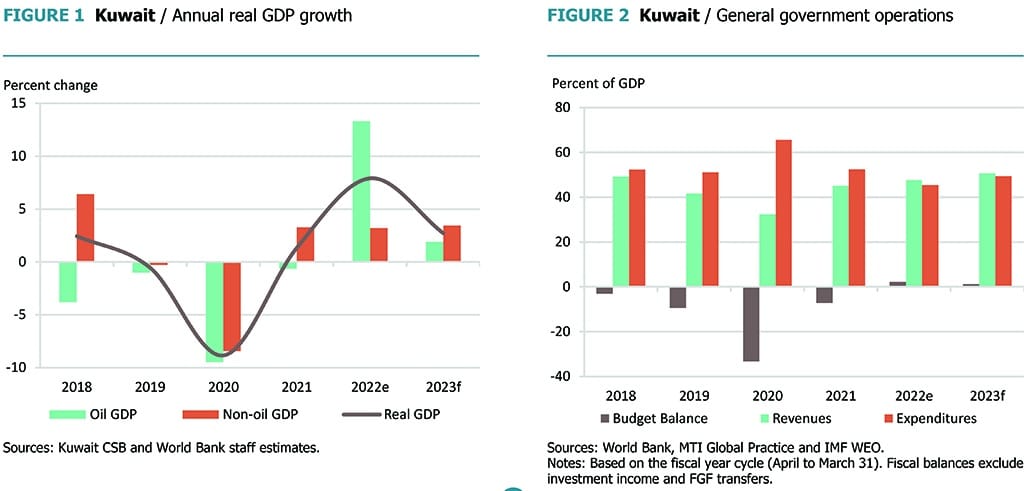

Recent developments Economic growth rebounded sharply in 2022, reaching 7.9 percent year-on-year, driven by the strong performance of the oil sector which grew by 13.3 percent. However, signs of a slowing oil sector are evident since November 2022 and reflect OPEC+’s latest agreement on cutting production quotas. The non-oil sector continued its recovery trajectory in 2022, growing by 3.2 percent, supported by high oil prices, strengthening consumer spending, increased government spending, and restoration of projects suspended by the pandemic. Private sector credit grew by 7.7 percent in 2022 — the fastest rate during the past 7 years — driven by the real estate, construction, and services sectors.

Monetary policy tightening as well as government subsidies on food and energy helped to contain the level of inflation, which averaged around 4 percent in 2022. Supported by higher oil production and prices, the fiscal surplus is estimated at 2.2 percent of GDP during 2022. In November 2022, the National Assembly passed the 2022-23 General Budget with an estimated fiscal deficit of KD 123.8 million (0.2 percent of GDP) based on an oil price assumption of $80 per barrel and an average oil production level of 2.7 million barrels/day. The government continues to implement measures to enhance Kuwait’s public financial management (PFM) including financial technology improvement, digitalization, and green energy investment.

The banking sector continues to be well capitalized and liquid. Financial soundness indicators remain strong with nonperforming loans estimated to reach 1.9 percent of total gross loans. Following tighter global financial conditions, the Central Bank of Kuwait raised policy rates from 1.6 to 4 percent (7 times) since March 2022, with the most recent hike in February 2023. Official reserve assets continue to stay at their comfortable levels, reaching KD 14.8 billion (18 months of imports) in 2022. The strong currency peg and higher oil receipts widened the current account surplus considerably during 2022, reaching 26.3 percent of GDP.

Kuwait’s labor market continues to recover from the impact of the pandemic, although many indicators have not yet rebounded to their pre-pandemic levels. The labor force participation rate is projected to increase slightly to 71.7 percent in 2023 (ILO) but remains about 1.3 percentage points lower than in 2019. Unemployment rates are expected to remain relatively steady in 2023 at 1.2 percent among men and 6.4 percent among women, still higher than the 2019 rates by 0.2 and 0.5 percentage points, respectively.

The shares of youth not in employment, education or training for 2022 suggest a faster post-pandemic recovery, as they are now estimated at 18.1 percent among men and 34.7 percent among women (below pre-pandemic shares by 0.6 and 0.8 percentage points, respectively). Economic growth is expected to slow to 2.7 percent in 2023 in response to a more cautious OPEC+ production approach and sluggish global economic activity. However, the newly established Al-Zour refinery will support growth in the oil sector which is expected to reach 1.9 percent in 2023. Based on the recent trend, political uncertainty is projected to remain elevated and cause delays in deciding and implementing new infrastructure projects as well as in pushing the reform agenda forward.

Kuwait’s non-oil sector is anticipated to grow by 3.4 and 3.7 percent in 2023 and 2024, respectively; driven primarily by private consumption. Meanwhile, tighter monetary policy and declining global commodity prices will translate into lower inflation rates (to 2.6 percent in 2023, and 2.5 percent in the following two years). Lower projected oil prices during 2023 will narrow the fiscal surplus to 1.3 percent of GDP — excluding investment income and FGF transfers. Softer projected oil prices will narrow fiscal balance surpluses and raise deficit concerns in the medium term.

Implementing the economic diversification program and introducing the VAT, in line with other GCC peers, would enable Kuwait to diversify its revenues and enhance fiscal sustainability. Monetary policy is projected to continue to closely follow the US Federal Reserve policy as the US dollar is the dominant currency in the Kuwaiti dinar pegged basket. Despite possible further monetary policy tightening, domestic credit is expected to continue growing but at a slower pace. Strong oil receipts and cheaper import prices should keep the current account surplus at comfortable levels during 2023 (21.9 percent of GDP) before moderating to an average of 20 percent of GDP in the medium term, the report added.