Recovery in consumer sector gained pace

KUWAIT: The non-oil economy improved in 2017, with growth exceeding expectations. The rebound has come from project spending and a recovering consumer sector. Data thus far in 2018 continued to indicate that the recovery in consumer activity is robust. Meanwhile, the solid US economy saw the Fed raise interest rates again in March, with the Central Bank of Kuwait deciding to do the same to keep interest rates margins narrow and to maintain the stability of the currency.

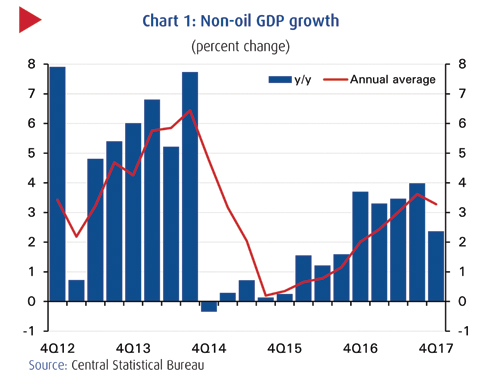

Non-oil GDP

The non-oil economy grew by 3.3 percent in 2017, up from 2 percent the year before and slightly stronger than our 3 percent forecast. The pace of growth slowed slightly in 4Q17 to 2.4 percent y/y, but overall the economy has continued to recover from the sharp slowdown in late-2014 and 2015. We expect this trend to continue in 2018 and 2019, with non-oil growth seen accelerating to 3.5 percent and 4 percent, respectively.

However, lower oil output saw total GDP shrink by 2.9 percent in real terms during 2017. Oil output was down 8 percent due to crude oil production cuts implemented by OPEC and its non-OPEC partners, a policy which helped reduce the imbalance in the international oil market and shore up the price of oil. Indeed, the recovery in oil prices over the last year helped increase nominal GDP in the oil sector by over 20 percent in 2017.

Project spending

Much of the boost to non-oil activity has come from a continued commitment to capital spending by the government, even as other countries in the region canceled planned projects or put them on hold. In March, the government re-iterated this commitment at this year's Kuwait Investment Forum with its ambitious plan to develop the northern region. With the aim of diversifying the economy away from oil and bolstering national security, the plan promises to generate 200,000 jobs for Kuwaitis. This project will boost income and spending, providing an impetus to credit and economic growth over the medium term.

Recovery in the consumer sector

The health of the consumer sector has been no less important to the recovery in the non-oil economy. Recent data has further confirmed the improving trend in the sector. The Ara consumer confidence index rose to 113 in March, up 15 percent y/y. This improvement in confidence has been felt most noticeably in consumers' view of the current economic conditions and employment opportunities, which reflect also the relative recovery in the price of oil.

Real estate buoyant

Real estate activity was up in February, though prices appeared to soften. Sales during the month stood at KD 189 million, up by 22 percent y/y. The strength came from the residential (26 percent y/y) and investment (46 percent y/y) sectors, while commercial sales remained weak. Prices in all sectors were softer in February, though residential land and home prices were within their 12-month ranges. The exception was the index of investment prices, which slipped to its lowest level in more than four years. This may reflect oversupply in the investment market (rental units) and lower demand stemming mainly from reduced growth among expatriates.

Business credit activity

Bank credit growth eased for the fifth consecutive month in February, with growth slowing to 2.5 percent, but credit to households and businesses showed some improvement. Business credit activity was encouraging, with its first gain in six months stemming mostly from core business activities such as trade and industry. These gains were partially offset by the drop in credit to non-bank financials and credit for the purchase of securities, with total outstanding credit posting an increase of KD 40 million.

CBK raises interest rates

To avoid a further widening of the spread between USD and dinar interest rates, the Central Bank of Kuwait (CBK) increased its policy rate in March following a similar move by the US Federal Reserve. An improving US economy no doubt further bolstered that decision. The CBK discount rate was increased by 25 basis points to 3 percent, after keeping rates unchanged following the two previous Fed hikes. The spread between dinar and USD rates has narrowed significantly over the last year, which required a hike to maintain the relative stability of the KD.

Banks adjusted their rates accordingly. This rate increase has not had any negative impact on lending and we do not expect it to lead to a drop in borrowing in the near future. For consumer lending, the increase is too small to make a dent. As for corporates, the interest rate is not the only factor affecting demand for credit, which still benefits from attractive expected rates of return on investment. Meanwhile, the increase in interest rates should boost bank deposits.

Budget deficit narrows

Higher oil prices have continued to support the fiscal position. The average price of Kuwait export crude stabilized at $62 in March, but remained 25 percent higher than a year ago. As a result, the fiscal deficit narrowed to KD 2.5 billion for FY17/18 to-date in February, to an annualized 7.3 percent of GDP. We think FY17/18 will close with a deficit of around 10 percent of GDP, well below the 17 percent projected in the official budget. The deficit is expected to remain broadly stable in the following two fiscal years at around 9 percent of GDP. If the price of oil remains close to its current level, government borrowing needs will be reduced and so will the need to draw down on the General Reserve Fund.

CA deficit turns to surplus

Improving oil prices also helped boost Kuwait's current account in 2017. The current surplus more than doubled to KD 1.1 billion in 4Q17 from the prior period, increasing the full 2017 balance to a surplus of 6.3 percent of GDP compared to a 4.5 percent deficit in 2016. The improvement is owed largely to a 19 percent increase in oil receipts during the year, though 8 percent growth in investment income and a 9 percent decline in worker remittances also supported the current account. At the same time, double-digit growth in imports and the services bill weighed on the balance. The current account is expected to improve further in 2018 but will continue to be weighed by the growth in imports on the back of the economic recovery and growth in consumer demand.

Inflation weakens

Despite an improving economy, inflation has been weakening, mostly on continued softness in housing inflation. Inflation eased to 0.8 percent y/y in February, from 1.0 percent in January and an average of 1.5 percent in 2017. The weakness is largely due to deflationary pressures from housing rent and food prices. Healthcare costs also continued to fall, while inflation eased in the transportation, communication, and education segments. The expected increase in demand this year is not likely to have a major impact on inflation given that much of the demand will be channeled through imports unless exchange rates in trade partners' countries appreciate noticeably against the dinar.

Bourse Kuwait

Boursa Kuwait ended the first quarter of 2018 on a healthy note, increasing by 3.6 percent q/q, supported by global trends in equities and by foreign investor interest following the release of a list of the ten most likely companies to be included in FTSE Russell's emerging market index. Kuwait's inclusion in the index is expected to be phased in over two stages in September 2018 and December 2018, with a target country weight of 0.4 percent. Analysts are predicting passive inflows of around $800 million as a result.

The market's capitalization added KD 1 billion over the quarter, with KD 145 million added in March. Despite this, trading activity eased, with the 1Q18 average daily value of shares traded decreasing by 19 percent to KD 12.4 million.

In April, Boursa Kuwait began implementing its new exchange structure, with a one-year phase-in period for some listings. The move is expected to boost the market's liquidity and attractiveness, particularly to foreign investors. Combined with the inclusion of Kuwait in the FTSE Russel index, the changes should provide some upward momentum in the market given the solid economic fundamentals Kuwait enjoys.

NBK ECONOMIC REPORT