Growth to remain above 2% despite crude output cuts

KUWAIT: Kuwait’s economic performance has steadily improved over the past two years, and the outlook for growth remains broadly encouraging. The downgrade to our oil price forecast implies a weakening fiscal outlook, but with the budget now close to balance following a period of successful consolidation and government reserves still very large, we do not expect a major change in fiscal policy that would negatively affect growth.

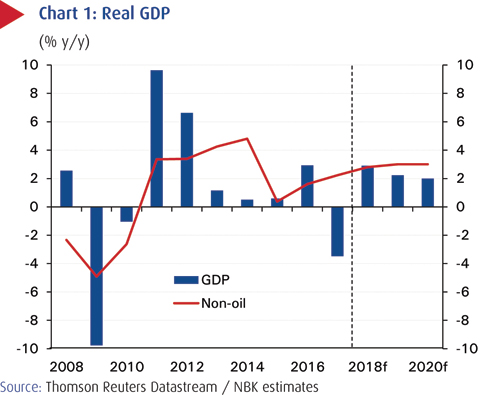

We also look for some pick-up in project activity in 2019, delays in which weighed on growth last year - as did slow credit growth and property market weakness, both of which may now be fading. This should help offset the impact of a weaker external environment and possible rises in interest rates over the next couple of years. After rebounding to an estimated 2.9 percent in 2018 due in particular to recovering oil output, GDP growth is set to ease to 2.2 percent in 2019.

The moderation is entirely due to slower growth in oil GDP reflecting changes in OPEC+ strategy. Although country-level quotas have not been announced, we assume that Kuwait’s crude production falls by around 2 percent in 2019 from its October reference level of 2.76 mb/d, broadly in line with the proposed aggregate cut for the group overall.

However the impact on oil GDP is more than offset by the continued rise in condensate output - not part of the OPEC agreement - which is projected to reach 0.18 mb/d in 2019 from 0.1 mb/d in 2018 (a further smaller rise is projected for 2020). Overall oil GDP therefore rises 1.5 percent in 2019 from 3.0 percent in 2018. Recent news suggests that an agreement may soon be struck with Saudi Arabia to restart production in the Neutral Zone. But any rise would likely be offset by a lowering of output from other mature fields such as Burgan. Over the past two years the non-oil economy has experienced a mild cyclical upswing, but upward pressures are still not very strong.

Non-oil growth is estimated to have risen to 2.8 percent in 2018 from 2.2 percent in 2017, and is forecast at 3.0 percent in 2019. The recovery in consumer spending that helped growth through 2017 may have peaked, though with inflation still low and employment growth steady, prospects remain reasonable. Meanwhile, despite lower oil prices, fiscal policy should remain broadly supportive, with capital spending forecast to continue to rise.

The pick-up in business credit growth recently also suggests that private investment may be recovering, potentially helped by the central bank’s decision to hike interest rates more slowly than the US Fed. In the medium term, however, growth will remain constrained by the slow pace of reforms, a lack of economic diversification and a potential slowdown in global growth.

The most serious challenge facing the government is arguably the employment situation, with the private sector recently accounting for only 15 percent of job growth for Kuwaiti nationals which is, in turn, pressuring the public sector wage bill. In addressing this, the government should focus on the skills mismatch and on measures to improve growth and the business climate, where the latest World Bank report shows that Kuwait continues to lag behind its Gulf peers. Political opposition to the government’s agenda, which includes plans for the introduction of the VAT and excise tax as well as further fuel subsidy cuts and a new debt law, are slowing reforms.

Project awards to rise

A further reason for modest growth in 2018 was a reduced pace of project activity. This has been important in supporting growth in earlier years. Project awards had reached a disappointing KD 1.6 billion by early December 2018, less than half of the KD 4 billion expected at the beginning of the year, and significantly below the average of the last five years. The low level of awards was due to delays in the implementation of megaprojects such as the KAPP Al-Zour North IWPP and the KIPIC petrochemical complex. Further setbacks came from cancelled roadworks that were scheduled to take place in the 1st half of 2018.

Restructuring of relevant government agencies (PART, KAPP) may have been at the root of the delays, among other factors. With pressure increasing from parliament and the State Audit Bureau arising from the setbacks, and given the critical role key projects play in Kuwait’s five-year (FY2015/16-2019/20) development plan and Vision 2035, awards are expected to pick up in 2019.

The bulk of awards is expected to come from the power and water, oil and gas, and construction sectors, and will include rescheduled projects from 2018.

Accelerating consumer spending growth has played an important role in the recovery in the broader economy over the past two years, but there are signs that the improvement may be tapering off. Growth in ATM and POS transactions eased to 8.6 percent y/y in 3Q18, while growth in the NBK consumer spending index slowed to a one-year low of 4.1 percent y/y. However, inflation is low, and other fundamentals, such as employment and credit growth, remain reasonably strong, so any slowdown in spending seems unlikely to be sharp.

Encouragingly, employment growth appears to be gradually picking up, reaching 3.3 percent y/y in 2Q18 from 2.4 percent y/y in 4Q17. The shedding of expatriate jobs in the public sector, down 14 percent y/y in 2Q18 mainly due Kuwaitization initiatives, has been more than offset by stronger growth in the private sector. But for Kuwaiti nationals, much of the rise in employment (around 85 percent) continues to come in the public sector, which will be difficult to sustain longer term.

Another softer spot for the spending outlook is wage growth, which for Kuwaiti nationals (for whom data is available) has been anemic in recent quarters. This could in part reflect the low inflation environment, but also potentially poor productivity growth.

Inflation to pickup in 2019

Inflation has come in even softer than expected in

2H18, and reached a 15-year low of just 0.1 percent y/y in

November. Weakness continues to be driven by deflation

in housing services (mostly rents), where price falls have

intensified this year due to ongoing softness in the real

estate market. Low rates of food price inflation - reflecting

international food price trends - have also been a factor.

But one measure of ‘core’ inflation, which excludes

both of these items, also decelerated to 1.3 percent in

November, half its rate of the end of last year.

We expect inflation to pick up next year to an average

of 2.0 percent from a downwardly-revised 0.6 percent in

- But much of this rise reflects a rise in food and

housing inflation after pronounced weakness in 2018. By

contrast, core inflation will accelerate more modestly, to

2.2 percent from 1.9 percent in 2018, with most of the

factors containing price pressures recently remaining in

place. These include only moderate economic growth, the

strong Kuwaiti dinar (reflecting the partial tie to the

strong US dollar) bearing down on import prices, and the

absence of planned subsidy cuts that pushed inflation

higher in 2016 and 2017. We also do not expect the VAT

to be introduced until 2021 at the earliest, while the

impact of a proposed excise duty on tobacco and selected

drinks would be modest.

Fiscal Position

The past two years have seen a major improvement in the fiscal position, thanks to a combination of higher oil prices and spending restraint. The deficit narrowed to 9 percent of GDP in FY17/18 from nearly 14 percent of GDP a year earlier; this year a further narrowing to just 0.5 percent of GDP is forecast and a balanced budget, which would be the first in four years, cannot be ruled out. Despite a recent fall, oil revenues - worth 90 percent of the total - are projected to rise 27 percent in FY18/19 based upon an average price of Kuwait Export Crude of $68/bbl, before slipping next year as oil prices fall back.

Non-oil revenues are projected to see notable rises due to the resumption in 2018 of UNCC compensation payments. The reduction in the deficit over the past two years has seen the government switch tack and boost spending to support the economy.

After rising 9 percent last year, spending is projected to see another solid rise of 5 percent in FY18/19, boosted by some one-off factors but also higher transfer payments due to rising oil prices. This still leaves spending 6 percent below its FY14/15 peak due to large cuts in the intervening years. Expenditures are projected to fall back slightly in FY19/20 as the drop in oil prices reduces transfer payments and as some of the one-off spending items drop out.

This limits the impact of lower oil revenues on the deficit, which climbs to 1 percent of GDP. Thanks to surpluses accumulated in previous years, the government’s broader financial position remains very strong, with sovereign wealth fund assets estimated at nearly $600 billion. Moreover, annual returns on these assets are worth up to 12 percent of GDP and not included in the headline fiscal accounts. These assets also underpin the government’s very strong AA credit rating, which has been maintained in recent years.

Nevertheless, the government’s room for maneuver on fiscal policy in the near term is slightly more limited than these figures imply. General Reserve Fund assets, which are used to finance deficit shortfalls, had declined to $88 billion at end-FY17/18, and could be depleted in a few years if the oil price weakens and if non-oil revenue-generating reforms are absent. Also, the government is unable to issue any further debt until the new debt law has been passed by parliament.

CBK maintains low interest rates

Monetary policy remains geared towards maintaining the dinar’s peg to a basket of currencies dominated by the US dollar. Unlike some other GCC countries whose currencies are fixed to the dollar, the Central Bank of Kuwait (CBK) left its lending rate on hold at 3.0 percent in December following the 25 bps hike by the US Fed.

The bank has now followed four out of the Fed’s nine rate hikes during the current tightening cycle which began in 2015, though the repo rate, a benchmark for deposits, has risen more frequently. In keeping rates low, the bank is taking advantage of the flexibility provided by the peg to an exchange rate basket to support economic growth while using other monetary policy instruments to ensure the stability of the dinar. The CBK implied that banks can raise their deposit rates without changing lending rates, which are benchmarked to the discount rate. Following a rough start to 2018, credit growth is gradually recovering and reached 2.9 percent y/y in October from a low of 0.8 percent y/y in May.

The improvement has been driven by a pick-up in business lending, helped by the unwinding of base effects (due to repayments in 2017) that have weighed on loan growth in that sector. Household lending has also picked up, and remains comparatively strong at 6.4 percent y/y. We expect credit growth to end 2018 at 4-5 percent y/y and to maintain that pace in 2019, supported by a pick-up in project awards. The CBK’s relaxation of lending restrictions late in 2018 should boost household borrowing in 2019. The current account has recovered after falling into deficit for the first time in modern history in 2016, and is forecast to record a surplus of 15 percent of GDP in 2018. The improvement was due to a 32 percent rise in oil exports driven by higher oil prices (oil receipts account for around 90 percent of all merchandise exports). Data for 1Q-3Q18 show goods imports up 10 percent y/y, boosted by imports of intermediate goods, but imports of capital goods were weak at 2 percent.

In 2019, the surplus is forecast to dip to 10 percent of GDP as the fall in oil prices lowers export revenues, but import growth is expected to remain reasonably solid. We note also that income from investment (mostly government) was worth a huge 16 percent of GDP in 2017, more than double the level of five years earlier. The dinar had, by mid-December, edged lower yearto- date against the US dollar (USD), but risen 5 percent versus the euro and 6 percent against the British pound. These changes reflect movements in the USD, which has appreciated by more than 5 percent on a trade-weighted basis due to a combination of strong US economic growth and rising US interest rates. It also reflects some reversal of USD weakness from 2017, when it had fallen by 8 percent. On a five-year basis, the dinar is still up more than 10 percent against the euro due to the longerterm rise in the dollar.

Stock market sees heightened interest

Boursa Kuwait performed relatively well in 2018 to end-November, supported by improved sentiment linked to continued market development efforts and inclusion in the FTSE Emerging Market index. Despite a drop in monthly trading volumes relative to previous years, 2018 has seen a record KD 177 million of net capital inflows, helping the All Share price index gain 5.8 percent year-to-date - the GCC region’s third best performer. Market capitalization stands at KD 29 billion. While volatile global markets, rising interest rates and the drop in oil prices in 4Q18 may weigh on market sentiment going forward, foreign interest will be helped by the second phase of inclusion in the FTSE EM index, scheduled for late December and also by a possible upgrade by MSCI in 2020 to be announced in June 2019. Moreover, the Ministry of Commerce in December proposed to remove the current 49 percent limit on foreign ownership of banks.

NBK Economic Report