Softer oil prices lead exports lower

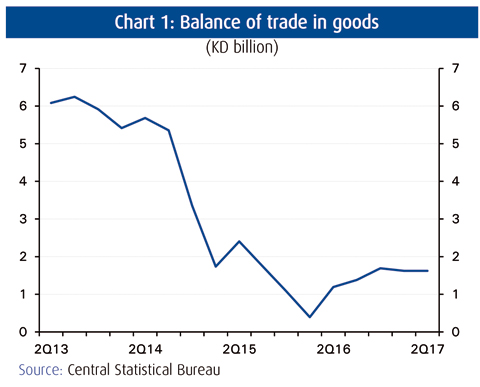

KUWAIT: Kuwait's trade surplus narrowed slightly to KD 1.5 billion in 2Q17, as softer oil prices led oil exports lower. Meanwhile, imports continued to improve after some weakness in 2016, thanks to solid capital goods imports data and some recovery in consumer goods. The surplus is slated to expand in the near- to medium-term, not least because higher oil prices will help prop up oil earnings. The Kuwait export crude price average came in higher in 3Q17 and is expected to continue to rise, especially on the back of a further extension of OPEC-led production cuts.

KUWAIT: Kuwait's trade surplus narrowed slightly to KD 1.5 billion in 2Q17, as softer oil prices led oil exports lower. Meanwhile, imports continued to improve after some weakness in 2016, thanks to solid capital goods imports data and some recovery in consumer goods. The surplus is slated to expand in the near- to medium-term, not least because higher oil prices will help prop up oil earnings. The Kuwait export crude price average came in higher in 3Q17 and is expected to continue to rise, especially on the back of a further extension of OPEC-led production cuts.

Oil export receipts came under pressure in 2Q17, after the price of Kuwait export crude (KEC) fell against a backdrop of steady oil production levels. Oil revenues edged down from KD 3.7 billion in 1Q17 to KD 3.5 billion in 2Q17. The price of KEC was down 7.0 percent quarter-on-quarter (q/q) while oil production remained stable.

Non-oil exports also came in lower in 2Q17 mainly on the back of a slowdown in growth in petrochemical exports. Non-oil export revenues fell by 10 percent q/q in 2Q17. Non-oil exports could fall further in the following quarter amid a drop in ethylene prices.

Imports held firm thanks to solid capital goods data and some recovery in consumer goods. At KD 0.5 billion, capital goods imports remained close to a multi-year high. Industrial supply imports also came in solid. The ongoing strength in these segments can be attributed to the improved implementation of the government development projects. Still, at 3.4 percent year-on-year (y/y) in 2Q17, import growth remains well below the 7.5 percent pace averaged in the four years prior to 2016. Consumer goods imports witnessed their first positive growth rate in a year, on the back of an improving consumer sector. Consumer imports jumped by 5.8 percent y/y in 2Q17, following strong rebounds in imports of food & beverages, passenger cars and transport equipment.

NBK ECONOMIC REPORT