KUWAIT: Qatar's industrials sector leads the top GCC M&A transactions during Q3 2020 as per a report recently issued by the Investment Banking Department at Kuwait Financial Centre "Markaz". Industries Qatar announced they intend to acquire an additional 25 percent stake in Qatar Fertilizer Company (QAFCO) for a total consideration of $1.0 billion.

QAFCO was established in 1969 as a joint venture between the Qatari government and a number of foreign investors with an aim to diversify the economy and utilize the nation's immense gas reserve. Moreover, the company's current shareholding structure is as follows: Industries Qatar (75 percent), Qatar Petroleum (25 percent). Upon the successful completion of this transaction, Industries Qatar would increase its total ownership to 100 percent, becoming the sole owner of QAFCO.

The second largest transaction involves National Petroleum Construction Company (NPCC) and National Marine Dredging Company (NMDC), who are in the midst of evaluating the opportunity to combine their operations upon receiving an offer from General Holding Corporation and other minority shareholders of NPCC. The key terms of the offer states that NPCC shareholders will transfer NPCC to NMDC in exchange of the issuance of an instrument that is convertible into 575.0 million ordinary shares, or 70 percent of NMDC's issued share capital. At a convertible share price of $1.2, the transaction would result in an estimated value of $688.8 million.

Moreover, Raha AlSafi Consortium has been awarded a bid for the First Milling Company, one of four milling companies to be privatized by the Saudi government, for a total consideration of $540.0 million. The consortium is comprised the following parties: Almutlaq Group, Al-Safi Abunayyan Holding and Essa Al-Ghurair Investment Company. The next transaction oversaw Delivery Hero acquire 100 percent of Instashop, a leading online grocery platform, for a total consideration of $360.0 million.

It is worth noting that this value is comprised of two components including a cash payment of $270.0 million and a deferred payment of $90.0 million, which is dependent on meeting certain milestones. Lastly, the UAE's Edge Group announced its intention to acquire a 40 percent stake in Advanced Military Maintenance Repair and Overhaul Center (AMMROC) for a total consideration of $307.0 million. AMMROC offers maintenance, repair & overhaul and support services for fixed and rotary wing military aircraft in the MENA and South Asian regions.

GCC M&A Growth

According to Markaz's report, the number of closed M&A transactions in the GCC during Q3 2020 decreased by 23 percent relative to Q3 2019 however it remained stable relative to Q2 2020. Kuwait, Qatar and the United Arab Emirates each recorded a growth in the number of closed transactions relative to the previous quarter whereas Bahrain and Saudi Arabia each witnessed a decline in the number of transactions that closed throughout this time period. Oman on the other hand did not report any closed transaction throughout the quarter.

Acquirers and targets

A majority of the transactions completed during Q3 2020 and Q2 2020 were carried out by GCC acquirers, accounting for 65 percent of the total number of transactions that closed during Q3 2020, while foreign acquirers accounted for 13 percent. The remaining 22 percent represents transactions for which the buyer information was not available. GCC acquirers also dominated the market during the previous quarter as they accounted for 65 percent of the total number of closed transactions while foreign acquirers accounted for 22 percent. Once again, the remaining 13 percent represents transactions for which the buyer information was not available.

Furthermore, GCC acquirers actively acquired both regional and international companies, whereas in the previous quarter, they primarily invested in the regional market. With that being said, GCC acquirers closed a slightly lower number of transactions relative to Q2 2020. Throughout Q3 2020, GCC acquirers closed a total of nine transactions that involved international companies, which is 31 percent lower in comparison to Q2 2020, which oversaw a total of 13 closed transactions that involved foreign targets.

Moreover, Saudi and UAE buyers each accounted for 30 percent of these transactions, followed by Bahraini, Kuwaiti and Qatari acquirers, who accounted for the remaining transactions. Lastly, Omani acquirers did not close any cross-border transaction throughout the quarter.

Foreign buyers

The GCC market received a slightly weaker level of interest from foreign buyers in Q3 2020 when compared to the previous quarter. Throughout Q3 2020, foreign buyers closed three transactions whereas in Q2 2020, they completed five transactions, which translates into a 40 percent decline quarter-over-quarter and a 67 percent decline year over year. The UAE continued to be the most attractive target out of the regional markets, which is a trend that has persisted throughout the past few quarters. It is worth noting that all closed transactions throughout the quarter purely targeted UAE companies.

Sectorial view

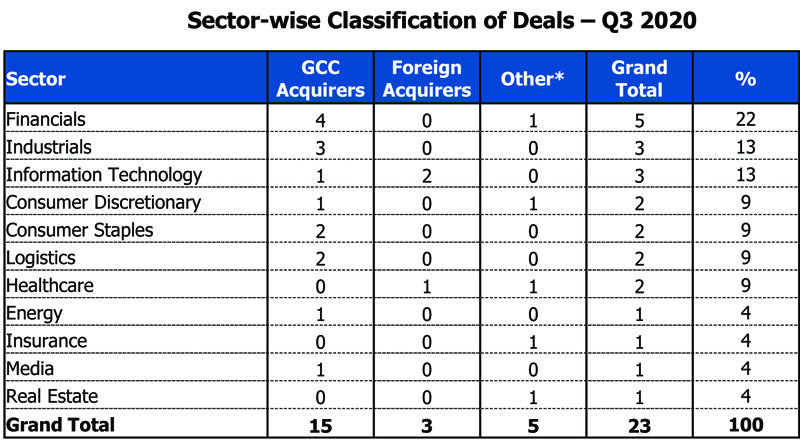

In addition, the closed transactions throughout the quarter spanned across multiple sectors which was also observed in the previous quarter. More importantly, the sectors that witnessed the greatest level of activity throughout Q3 2020 were the Financials, Industrials and IT sectors. Collectively, these three sectors accounted for 48 percent of the total transactions that closed throughout the quarter. The Financials and Industrials sectors were also among the sectors that witnessed the greatest level of activity in Q2 2020.

Deals pipeline

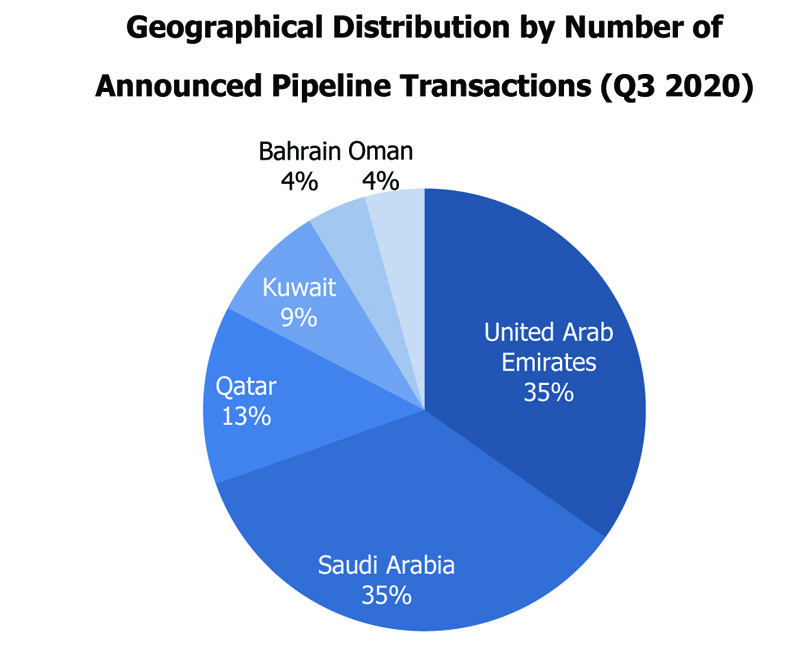

By the end of Q3 2020, there was a total of 23 announced transactions in the pipeline, which is significantly higher relative to Q2 2020. As witnessed last quarter, the majority of these transactions involved Saudi and UAE targets, each of whom accounted for 35 percent of the total number of deals announced. The remaining transactions primarily included Kuwaiti and Qatari targets whereas Bahrain and Oman each announced one transaction throughout the quarter.