Click here to view larger

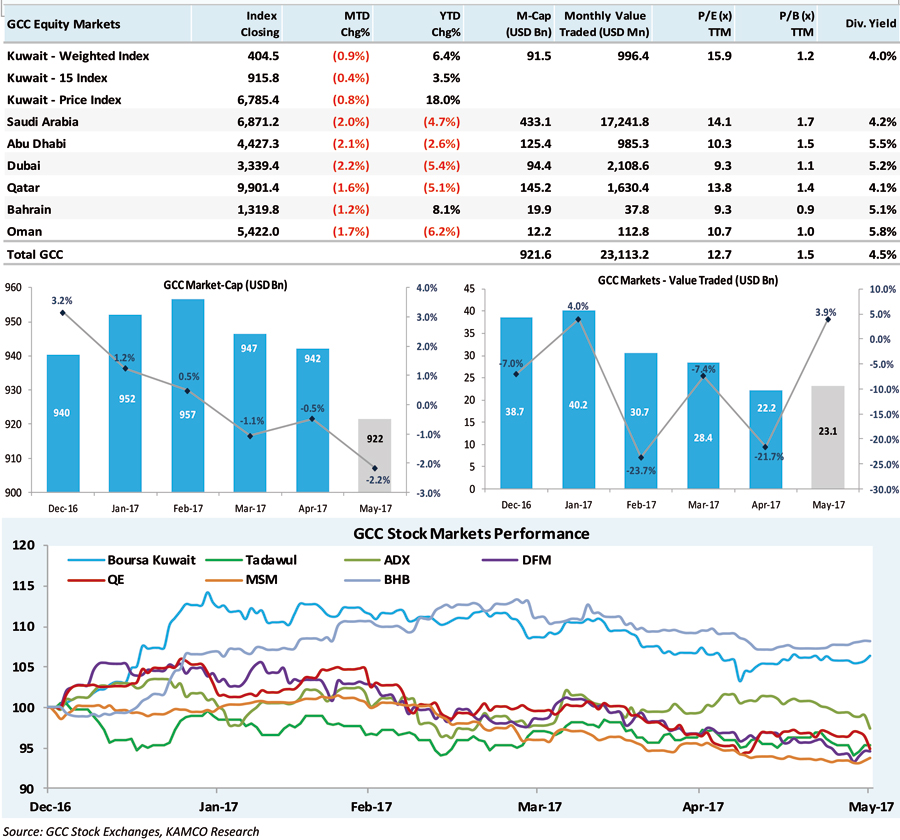

Click here to view largerThe slide in GCC markets continued during May-17 as investors cashed on before the Ramadan season. The decline was broad-based throughout the GCC as seen from the 0.7% decline in the S&P GCC index. Kuwait and Bahrain continue to be the only markets in the GCC with positive YTD-17 returns of 6.4% and 8.1%, respectively. GCC markets also took note of the result of the renewed oil accord. According to the agreement, OPEC and non-OPEC oil producers agreed to extend the combined 1.8 mb/d supply cut by a further nine months until March-18. This was, however, the base case expected by oil watchers as against expectations of larger cuts, which resulted in slide in oil prices. Nevertheless, the recent decline in oil inventories also suggest that the decline in oil price is exaggerated and with gradually rising oil demand, prices are expected to gain stream in the near term.

In a related development, after downgrading China for the first time in nearly 30 years, Moody's downgraded Qatar's long term debt rating by a notch to Aa3 with a Stable outlook highlighting the country's sharply rising external debt. At the same time, the agency upgraded the ratings outlook for UAE and Kuwait based on diversification and strong balance sheet, respectively.

Meanwhile, markets globally had a strong bull run during the month with the S&P 500 reaching new record high on the back of improving economic fundamentals. The MSCI World index also reached a new high after rising almost 2% during the month. Markets are now fully pricing in a rate hike in Fed's June policy meeting while the possibility of a third hike this year is also seeing increasing probability. KAMCO Research expects GCC markets to remain range-bound during June-17, which would see the full impact of the month of Ramadan further factoring in lack of any new catalyst. Trading activity is expected to remain subdued after seeing slight increase during May-17.

Boursa Kuwait

Weak trends in the GCC equity markets didn't spare Kuwait during May-17 as all the three benchmark indices declined. However, the decline in Kuwait was the smallest in the GCC with the price index seeing the smallest decline of 0.8%. The Weighted index also declined by 0.9%, but managed to remain above the 400 points mark to close the month at 404.5 points. The performance of large-cap stocks was relatively better as seen from the 0.4% decline in the Kuwait 15 index.

Within the index, Agility saw the biggest monthly gain of 15.1% followed by Americana at 11.3%. Shares of Agility surged after the company settled a US lawsuit that barred the company from bidding for Middle East US defense contracts. The company agreed to pay USD 95 Mn in cash to settle the civil lawsuit that has now opened doors for potential government and commercial contracts that at one point accounted for almost 40% of the company's revenues. On the other hand, the gain in shares of Americana came after the company reported 10.1% increase in Q1-17 net profits that reached KWD 16.7 Mn, although the company reported a decline in topline.

Trading activity on the exchange continued to slide during May-17, marking the fourth consecutive month of decline and reaching the lowest point in seven months. Total volume of shares traded more than halved to reach 2.7 Bn shares as compared to 5.9 Bn shares during the previous month on the back of almost 60% decline in average daily volumes. Similarly, monthly value traded also declined but at a slightly lower pace of 42% to reach KWD 301 Mn as compared to KWD 517 Mn during April-17.

The average daily value traded declined by almost 50% to KWD 13.1 Mn as compared to KWD 25.9 Mn during the previous month. On the volume chart, Ithmaar Bank was the most actively traded stock with a monthly volume of 182 Mn followed by Alimtiaz Investment and Al Tameer Real Estate at 133 Mn shares and 127 Mn shares, respectively. On the monthly value chart, KFH topped the list with KWD 30 Mn worth of shares traded during the month followed by NBK and Alimtiaz Investment recording KWD 24.5 Mn and KWD 20.5 Mn in trades, respectively.

The monthly gainers chart was topped by Eyas for Higher & Technical Education recording a surge of 80% followed by Al Madar Finance and Alafco with gains of 68% and 22%, respectively. The decliner chart was topped by Al-Mal Investment that fell 26.8% followed by Al Rai Media and MENA Real Estate with declines of 24.7% and 23.4%, respectively. The monthly market breadth was strongly skewed towards decliners that included 107 stocks as against 43 gainers. Meanwhile, against a backdrop of GCC banking sector consolidation, KFH (-2.4%) is reportedly said to be in talks to buy Bahrain's Ahli United Bank along with its Kuwaiti unit to create Middle East's biggest Islamic lender with assets worth USD 85 Bn. The talks are said to be in initial phase with both the parties declining to comment on the issue.

Saudi Arabia (Tadawul)

After managing to stay afloat for the past two months, the Tadawul All Share Index (TASI) fell 2% during May-17 to close below the 7,000 mark at 6,871.2 points. The index reached the lowest point since November-16 after OPEC and non-OPEC members agreed to extend the oil production cut agreement by a further nine months until March-18. The declines comes as the market was expecting higher cuts, which pushed prices to 5-week high level just before the OPEC meeting. The high correlation between oil price and the Saudi market also resulted in an 8% drop in the Energy index during the month.

The sectoral index performance also reflected negative trends with merely six indices reporting marginal gains during the month. The Capital goods index recorded the biggest drop of 13.9% during the month after all the constituent stocks declined. National Industrialization (Tasnee), the biggest stock in the index, witnessed the steepest drop of 18% during the month. The newly introduced REIT index, which now includes four stocks after the listing of Taleem REIT Fund, witnessed the second biggest monthly drop of 11.3% and this comes despite the newly listed REIT fund surging 21% by the end of the month after being heavily oversubscribed.

On the gainers side, the Retailing index topped monthly index gains with a surge of 4.1% on the back of 6% gain in shares of Jarir Marketing and 5.7% gain in shares of Fawaz Abdulaziz Al-Hokair. The gains in Jarir Marketing shares came after the company reported 26.5% increase in Q1-17 net profit on the back of strong smartphone sales. The Food & Beverage index also surged by 3.5% during the month on the back of 11% gains in shares of Almarai and 24.1% gains in shares of Ash Sharqiyah Development offsetting decline in most of the other stocks in the index. The large-cap Banking index witnessed flat performance during the month with 4 out of 12 banks reporting gains.

Meanwhile, after declining for the past two months, trading activity reversed to show a strong gain during May-17. Total monthly volume of shares traded surged 27.7% to reach 4.1 Bn shares as compared to 3.2 Bn shares during the previous month. Dar Al Arkan Real Estate topped the monthly volume chart with 1.4 Bn shares followed by Alinma Bank and Saudi Kayan with 572 Mn shares and 217 Mn shares, respectively. On the other hand, the monthly value traded increased at a much slower pace of 5.2% to reach SAR 64.7 Bn during May-17 as compared to SAR 61.5 Bn during April-17.

Dar Al Arkan Real Estate once again topped the chart with SAR 8.9 Bn worth of shares changing hands followed by Alinma Bank (SAR 8.2 Bn) and SABIC (SAR 7 Bn). The monthly gainers chart was topped by Ash Sharqiyah Develpoment recording a gain of 24.1% followed by 21% gains for the recently listed Taleem REIT Fund. Jadwa REIT was third on the gainers chart after recording gains of 18.6%. The decliners side was topped by Al Sagr Cooperative Insurance that recorded a decline of 25% followed by Nama Chemicals and Medgulf with declines of 21.7% and 21.5%, respectively.

On the economic front, the Saudi CMA's efforts to open the market coupled with the developments on the listing of ARAMCO is garnering increasing interest in the financial services sector in the Kingdom. During the month, Qatar National Bank applied for an investment banking license in the Kingdom. This follows Citigroup securing a capital markets license last month and Credit Suisse mulling to enter the Kingdom. It was also reported that Goldman Sachs has applied to the regulator for a license to trade equities in the Kingdom.

Abu Dhabi Securities Exchange

The ADX index slipped in line with other markets in the region, and was the second worst performing market in the region for the month of May-17, as oil price volatility weighed on GCC indices. The index was down 2.1% m-o-m in May-17 and closed at 4,427.30 points. Consumer Staples was the key laggard as the index plunged by over 8% as Agthia Group, Foodco Holding contributed to the decline with share price drops of 8.9% and 7.9% respectively. In the financials pack, Investment & Financial Services companies and the Banking sector declined by 6.1% and 3.1% respectively, while Energy names dropped by 4.3% over the same period. Index gainers sectorally were led by Services, which went up 8.3% as compared to the previous month, as Gulf Medical Projects jumped by 37% over the same period. The Industrials index also moved up by 2.7%, ascribed to gains from Gulf Pharmaceutical (+4.6%) and Arkan Building Materials (+6.0%).

In prominent Q1-17 earnings releases, developer Aldar reported revenue growth of 28% y-o-y to AED 1.58 Mn, driven by revenue recognition on developments under construction and land plot sales. Net profit during the quarter amounted to AED 641 Mn, down from AED 654 Mn in Q1-17. Total development sales value came in at AED 1 Bn, led by West Yas, land plot sales and Al Nareel. In the asset management business, Yas Mall maintained strong trading occupancy with 95% units trading, and residential and office portfolio occupancy remained at 90% and 95% respectively as at 31 Mar-17.

In the energy sector, Dana Gas reported Q1-17 gross revenues of USD 118 Mn, up 44% from the Q1-16 figure of USD 82 Mn. Q1-17 net profit was USD 11 Mn, up 83% y-o-y from USD 6 Mn in the same quarter of the previous year. Average production during the quarter in 2017 was 69,900 boepd, up 16% y-o-y (Q1 2016: 60,500 boepd), while the company mentioned that they were successful with cost reduction with Q1-17 and reduced operating expenditure by 23%.

Trading trends was mixed in May-17, as traded volumes dropped m-o-m by 4% while value traded improved by 10%. Total volumes receded to 1.49 Bn shares (April: 1.55 Bn) while value traded during May-17 improved to AED 3.6 Bn (April: AED 3.3 Bn). Gulf Medical Projects led the gainers list with a monthly return of 37%, followed by Emirates Driving and Fujairah Cement Industries, which went up 19.8% and 14.3%, respectively. Prominent decliners included Sharjah Cement with a monthly share price decline of 18.2%, followed by Sudan Telecom and Oman & Emirates Investment Holding, as they saw their stock prices erode by 18.0% & 17.4% respectively.

In ratings related action, Moody's changed the ratings outlook of Mubadala, International Petroleum Investment Company (IPIC) and Etisalat to stable from negative. At the same time, Moody's has affirmed the Aa2 long-term issuer rating of Mubadala, the Aa2 long-term issuer rating of IPIC and the Aa3 long-term issuer rating of Etisalat. The ratings actions follow the recent change in rating outlook to stable from negative on both the Government of UAE and the Government of Abu Dhabi, as well as the affirmation of their Aa2 long-term issuer ratings.

The outlook was changed primarily due to the effective and broad reforms policy response to the lower oil price environment, the economy's growth prospects, and a healthy banking system and an easing of contingent liability risk. Moody's further expects Abu Dhabi's fiscal deficit to come down to 2.0% of GDP in 2017 and 0.3% of GDP in 2018, and expect the government's debt burden to likely to reflect these declining deficits and stabilize at very low levels, below 8% of GDP by 2018.

Dubai Financial Market

DFM continued its declining trends from the previous three months into April-17 as well, and was the worst performing market in the GCC. For May-17, DFM was down by 2.2% and closed at 3339.37 points as sectoral trends were mostly skewed towards decliners. The Consumer Staples & Discretionary sector dropped significantly by 23.9% for the month of May-17, as Marka and DXB Entertainment pulled down the index, plunging by over 46% and almost 20% respectively for the month of May-17. Dubai Parks was punished mainly over footfall related concerns in the holiday season and going forward.

Financials and Investment Services index was amongst the main laggards as well, as the index plunged by 4.1% m-o-m in May-17, followed by Telecoms, which went down by 3.6% over the same period. The Services index was the only sector, which witnessed higher levels, and was up 1.7% m-o-m, led by Amanat Holdings, which went up by 3.6% m-o-m. The Industrial sector remain flat as compared to the previous month.

In prominent earnings, Emaar Properties reported Q1-17 revenues of AED 4.072 Bn, which increased by 15% y-o-y as recurring revenues from malls, hospitality, and entertainment and leisure businesses came in at AED 1.592 Bn and contributed to 39% of total group revenues. Revenues from international operations grew by 62% y-o-y to AED 806 Mn and contributed to 20% of group revenues. Net income came in at AED 1.4 Bn during the first quarter of this year as compared to AED 1.3 Bn in Q1-16. DSI reported Q1-17 revenues of AED 796 Mn, down 23% y-o-y. The company reported a net loss of AED 722 Mn due to the provisions and impairment charges undertaken in the quarter. Order Backlog stood at AED 7.3 Bn as of 31 Mar 17. The proposed share capital reduction of AED 992 Mn was approved.

Damac Properties was the top performing stock in the index for the month, as its share price surged by 18.7% in May-17. Al Salam Group followed along with Gulf Navigation, as their stock prices moved up by 18.4% and 16.9% respectively. On the other hand, shares of Marka, a company which featured in the gainers list last month, led the monthly losers chart as its share price declined by 46.2% m-o-m. DSI and DXB Entertainments followed with declines of 21.7% and 20.0% respectively for the month. Gulf Finance House (GFH) was the most actively traded stock yet again on the exchange as AED 0.92 Bn worth of stock was traded, followed by Emaar Properties with value traded of AED 0.91 Bn. Market breadth was weak as well, as 8 stocks moved up while 31 stocks lost ground during the month of May-17.

Data for April-17 from Emirates NBD Economy Tracker index signaled a further improvement in overall business conditions across Dubai's private sector, signaling the fastest growth since February-2015. The indicator grew from 56.6 in March-17 to 57.7 in April-17. Output and new orders increased at a robust pace in April, with the indices at 62.6 and 63.2 respectively. The construction sector saw a sharp improvement in business conditions during the month as well, after lagging the other key sectors since the start of the year as the index grew more than 3 points to 57.9 in April, indicating the fastest rate of growth since March 2015. Employment (51.2) increased at a slightly faster rate than in March but jobs growth remains sluggish overall, particularly when compared with the rate of new work and output growth.

Qatar Exchange

The QE 20 index continued its negatives trends into May-17, even as general sentiment across other markets in the GCC was along similar lines of exhibiting m-o-m declines. The index was down 1.6% m-o-m in May-17 and closed below the 10,000 point mark at 9901.38 points. The Qatar All Share index which maps the broader index witnessed higher declines and dropped by 3.3% m-o-m, as all sectoral indices barring one were down as compared to April-17.

Banking was the only index which stayed above its previous month close as it gained by 1.8% m-o-m. The m-o-m increase was ascribed to large cap banks led by CBQ (+3.7%), QNB (+1.7%) and QIB (+1.9%). Real Estate was the main sectoral index which pulled down the overall index as the sector plunged by over 18% m-o-m, in large part due to a 27.5% drop in Ezdan. The drop was ascribed to the developer's shareholders giving a preliminary approval to take the company private.

In corporate developments, Qatar Islamic Bank (QIB), signed a USD 925 Mn (QAR 3.4 Bn) structured Shari'a compliant financing facility with Gulf Drilling International Limited QSC. This new facility will be used to re-organize the company's debt and further enhance its operational and financial performance. Separately, Barwa Real Estate announced the signing of contract for the construction of phase 2 of Madinat Al Mawater with INSHA Co. that has also developed Phase-1 of the project. The contract value amounts to QAR 112.5 Mn and with a construction duration of 12 months so as to meet the growing leasing demands on the project.

Trading activity on the index turned and was positive as well, as value traded during May-17 increased by 26.8% to reach QAR 5.9 Bn, while traded volumes improved by 26.0% m-o-m to reach 231 Mn shares. In terms of trading activity, Qatar National Bank topped the monthly value traded chart with QAR 573 Mn worth of shares traded, followed by Vodafone Qatar and Ezdan Holding recording QAR 535 Mn and QAR 516 Mn in monthly value traded. In terms of volumes, traded Vodafone Qatar led all stocks with traded volumes of 59 Mn shares. Ezdan holding and Qatar First Bank followed with traded volumes of 35.7 Mn shares and 35.5 Mn shares respectively. Islamic holding Group was the top performing stock in the index for the month as its share price surged by 8.6%. Masraf Al Rayan followed along with Commercial Bank of Qatar, as their stock prices moved up by 6.0% and 3.7% respectively. On the other hand, shares of Ezdan Holding led the monthly losers chart with its stock losing 27.5% m-o-m. Al Ahli Bank of Qatar and Qatar Cinema & Film Distribution followed with declines of 13.7% and 13.6% respectively for the month.

In economic updates, ratings agency Moody's downgraded the Government of Qatar's long-term issuer and senior unsecured debt ratings to Aa3 from Aa2 and changed the outlook to stable from negative. Key drivers for the ratings downgrade were a weakening of Qatar's external position and uncertainty over the sustainability of the country's growth model over the medium to long term. The stable outlook is ascribed to the implementation of fiscal and economic reforms, coupled with sizable reserve buffers, will help shield Qatar's credit profile from deteriorating further. Moody's also lowered Qatar's long-term foreign-currency bond and deposit ceilings to Aa3 from Aa2, whereas the short-term foreign-currency bond and deposit ceilings remain unchanged at P-1.

GCC MARKETS MONTHLY REPORT